Crude oil is a crucial commodity for the global economy, fueling various industries and transportation systems globally. The objective is to provide a guide that aims to provide full information that is easy to understand. This includes trading approaches, financial tools, basic knowledge, trading platforms, and other relevant topics.

Table of content

- What is oil trading?

- Understand the basics of oil trading

- Choose your preferred method of trading oil

- Choose the right oil trading platform

- Create your demo trading account

- Develop an effective oil trading strategy

- Practice your oil trading strategy on a demo account

- Transition to live trading and place your first trade

- Continuously monitor and update your trading strategy

- Common trading mistakes and how to avoid them

Ready to practice oil trading without putting in real money?

1. What is oil trading?

Oil trading includes buying and selling oil and its by-product in the financial markets. The objective of oil trading is to have an edge over fluctuating oil prices based on factors such as supply & demand, economic indicators, and geopolitical events.

Financial instruments such as CFDs (Contract for Difference), options, spot markets, futures contracts, and ETFs (Exchange-Traded Funds) are directions for oil trading. Since the oil market is a global and highly liquid market, it is a perfect opportunity for traders to exploit from price movements.

2. Understand the basics of oil trading

I. Types of crude oil and their differences: WTI vs Brent

Among the numerous types of crude oil traded worldwide, 2 primary varieties serve as global benchmarks for determining oil prices: Brent Crude Oil and WTI Crude Oil.

Below is a comparison table of the 2 crude oil benchmarks

| Brent Crude Oil | West Texas Intermediate (WTI) Crude Oil | |

| Definition | An international benchmark | A benchmark for North American crude oil |

| Location | North Sea | United States |

| Quality | Light, sweet | Light, sweet |

| Trading Symbol | ICE Brent Crude | NYMEX WTI Crude |

| Price | Typically priced higher | Typically priced lower |

| Supply | Sourced from Europe, Africa, and the Middle East | Sourced mainly from the United States |

| Demand | Widely used globally | Primarily used in North America |

| Market Impact | Influenced by global factors | Influenced by US-specific factors |

II. Factors affecting oil prices

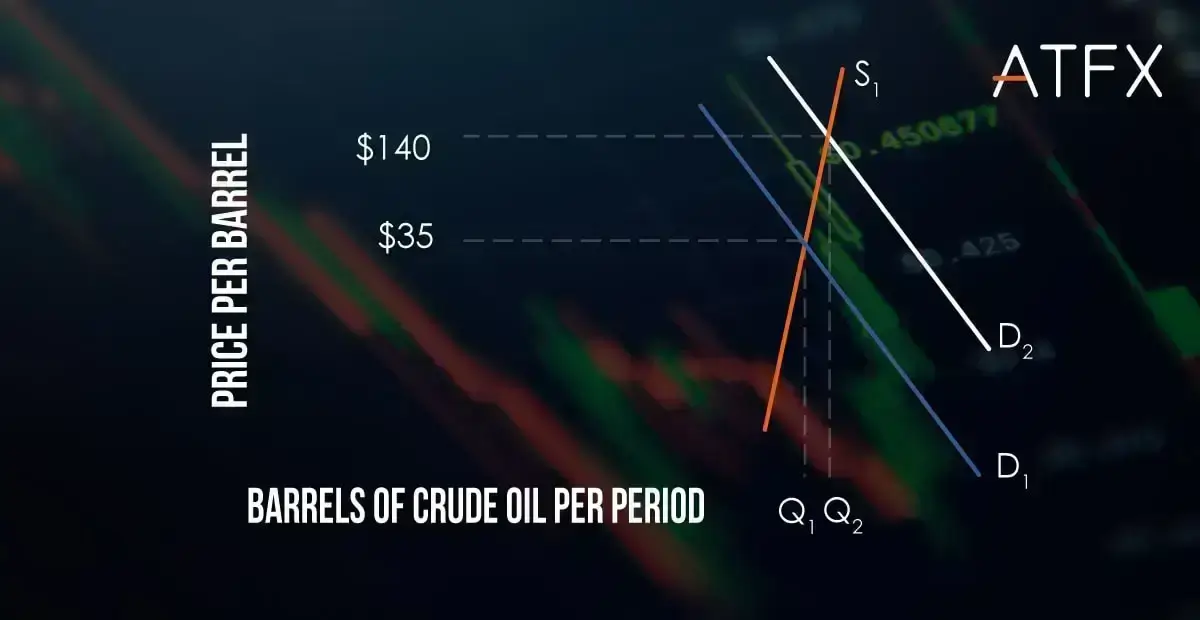

a. Supply and demand:

