Forex, short for foreign exchange, is a global marketplace for trading various currencies against each other. At the heart of forex trading is a concept known as a ‘lot’, which is essentially a unit used to measure and standardize forex trades. This article aims to help you understand lot sizes in forex and their importance in your trading journey.

Table of contents:

- What is a lot in forex trading?

- Understanding the 4 types of lot sizes in forex

- Why lot size matters

- How to calculate profit and loss in forex using lot size and pip?

- How to determine the appropriate lot size

- Setting lot sizes on forex trading platform

- How to start trading forex?

1. What is a lot in forex trading?

In forex trading, a ‘lot’ signifies a standardised quantity of the currency pair you are trading. The concept of a ‘lot’ is one of the fundamental elements of forex trading, as it measures the transaction size of your forex trade.

In the most basic terms, when trading currency pairs, you can’t simply say, “I’m buying Euros” or “I’m selling British Pounds.” Instead, your trade will be measured by the specific number of lots you trade of your chosen currency pair. The term ‘lot’ is borrowed from the traditional stock exchange terminology, which refers to the standard number of units traded off security.

Forex trading occurs in a highly liquid market, meaning vast amounts of currencies are traded daily against each other. To manage the large volumes, currency pairs need to be grouped into manageable sizes, which is where the concept of a lot comes into play.

Understanding lots in forex with the pizza analogy

Suppose you run a pizza shop selling pizzas in two standard sizes: small pizzas for 4 people and large pizzas for 8 people. Customers can’t buy a single slice, only a whole pizza.

Similarly, in forex trading, you can’t buy a single unit of currency. Instead, you trade in ‘lots’. For example, a standard lot in forex might be 100,000 units of the base currency, equivalent to baking large pizzas for a big event. Or, you could trade a micro lot of 1,000 units of the base currency, similar to baking a small pizza for a family dinner.

Just like pizzas come in standard sizes, so do forex trades. The size of the lot impacts your potential profit or loss, just as the size of the pizza affects the revenue of your pizza shop.

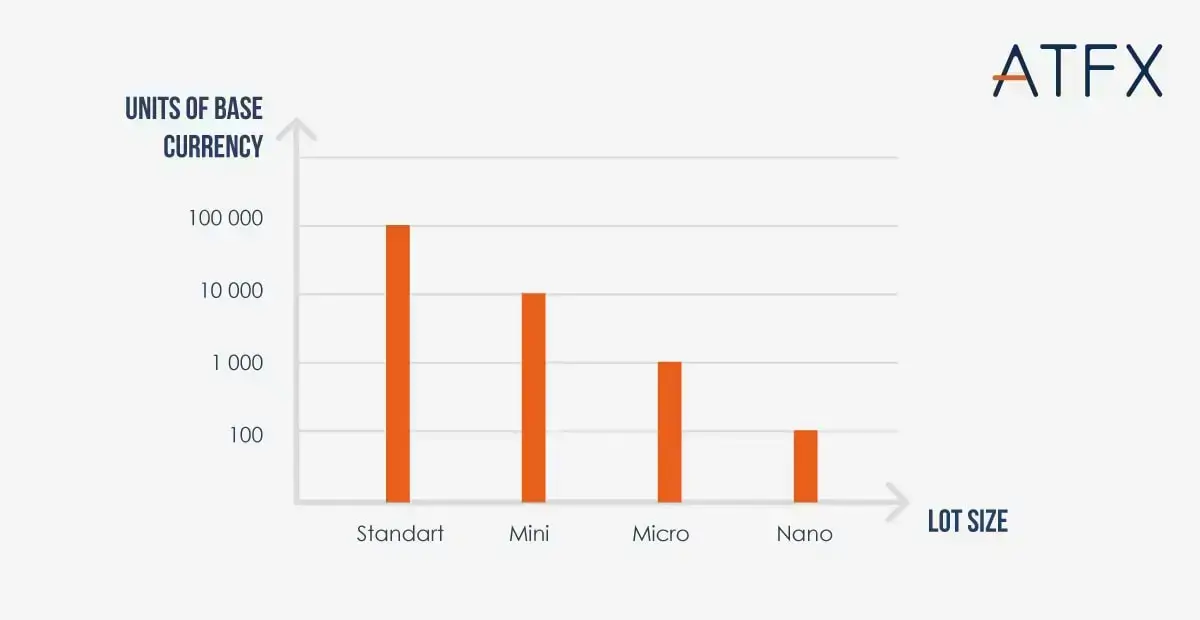

2. Understanding the 4 types of lot sizes in forex

Forex is typically traded in 4 specific lot sizes, which are: Standard lots, Mini lots, Micro lots and Nano lots.

