美国3月未季调CPI年率今晚将揭晓,目前市场预计值为8.5%,前值为7.9%,公布值若如市场所料,那么CPI将为1982年1月以来首度“破8”。面对这一前所未有的消费者物价指数,美联储是否将以更强劲的鹰派政策平抑物价成为市场焦点,同时股市方面,市场押注美联储加息力度将提升至最大,加剧了美股近期走势的动荡。

CPI何时回落?

此次CPI的继续走高原因在于,一方面俄乌之间的地缘政治冲突持续,导致大宗商品价格上升,令美国3月物价指数持续飙升。近期,世界大多数农产品的价格继续上涨,俄罗斯是世界最大的小麦出口国,加上乌克兰,供应量占全球的3成。

在油价方面,虽然美国释放战略储备油等多重原因造成国际油价近日持续下跌,有望为美国高企的物价降温,但是不确定因素仍然非常多。如果增加对俄制裁,油价在未来有可能出现回升,这令市场仍处于担忧之中,因此油价的跌势也受到一定限制。

除了油价和大宗商品的增幅,市场也更多开始聚焦美国服务业价格的涨幅,美国3月ISM非制造业指数58.3,预期58.6,2月为56.5。3月份由于美国国内逐渐放宽了疫情限制措施,服务业得到提振,但是目前美国服务业的劳动力存在最大的缺口,加上能源、燃料和其它原材料价格飙升,企业为吸引劳动力提升工资导致企业成本大涨,服务业收费价格正以前所未有的速度上涨。

因此,对于美国CPI是否见顶也有两种截然不同的看法,有市场人士认为,目前美联储的鹰派立场还没有达到顶峰,暂时还无法遏制住CPI的增长势头,预计CPI的值仍没有见顶。而另一些人认为,3月通胀已经到顶,未来会逐渐回落。

近期美股或承压

不过,无疑的是CPI若破8对美联储来说会形成更大的政策压力,有可能会影响接下来缩减购债的规模和加息的程度。随著大宗商品价格上涨引发通胀飙升,市场押注联储会将实施近30年来最激进的货币紧缩政策。

货币市场交易员预计,美联储将在年底前再加息225个基点。考虑到美联储今年还有6次议息会议,若美联储在每次议息会议上都宣布加息,再加息225个基点的市场定价则意味着会有3次各50个基点的加息和3次各25个基点的加息。

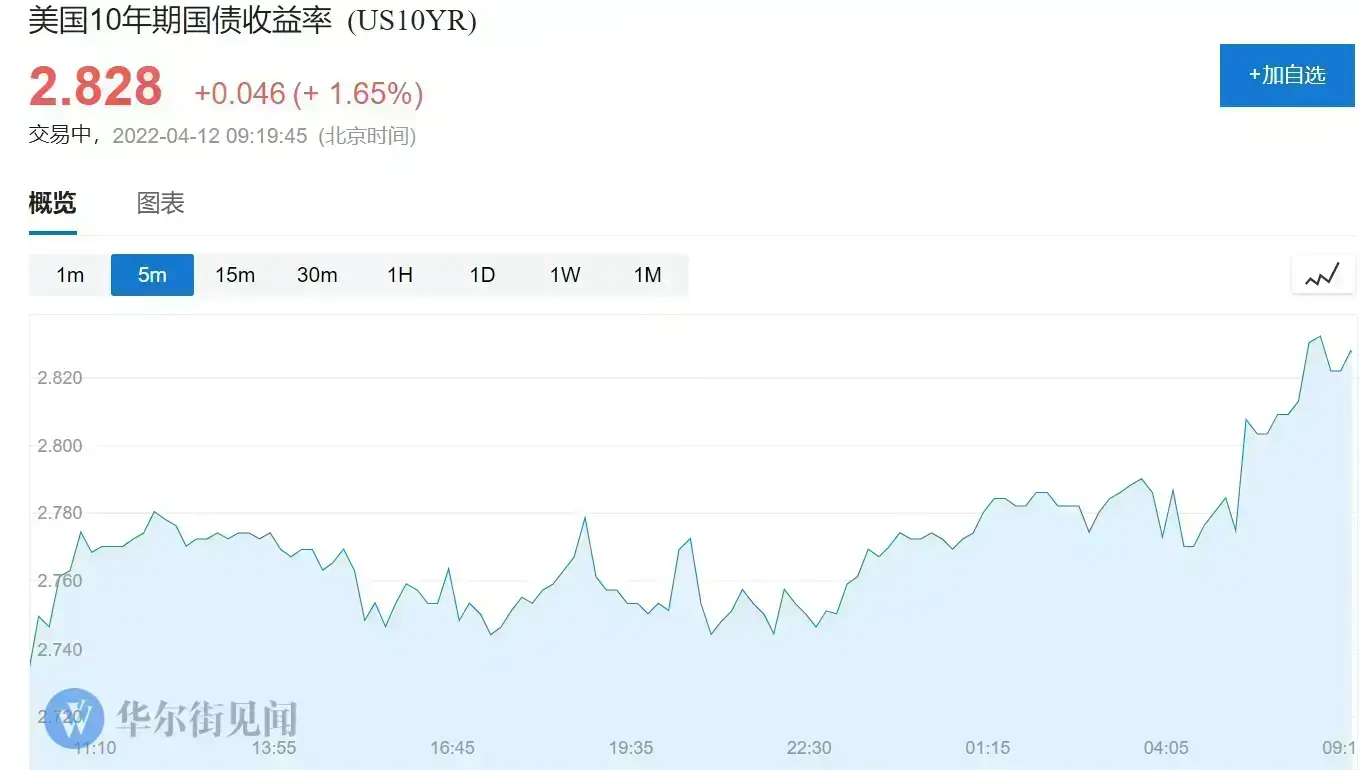

由于市场预计美联储增加紧缩政策力度,短期内美股走势波动,若CPI最终破8,美债收益率可能进一步飙升,预计会对美股中对息口敏感的科技股带来较大的负面影响,而CPI的公布可能会带来新一轮科技股的波动行情。

(来源:华尔街日报)

另一方面,虽然市场加息预期升温,利好银行股表现,但是本月各大银行将陆续公布第一季度的财报,分析师预期银行股第一季度利润或同比下降35%。对于银行股来说,盈利表现也是投资者不得不考虑的重要因素,盈利不佳也会令其股价承压。由于原油、原材料、大宗商品、服务业等价格在第一季都经历了不同程度的上升,这些因素为美国企业第一季度的财报表现带来压力,进一步可能令美股在近期整体承压。