Table of contents:

- What is Forex Trading

- Best 10 Forex Trading Strategies

- How to Choose The Best Forex Trading Strategy That Suits You

- Why Choose ATFX

- How to Open a Live Trading Account & Start Trading with ATFX

Introduction to Forex Trading

Forex trading, or FX trading, is the buying and selling of currencies on the global market to generate a profit. With daily trading volumes exceeding $7.5 trillion, it is the world’s largest and most liquid financial market. This market lets traders speculate on currency pair differences, such as the euro vs the US dollar (EUR/USD). Due to the overlap of trading sessions across time zones, the forex market is open 24 hours a day, five days a week, and is available around the clock. Governments, financial institutions, businesses, and retail traders play a crucial role in the forex market. Forex traders must thoroughly understand political events, technical analysis, and economic data to make accurate decisions and manage risk effectively.

Learn more about what forex trading is and how it works.

Best 10 Forex Trading Strategies

The ability to perform well in the forex market depends heavily on choosing the best forex trading strategy. A trader can use a comprehensive plan to select whether to purchase or sell a currency pair in the foreign exchange market via a forex trading strategy. It employs specified rules and criteria to find the best trading times methodically. Trading strategies range from uncomplicated strategies like trend following to complex systems with technical indicators and algorithms. The main objectives are to profit while effectively managing risk, preventing personal biases and maintaining consistency in trading behaviour.

Trend Following Strategy

This forex trading strategy relies on recognising and executing trades based on the market trend, which can be upward, downward, or sideways. Investors use tools like moving averages and the MACD (Moving Average Convergence Divergence) to identify potential trends. For instance, a trader may purchase a currency pair in a bear market and keep it until the trend reverses. The main advantages of this method are its simplicity and potential for significant returns during trending markets.

Learn more about trend trading.