A. What is a standard lot in forex?

A standard lot is the largest lot size in forex trading, consisting of 100,000 units of the base currency. It is mostly used by traders with larger accounts.

Example:

As a trader, when you’re trading the USD/JPY pair, and you buy a standard lot, you are buying 100,000 units of U.S. dollars. If the current exchange rate is 110, you would be selling 11,000,000 units of Japanese yen to buy the dollars.

B. What is a mini lot in forex?

A mini lot is one-tenth the size of a standard lot, which comprises 10,000 units of the base currency.

Example:

As a trader, when you’re trading the GBP/USD pair, and you buy a mini lot, you are buying 10,000 units of British pounds. If the current exchange rate is 1.35, you’d be selling 13,500 units of U.S. dollars to buy the pounds.

C. What is a micro lot in forex?

A micro lot is even smaller, consisting of just 1,000 units of the base currency.

Example:

If you’re trading the EUR/USD pair and you buy a micro lot, you’re buying 1,000 units of Euros. If the current exchange rate is 1.18, you would be selling 1,180 units of U.S. dollars to buy the Euros.

D. What is a nano lot in forex?

A nano lot is the smallest lot size in forex trading, and it’s not offered by all forex brokers. It consists of 100 units of the base currency.

Example:

If you’re trading the AUD/USD pair and you buy a nano lot, you’re purchasing 100 units of Australian dollars. If the current exchange rate is 0.75, you’d be selling 75 U.S. dollars to purchase Australian dollars.

Summary table: standard vs mini vs micro vs nano

| Lot Size | Units of Base Currency | Risk Level | Profit/Loss Potential | Ideal for |

| Standard Lot | 100,000 | High | High | Traders with larger account sizes and more trading experience. |

| Mini Lot | 10,000 | Medium | Medium | Traders who want to take on a moderate risk or are trading with a smaller account size. |

| Micro Lot | 1,000 | Low | Low | Beginner traders, or those testing new strategies, want to keep risk low. |

| Nano Lot | 100 | Very low | Very low | Novice traders, or those who want to practice trading strategies with minimal risk. |

3. Why lot size matters:

The size of the lot you trade directly impacts your risk. For example, a standard lot has a much higher risk than a micro lot. This is because the value of each pip (the smallest price move a given currency pair can make) changes with the lot size. Hence, lot size selection is a critical component of risk management in forex trading.

Example:

Suppose you have $1,000 in your trading account and wish to trade the EUR/USD pair.

Without leverage, your $1,000 could directly control a micro lot trade of 1,000 Euros. But with leverage, you can control a much larger amount.

Let’s say your broker provides a leverage of 100:1. This means you could control a $100,000 position, which is equivalent to a standard lot in forex trading, with just $1,000 of your own capital.

Now imagine the EUR/USD pair rising by 1%. If you had traded a micro lot without leverage, your profit would be $10 (1% of $1,000). However, with the 100:1 leverage controlling a standard lot, your profit would be $1,000 (1% of $100,000). This demonstrates how leverage can significantly increase your potential profits.

But remember, if the EUR/USD pair had declined by 1%, you would have lost the same amount, which underlines how leverage can also magnify your potential losses.

So, while leverage and lot sizes allow you to maximize profits from small movements in currency pairs, they must be used wisely to manage your risk exposure.

Learn also: why is leverage high in the forex market?

4. How to calculate profit and loss in forex using lot size and pip?

Profit/Loss = (Closing Price – Opening Price) x Lot Size x Pip Value

Let’s break this down:

Closing Price: This is the price at which you close (sell) the position.

