Trump 2025 Administration: Impact on S&P 500, NASDAQ 100, and Other Key Markets

As Donald Trump’s 2025 administration takes shape, its policies on energy, fiscal matters, and foreign relations will drive volatility and growth opportunities in major markets.

Key areas to watch include:

Stock Indices: S&P 500 and NASDAQ 100 may see short-term volatility but long-term growth.

Energy Policy: Pro-energy stance and geopolitical tensions could affect Oil Markets.

Commodities: Gold and precious metals as safe-haven assets during uncertainty.

Forex Market: Currency volatility driven by trade policies and foreign relations.

Learn how these shifts could impact markets and explore trading opportunities with ATFX by reading the full article here: [Read More]

Federal Reserve 2025: Navigating Rate Hikes, Inflation, and Trade Wars in Forex, Gold, and Global Markets

In 2025, the Federal Reserve’s (Fed) policies under the new U.S. leadership will have a profound impact on global markets.

Key areas to watch:

Interest Rate Changes: The Fed’s decisions will affect the U.S. Dollar, stock indices, and commodities.

Trade Wars & Currency Wars: Trade conflicts and currency fluctuations may lead to market volatility.

Gold & Inflation: Inflationary pressures could make Gold a safe-haven investment.

Stay informed on how these shifts will influence forex, commodities, and more.

Magnificent 7 Stocks: Driving the 2025 Market Outlook

The Magnificent 7—Apple, Microsoft, Amazon, Alphabet, Meta, Tesla, and Nvidia—continue to influence major indices like the S&P 500 and NASDAQ 100.

Key things to follow:

Technology Innovation: AI, EVs, and cloud computing and semiconductors (chips) are powering growth across these market leaders.

Earnings Growth: Tech giants setting the pace for stock market trends.

Institutional Investment: High demand for these growth stocks as economic leaders.

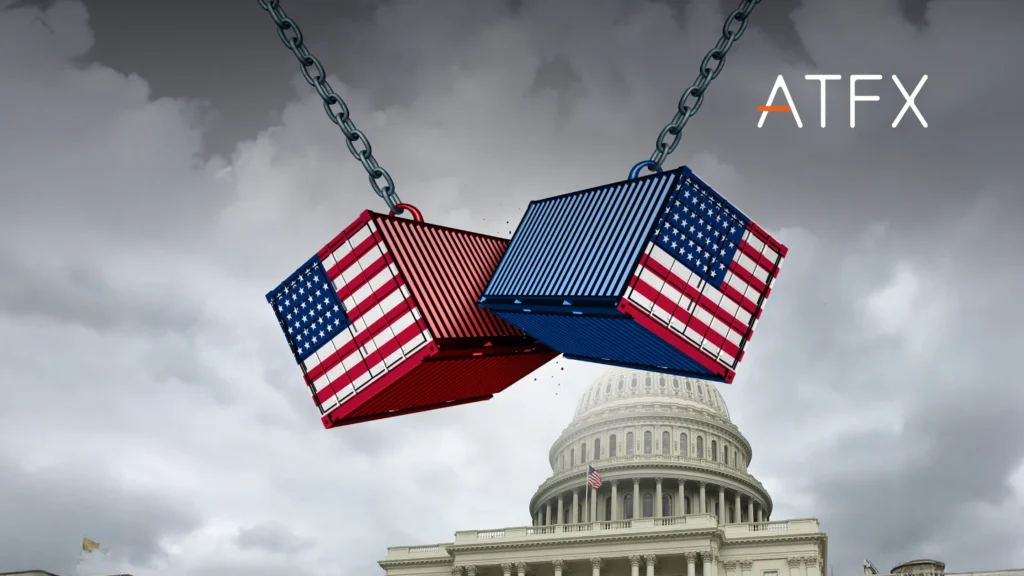

US Trade War Risks in 2025: Trump’s Policies and Global Market Impact

President Trump’s “America First” policies will influence global markets in 2025. Key trade tensions with China, Mexico, and Canada could create volatility.

Watch for:

Tariff Policies: Potential for escalating trade wars and market disruptions.

China’s Response: Economic measures may impact U.S.-China trade relations.

Mexico and Canada: Tariff reactions could affect key industries.

Market Impact: Commodities like oil and copper, and Stock Indices could face volatility.

Europe’s Economic Risks and Political Uncertainty: Trading Opportunities Amid Recession Fears

Europe’s economic struggles and political instability create market volatility, especially with Germany’s elections and weak French growth.

Key points:

Political & Economic Risks: Instability in Germany and France may affect major indices, the euro, and trading opportunities.

Market Impact: Watch for volatility in DAX 40, Eurostoxx 50, EUR/USD, and safe-haven assets.

Leverage ATFX’s platform to trade forex, CFDs, and commodities amid European market shifts.