Starbucks stock slumped after its recent earnings release, and the coffee chain is facing a potential price war in one of its largest markets.

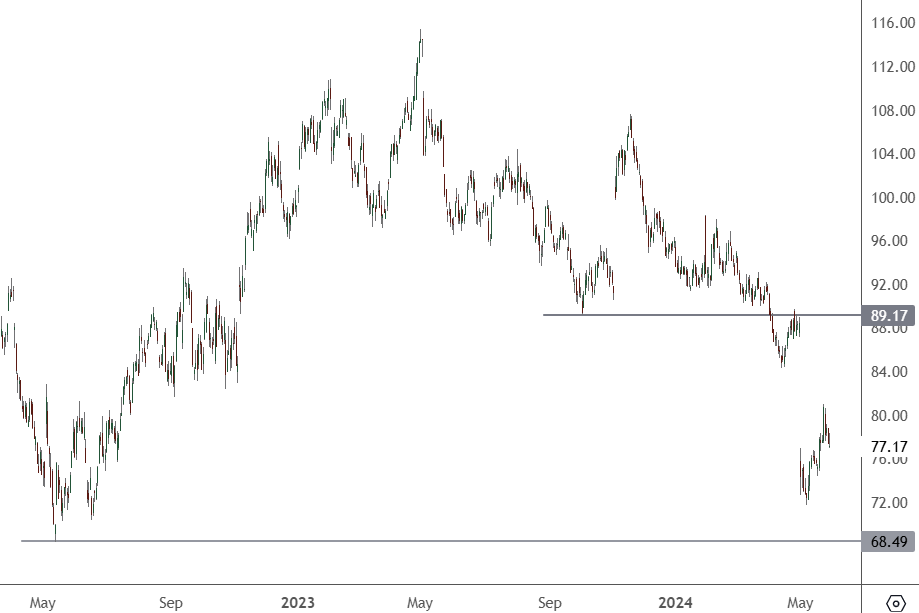

SBUX – Daily Chart

SBUX shares trade at the $77.17 level, with solid support at the $68.50 level.

According to a report from Reuters, the iconic Seattle coffee brand is facing a tough test in China, its second-largest market. Despite previous efforts to avoid a price war, the company will compete with low-cost rivals like Luckin Coffee. The shift in strategy comes after Starbucks’ sales in China have declined, resulting in a rise in offers and discount coupons.

“We are not interested in entering the price war,” Starbucks’ China CEO Belinda Wong said in January. We focus on capturing high-quality but profitable, sustainable growth.” CEO Howard Schultz repeated a similar tone during his visit to China in March.

However, analysts, Reuters checks, and social media posts show increased price discounts on Starbucks’ programs, Douyin, and third-party delivery platforms.

The move comes after a recent earnings release that showed slow performance. For the second quarter of 2024, Starbucks reported an 11% drop in same-store sales in China. This decline also saw management revise its guidance lower for annual sales. With Chinese customers becoming more cost-conscious, the economic backdrop was another factor in the slowdown.

Despite the recent struggles, Starbucks remains a significant player in the global coffee market. Its current footprint is around 39,000 stores worldwide, with a substantial focus on the United States and China. However, the company has also had recent run-ins with unions for better pay and conditions, and there have been store boycotts over the company’s Israel stance.

Schultz has called on the company to return its focus to a better customer experience, particularly in the US. Valuation concerns have also been an issue for investors. The company rebounded well from pandemic store closures. However, investors were slow to price in the Chinese economic slowdown and other issues.

On inside transactions, Chief Financial Officer Rachel Ruggeri recently sold 3,750 company shares at $80 per share, highlighted in a recent SEC filing. Ruggeri still owns 65,431 shares of Starbucks but has been reducing her stake over the last year.

Despite the recent woes, value investors may start looking at China’s recent stimulus and economic bounce as a catalyst for improvement.