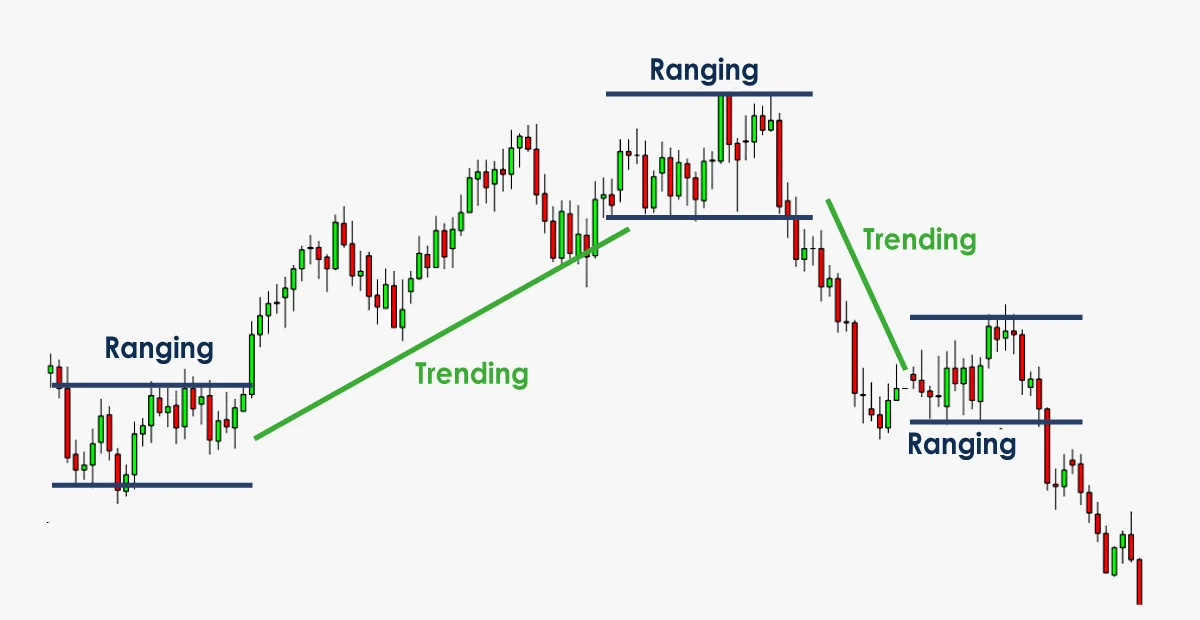

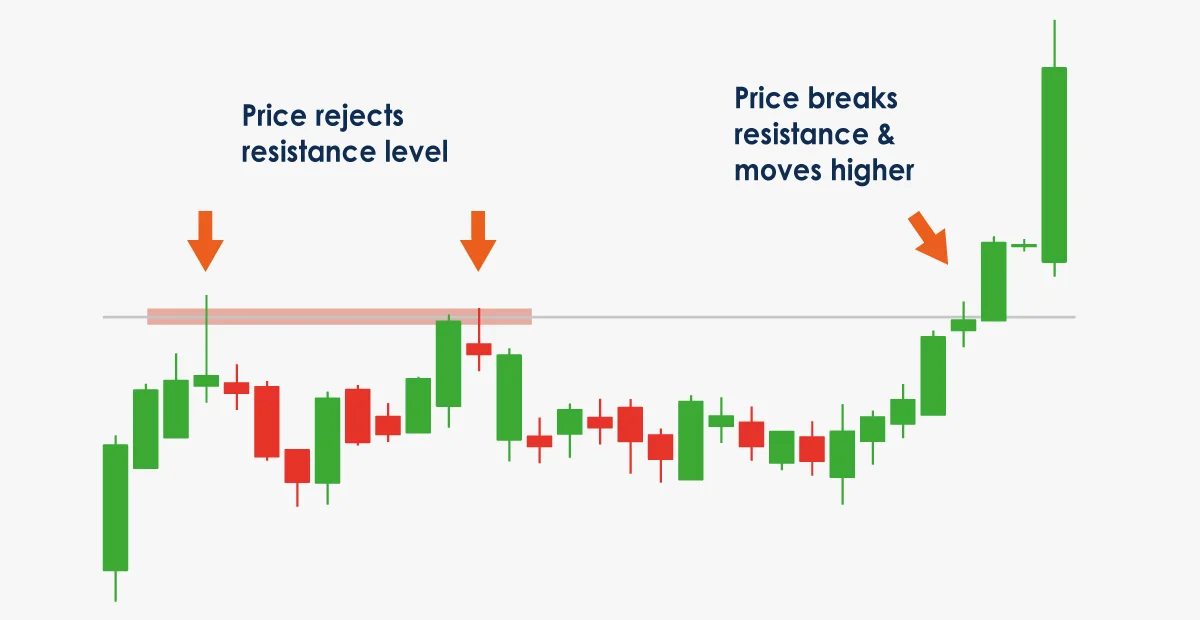

Range Trading Strategy

The key to success in range trading is to choose a currency pair that trades within a particular price range and profits from the anticipated highs and lows within that range. The higher boundary, or resistance, is where traders sell, with the lower boundary, which acts as support, being where they buy. Traders use indicators like the RSI (Relative Strength Index) and Bollinger Bands to identify these ranges. This approach is most effective in markets with no discernible trend pattern and where price fluctuations are possible to profit from.

Breakout Strategy

Traders monitor price movements that move past established support or resistance levels during breakout trading. These breakouts usually lead to significant price moves, which offer lucrative trading opportunities. Support and resistance levels and volume indicators confirm the breakout’s legitimacy. One example is buying a currency pair after it breaks over a resistance level, anticipating more upward momentum.

Position Trading

Position trading is a long-term trading technique where you hold trading positions for weeks, months, or even years, depending on market trends. This approach focuses on economic indicators, interest rate differentials, and political developments and is primarily based on fundamental research. A trader may buy a currency pair based on the country’s economic growth forecasts and hold the position until the outlook changes.