Oil prices and demand operate in a unique manner compared to other commodities. Despite restricted supply or high costs, oil usage is so widespread that it is always in demand. Regardless, since oil is a scarce resource, expects forecast that there will be a supply decrease in the coming decades, forcing many nations to prospect for alternatives likes of renewable energy. With the increase in wealth of the world’s population, particularly in emerging markets like China, the demand for oil will remain at a constant high.

b. Geopolitics:

As the core essential of industrial production, crude oil is a crucial commodity for every nation. When major oil-producing nations may experience political instability or unexpected events, the risk of the global supply of crude oil arises. The OPEC (Organization of the Petroleum Exporting Countries) member countries usually develop timely policies on oil production and exports to secure the interest of oil-producing countries.

Learn also: 5 Major Oil Crisis’ that Changed The World

c. Exchange rate fluctuations:

Since oil prices are primarily denominated in US dollars, changes in exchange rates directly impact oil prices. When the US dollar strengthens, oil prices tend to decline under pressure. Conversely, a weaker US dollar provides support for higher oil prices.

d. Economic development:

In the context of sound economic growth and stable inflation, increased demand for crude oil tends to lead to upward pressure on oil prices. This subsequently drives a series of price increases in the downstream market for raw materials and industrial production.

e. Seasonal variations:

Winter and summer are peak demand seasons. Winter is a high-consumption period for heating oil, while summer represents a peak period for gasoline consumption due to travel. The magnitude of demand has a stimulating effect on prices, leading to potential price increases.

