星巴克(SBUX)的股票在其最近的业绩发布后下跌,这家咖啡连锁店在其最大的市场之一面临着潜在的价格战。

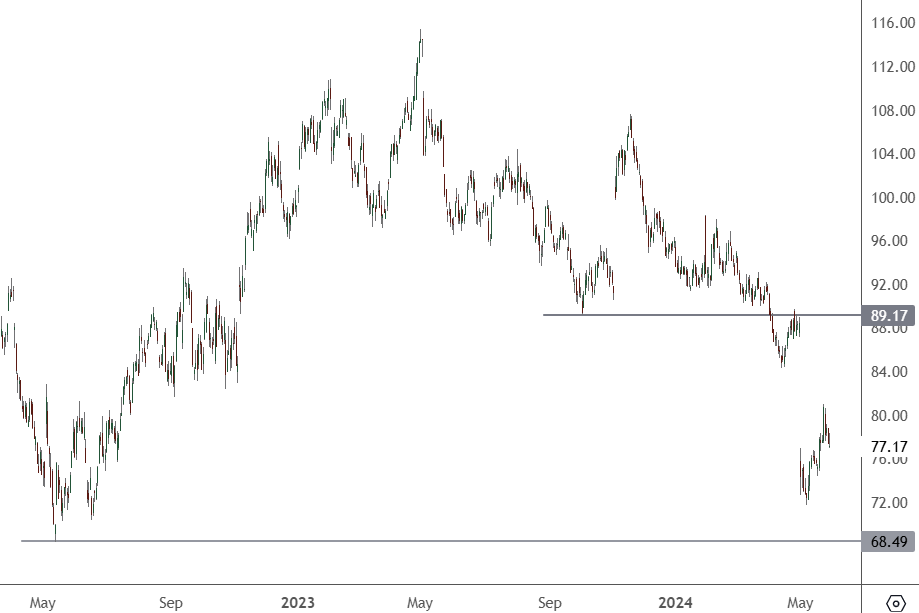

星巴克——日图

星巴克股价交投于77.17美元,在68.50美元水准有稳固支撑。

据路透社报道,这家西雅图标志性咖啡品牌在其第二大市场中国正面临严峻考验。尽管之前曾努力避免价格战,但该公司将与瑞幸咖啡(Luckin Coffee)等低成本竞争对手竞争。此前,星巴克在中国的销售额出现下滑,导致优惠和折扣券增加。

“我们对价格战不感兴趣,”星巴克中国首席执行官Belinda Wong今年1月表示。我们专注于获得高质量但有利可图的可持续增长。”星巴克首席执行官舒尔茨今年3月访问中国时也重复了类似的论调。

然而,分析师、路透社的调查和社交媒体上的帖子显示,星巴克的计划、抖音和第三方外卖平台的价格折扣有所增加。

此前,该公司最近发布的财报显示,业绩表现缓慢。2024年第二季度,星巴克在中国的同店销售额下降了11%。这一下降还导致管理层下调了年度销售预期。随着中国消费者变得更加注重成本,经济背景是销量放缓的另一个因素。

尽管最近举步维艰,星巴克仍然是全球咖啡市场的重要参与者。它目前在全球约有39000家门店,主要集中在美国和中国。然而,该公司最近也与工会发生了冲突,要求提高工资和工作条件,而且由于该公司对以色列的立场,已经有商店抵制该公司。

舒尔茨呼吁公司将重点重新放在更好的顾客体验上,尤其是在美国。估值担忧也是投资者的一个问题。该公司在疫情期间关闭门店后反弹良好。然而,投资者对中国经济放缓和其他问题反应迟缓。

在内部交易方面,公司财务长Rachel Ruggeri最近以每股80美元的价格出售了3,750股公司股票,这在最近提交给SEC的文件中得到了强调。Ruggeri仍然持有65,431股星巴克股票,但去年一直在减持。

尽管最近出现了问题,但价值投资者可能开始将中国近期的刺激措施和经济反弹视为改善的催化剂。