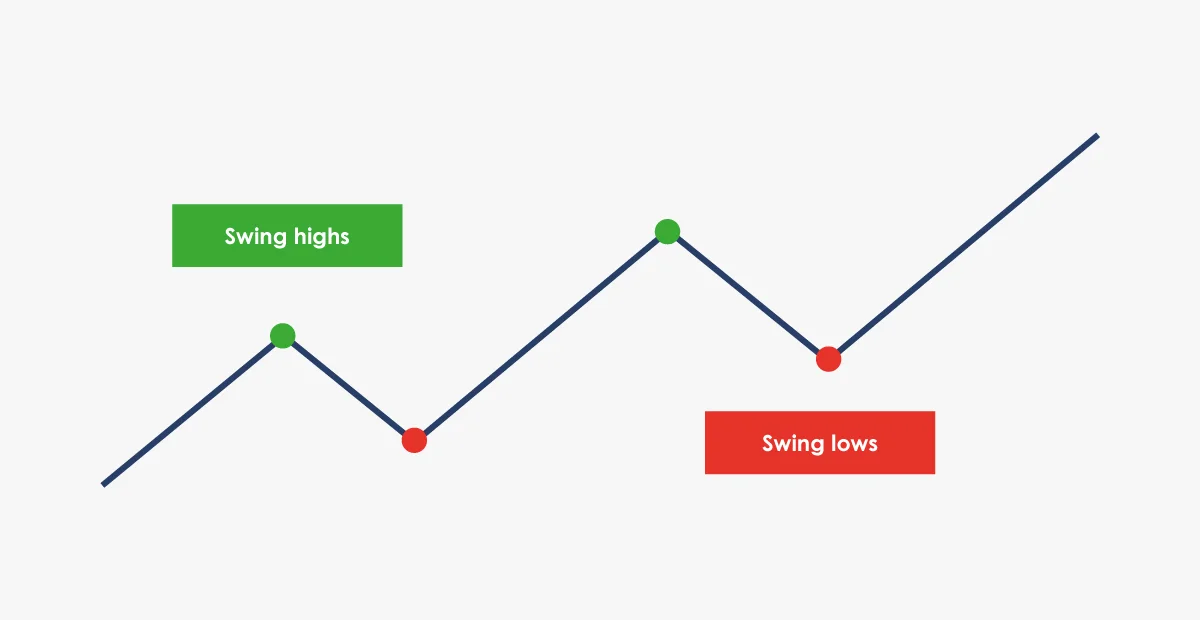

Swing Trading

By maximising market fluctuations, swing trading aims to make short—and medium-term gains within a more extended pattern. Traders use Fibonacci retracements, trend lines, and momentum indicators to identify potential reversals. A typical swing trade could involve purchasing a currency pair after a gradual decline in the overall trend and selling at a higher price the following month.

Check out swing trading vs day trading.

Scalping

A high-frequency investing strategy that seeks minuscule returns from a sizable number of trades executed over tiny fractions of time, frequently minutes, is known as scalping. Scalpers use narrow spreads, robust liquidity, and fast decision-making to profit from small price fluctuations. They employ tools like one-minute charts and sophisticated order types to execute trades more effectively. Due to its rapid tempo, scalping necessitates a high degree of discipline and quick reactions.

Learn which are the best pairs for scalpers.

Momentum Trading

This strategy involves trading based on the strength of recent price trends. Traders look for assets moving substantially in the opposite direction with high volume. Momentum traders frequently use tools like the Momentum Indicator and the Relative Strength Index(RSI) to identify solid trends and capitalise on market volatility. A trader might purchase a currency pair with powerful upward momentum before reversing after a certain point.

News Trading

Following significant economic news releases like interest rate decisions, unemployment rate data, and GDP data, news trading attempts to benefit from market volatility. Traders take trades right before or after significant news reports and events because they follow economic calendars. A seller might purchase a currency pair with the expectation that it will appreciate, for example, if an interest rate increase is announced.