Learn also: How US Bond Yields Impact Forex, Stocks, Gold & Oil Prices

3. Choose your preferred method of trading oil

In general, there are 5 common financial instruments to trade oil

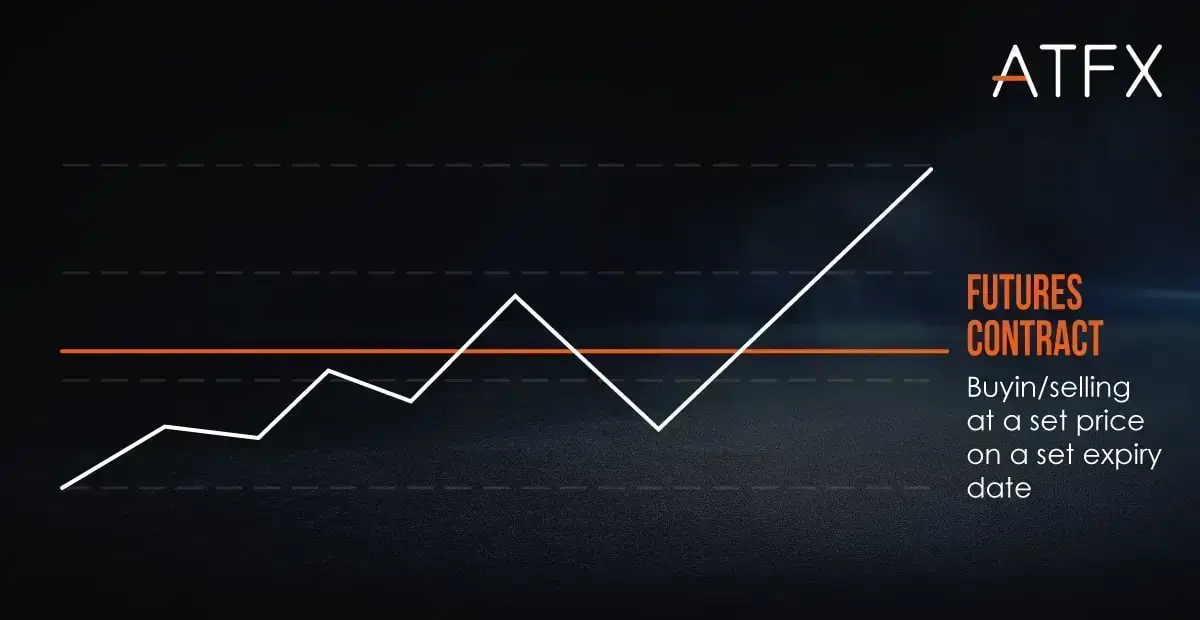

I. Trading oil futures

How oil futures work:

Oil futures involve a contractual agreement between traders to buy or sell a predetermined quantity of oil at a future date.

Instead of receiving physical oil barrels upon the contract’s expiration, traders can choose to extend their position by rolling the contract over to the following month.

Pros and cons:

Oil futures offer significant leverage and higher profit return, but they also carry higher risk since you could lose more than your initial investment.

II. Trading oil CFDs

How CFDs work:

CFD trading involves speculating on the price movements of an asset without owning it. Traders make or lose money based on the difference between the entry and exit prices.

Pros and cons:

CFDs offer leverage and flexibility, allowing traders to profit from both rising and falling markets. However, they also carry risks, such as the potential for large losses if the market moves against your position.

III. Trading oil ETFs

How ETFs work:

Exchange Traded Funds (ETFs) are investment funds that trade on stock exchanges, providing investors with exposure to specific markets or sectors. Oil ETFs track the performance of oil or oil-related assets.

Pros and cons:

ETFs offer a simple way to gain exposure to oil without trading futures or CFDs. They are generally more accessible and have lower fees than other trading instruments but may have limited potential for gains compared to leveraged instruments.

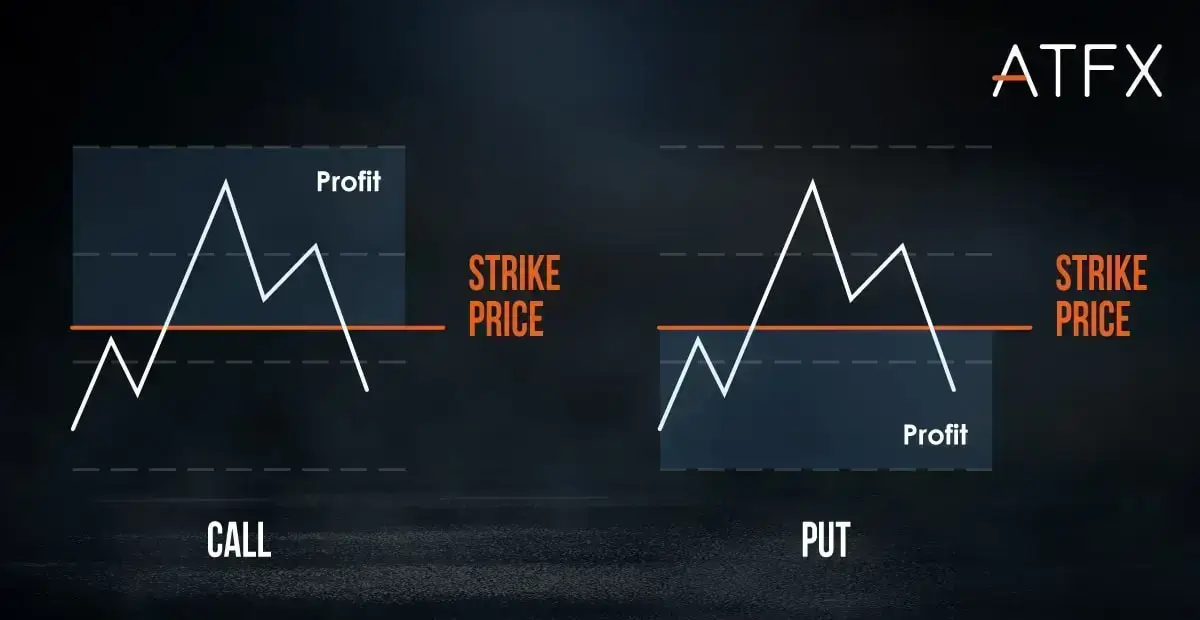

IV. Trading oil options

How options work:

Options contracts grant the buyer the right, but not the obligation, to buy or sell an asset at a specified price before a certain date. Traders can use options to speculate on price movements or to hedge their existing positions.