Opening Price: This is the price at which you open (buy) the position.

Lot Size: This is the size of your trade (i.e., standard lot, mini lot, micro lot, or nano lot).

Pip Value: This is the value of a one-pip move in the currency pair you’re trading.

| Lot Size | Units of Base Currency | Volume | Pip value ($) |

| Standard Lot | 100,000 | High | High |

| Mini Lot | 10,000 | Medium | Medium |

| Micro Lot | 1,000 | Low | Low |

| Nano Lot | 100 | Very low | Very low |

For example, a trader buys one standard lot (100,000 units) of EUR/USD at an opening price of 1.1700 and sells it at a closing price of 1.1750.

Here’s how the trader can calculate their profit:

Get the difference between the closing and opening prices: 1.1750 – 1.1700 = 0.0050 or 50 pips.

Assuming a pip value of $10 for a standard lot, calculate the total change in value: 50 pips x $10/pip = $500.

Since the trade moved in the trader’s favour, they made a $500 profit.

Remember, if the trade had gone in the opposite direction, you would similarly calculate the loss. For example, if you sold at 1.1650 instead of 1.1750, you would have incurred a loss of 50 pips, equating to a $500 loss for a standard lot.

Remember that pip value usually varies depending on the currency pair you’re trading and your trading account currency. For most currency pairs, a pip is the 4th decimal place (0.0001). However, in pairs involving the Japanese yen, a pip is the 2nd decimal place (0.01).

Learn also: how to calculate the margin and profit and loss amount in forex.

5. How to determine the appropriate lot size

Choosing your lot size should consider your account size, risk tolerance, and trading strategy. A common technique is the 1% rule, which requires one not to risk more than 1% of their account on a single trade. Therefore, if you have a $10,000 trading account, any trading loss should never exceed $100.

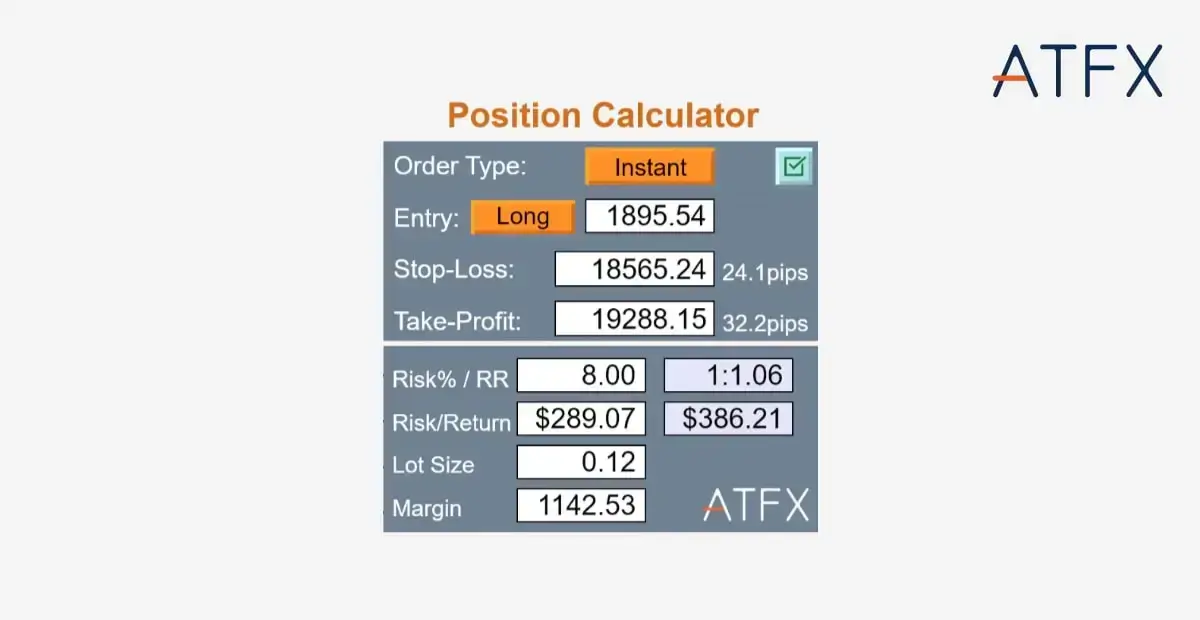

A. Software Tools for Determining Lot Size

Various tools are available online that help traders calculate their optimal lot size based on their account size, risk tolerance, and the stop-loss level on the trade. These tools provide a numerical result, helping you make more informed trading decisions. An example of such a tool is the ‘Position Size Calculator‘ available on our trading platform at ATFX.