Pros and cons:

Although a trader can make significant profits with limited risk, options trading may pose challenges since options require more expertise compared to other trading instruments.

V. Trading oil on the spot market

How the spot market works:

Commodities are bought and sold for instant payment and delivery on the spot market. Prices are driven by the forces of supply and demand on the spot market.

Pros and cons:

Immediate exposure to oil prices and rapid settlement make spot trading suitable for short-term trading opportunities.

However, spot oil trading may be less available to retail traders compared to other financial instruments since it requires more funding due to the absence of leverage. Furthermore, individual traders may encounter logistical difficulties associated with the physical delivery and storage of oil.

Summary table

| Oil Futures | Oil CFDs | Oil ETFs | Oil Options | Oil Spot Market | |

| Leverage | Significant leverage | Leverage | No leverage | Substantial leverage | No leverage |

| Profit Potential | High | High | Moderate | High | Moderate |

| Market Access | Wide | Wide | Wide | Wide | Limited |

| Risk | High | High | Lower | Limited risk | Moderate |

| Complexity | Moderate | Moderate | Low | High | Moderate |

| Expertise Required | Moderate | Moderate | Low | High | Moderate |

| Accessibility | High | High | High | High | Lower |

| Fees | Varies by platform and broker | Varies by platform and broker | Generally lower | Varies by platform and broker | Varies by platform and broker |

| Short-term Trading | Suitable | Suitable | Suitable | Suitable | Suitable |

| Hedging Capability | Yes | Yes | Limited | Yes | Limited |

| Physical Delivery | Possible (but often cash-settled) | No | No | Possible (but often cash-settled) | Yes |

| Logistical Challenges | No (unless physical delivery is required) | No | No | No (unless physical delivery is required) | Yes (physical delivery and storage) |

4. Choose the right oil trading platform

Factors to consider when choosing a broker:

I. Ease of use:

A user-friendly platform is essential, especially for beginners. Look for platforms with intuitive interfaces and helpful resources that offer a seamless trading experience.

II. Fees and commissions:

Compare fee structures and consider the long-term costs of trading on each platform to make informed decisions that align with your trading strategy and budget.

III. Security and regulation:

Prioritize platforms that are regulated by top-tier regulators and adhere to regulatory requirements, such as licenses and compliance frameworks. It is important to choose platforms that implement robust security measures to safeguard your funds and personal information from potential breaches.

IV. Customer support:

Opt for platforms that have responsive and knowledgeable customer support teams. Having access to a reliable support agent can be invaluable, especially when facing technical issues or needing assistance with trading-related inquiries.

V. Financial instruments offered:

Before signing up for a trading account, confirm the broker’s available financial instruments. While ATFX offers oil futures and CFDs, other brokers might differ. Always check with your preferred broker to ensure they provide the instruments you need before committing to their platform.

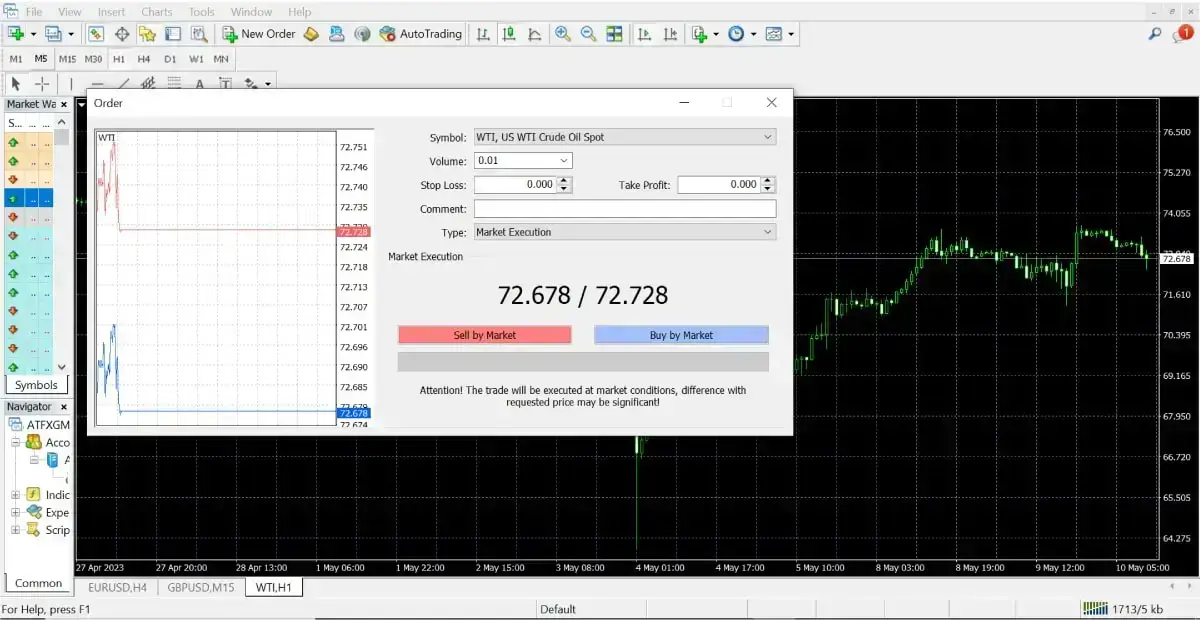

5. Open your crude oil trading account

Begin by opening a demo account on the ATFX broker’s website. This allows you to practice oil trading risk-free without risking your hard-earned money.

Complete the registration process by verifying your identity and providing the required documents. There’s no obligation to deposit real money until you are ready to move on to a live trading account.

You can take your time and play around with the platform’s features and tools to ensure familiarity with the platform, leading to a smooth trading experience before moving on to the next stage.

6. Develop an effective oil trading strategy

You need to set your trading goals and risk tolerance before developing a comprehensive oil trading strategy. Choose a trading style that aligns with your preferences, such as day trading, swing trading, or long-term investing.

Learn also : 3 crude oil trading tips

Establish entry and exit rules for your trades and integrate risk management techniques to protect your investments. ATFX’s educational resources and market news can help you fine-tune your strategy. Below are some ideas to develop your own trading strategy.

I. Importance of a trading plan:

A well-crafted trading strategy is crucial for proper decision-making and controlling potential trading risks. A trading plan should include your goals, risk tolerance, and specific trading strategies.

II. Risk management

Setting stop-loss orders: Stop-loss orders help limit potential losses by automatically closing a position if the market moves against you by a specified amount.

Position sizing: Determine the appropriate size for each trade based on your risk tolerance and account size to avoid risking too much on a single trade.