B. Practical Tips for Lot Size Management

Managing your lot size effectively is crucial for successful forex trading. Here are a few practical tips:

- Always align your lot size with your account size and risk tolerance.

- Consider the currency pair’s volatility before deciding on a lot size.

- You can increase your lot size over time as you gain more trading experience and confidence in your strategies. Never risk an amount that you can afford to lose on each trade.

Learn also: how to trade forex for beginners

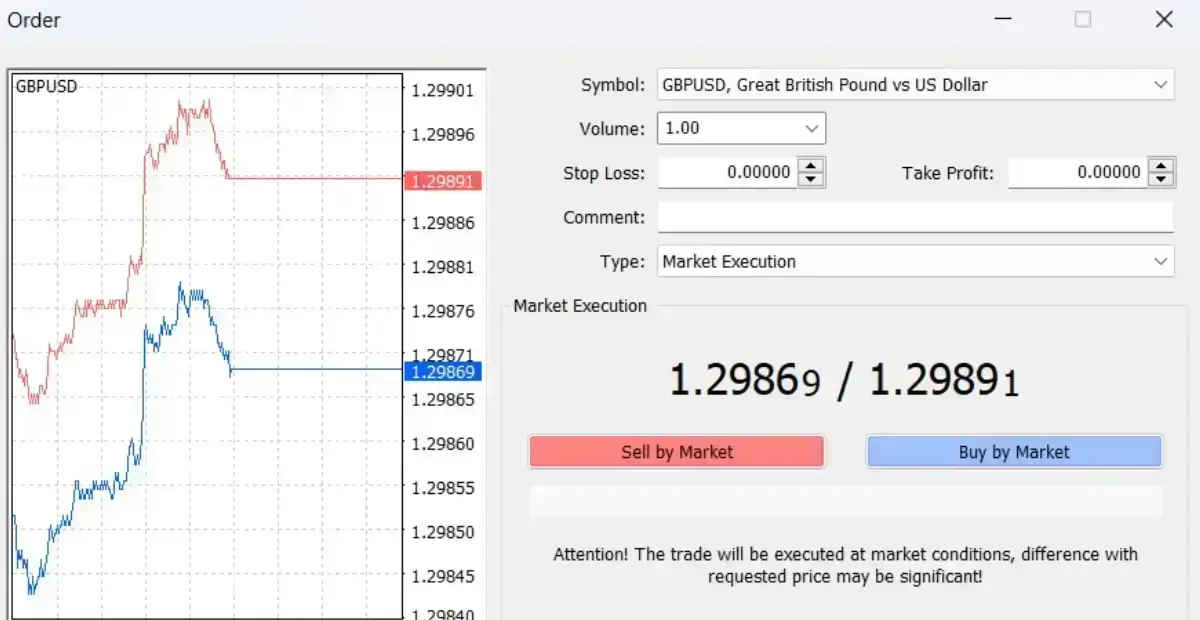

6. Setting lot sizes on forex trading platform

Most trading platforms, such as ATFX, allow you to set your preferred lot size. For instance, on the MetaTrader 4 platform, you can select your lot size from the ‘New Order’ window before executing the trade.

Learn also: Why do most Forex Traders use MT4? 5 Major Benefits of the MT4 Platform

7. How to start trading forex?

We invite you to start your forex trading journey online with ATFX. We recommend exploring our comprehensive forex trading guide and understanding currency pair transactions. Once you’ve grasped the fundamental concepts, including how forex lots work, you can dive into live trading account or opt for a free demo account to refine your skills.

Learn more about forex trading with ATFX now!