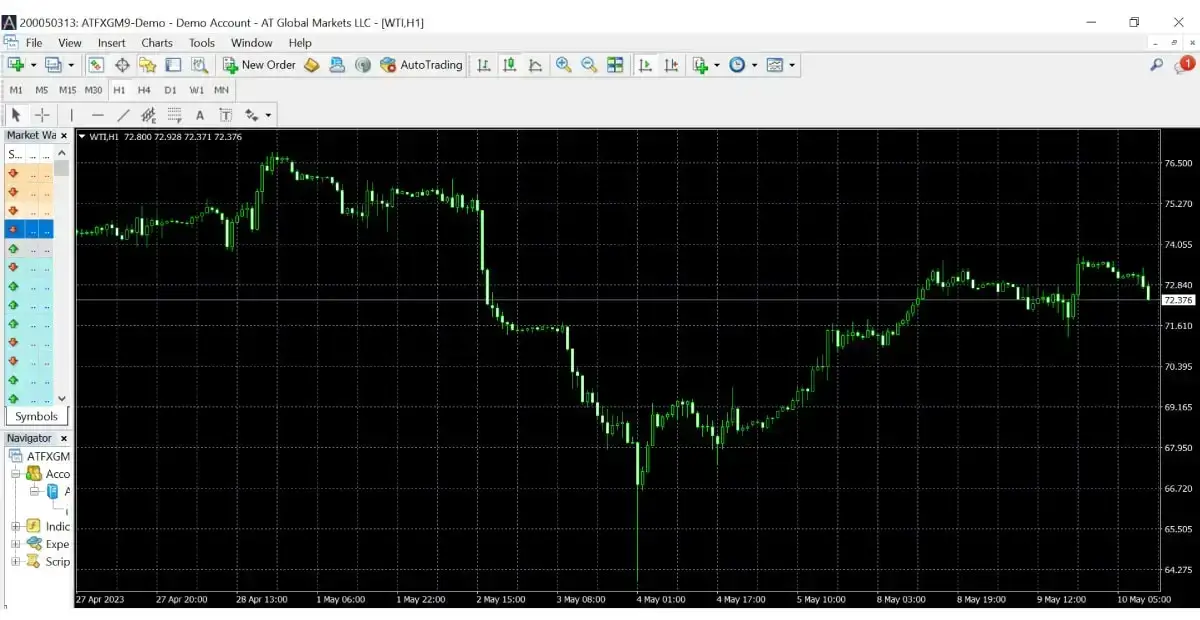

III. Technical analysis

Chart patterns: Recognize and interpret common chart patterns to identify potential trading opportunities.

Technical indicators: Utilize technical indicators such as moving averages, Relative Strength Index (RSI), and Bollinger Bands to better time your trading decisions.

IV. Fundamental analysis

Analyzing supply and demand factors: Keep track of global oil production levels, inventory data, consumption trends and output cuts by OPEC to understand the dynamics of the global crude oil market.

Monitoring global events and news: Stay informed about geopolitical events, economic data releases, and industry news that may impact oil prices.

7. Practice your oil trading strategy on a demo account

Utilize your ATFX demo account to execute trades based on your strategy. This risk-free environment enables you to monitor and analyze your trades, identifying areas for improvement. Refine your strategy based on your results and the ever-changing market conditions.

8. Transition to live trading and place your first trade

Once you feel confident in your trading strategy, open a live trading account with ATFX.

Deposit your initial investment capital and apply your refined strategy and risk management techniques to live trades, which we will share later in the article. Start with a small amount to minimize risk as you gain experience in the real market.

9. Continuously monitor and update your trading strategy

Stay up-to-date with crude oil market developments and news by utilizing ATFX’s educational resources. You can follow our blogposts for the latest market news and our YouTube channel for more trading ideas.

Regularly review your trades and performance, adapting your strategy as needed based on market conditions and your personal growth.

A successful trader continually learns and adjusts their approach to remain profitable in the ever-changing oil market.

10. Common trading mistakes and how to avoid them

I. Overtrading:

Trading too frequently or with excessive risk can lead to significant losses. Stick to your trading plan and avoid impulsive trading decisions.

II. Lack of risk management:

Implement strict risk management strategies, including setting stop-loss orders and properly sizing your positions.

III. Trading without a plan:

Develop a comprehensive trading plan and follow it consistently to ensure long-term success.

IV. Emotional trading:

Avoid making trading decisions based on emotions such as fear or greed. Focus on objective analysis and adhere to your trading strategy.

V. Failing to keep a trading journal:

Record your trades and analyze your performance to identify areas for improvement and refine your strategy.

Ready to practice oil trading without putting in real money?

Ready to dive into the world of oil trading? Consider signing up for a free demo account with ATFX to put your newfound knowledge into practice. Apart from oil trading, ATFX also offers many other financial products on a solid trading platform that allows you to practise different strategies while still learning from such guides or the free training materials ATFX provides. So, get your demo trading account for free now!