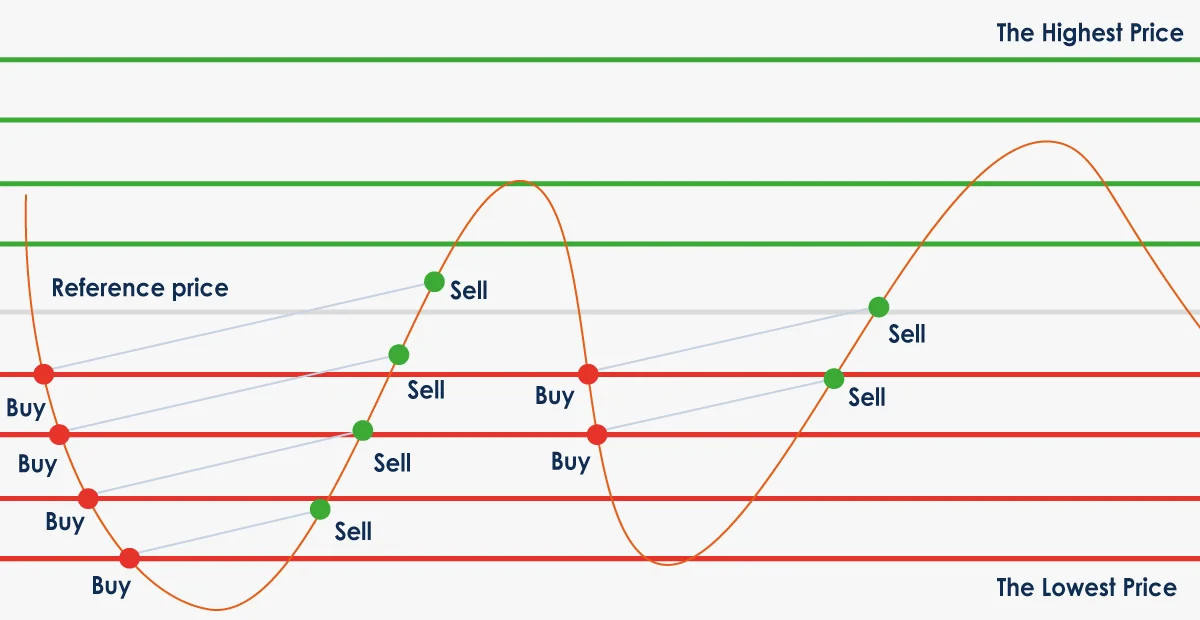

Grid Trading

A “grid “of orders is created when various buy and sell orders are placed at set intervals above and below a specific price. While avoiding market direction, this method aims to gain from market volatility and price variations. A trader spot purchases every 10 pips below the current price and buys every 10 pips above, moving forward as the price moves between the two levels.

Learn more about grid trading and how it works.

Algorithmic Trading

Algorithmic trading, more commonly known as automated trading, uses computer programs to execute transactions according to predetermined rules and algorithms. Regarding productivity and accuracy, these algorithms surpass human traders in processing large amounts of data and executing trades quickly. One example is a system that, to reduce trader involvement, instantly purchases a currency pair when a particular technical trend is observed.

Learn more about automated trading vs manual trading.

To remain successful in the forex market, you must implement the best forex trading strategy that works for you. A well-developed forex trading strategy is essential for navigating the tumultuous money markets, allowing traders to manage risks while maximising potential rewards. Additionally, it provides information for traders regarding when to buy and sell a currency pair.

How to Choose The Best Forex Trading Strategy That Suits You

You must consider several factors when choosing the best forex trading strategy to ensure it aligns with your investing goals, risk tolerance, and lifestyle. This is the complete breakdown:

Evaluate Your Market Knowledge

The degree of market understanding is essential in deciding which trading forex strategies to use. Beginners frequently succeed with basic forex trading methods such as trend following, which detects and follows the overall market direction. These forex trading strategies are more straightforward to understand and use. On the other hand, more seasoned investors may favour more complex methods, such as computational trading, which uses computer programs to execute trades based on advanced algorithms and can process large amounts of data quickly.

Continuous learning and experience will enable traders to develop and apply more advanced trading strategies.

Assess Your Risk Tolerance

Trader risk tolerance determines the degree of risk they are willing to accept. Various forex trading strategies have different risk levels. High-risk forex trading techniques like scalping, for instance, can yield significant profits while posing a risk of substantial loss when combined with numerous small transactions made in a relatively short time. To minimise risk, consider position trading, which involves keeping positions for extended periods to make smaller, more consistent income. Knowing your risk tolerance can help you choose a program that best suits your comfort level and financial goals.

Consider Your Time Availability

Day trading and scalping require constant market monitoring and quick decision-making, which may take time and effort. These strategies suit traders who regularly spend a lot of time trading. On the other hand, swing and position trading are more versatile because they demand less monitoring of positions for an extended period, weeks, or even months. These methods are ideal for traders who prefer to make accurate trading decisions when they don’t have time to watch the markets all day.

Test Different Strategies in a Demo Account

Before investing real money, it is prudent to examine several forex trading strategies on a demo account. This practice allows traders to experience each strategy’s performance without the financial risk. This enables an understanding of how different forex strategies fit into a trading strategy in terms of their subtleties and effectiveness. Using a demo account, traders can experiment with other forex trading strategies based on their interests and skills.

Match the Strategy to Your Personality

The effectiveness of a trading strategy depends significantly on a trader’s personality. For instance, if a trader enjoys fast-paced environments and thrives under stress, scalping might be the best choice because it requires quick thought and execution. Position trading might be more appropriate if a trader is persistent and prefers a more deliberate, slower strategy. Position trading involves making fewer decisions that are less stressful and more suited to the temperament of the individual trader. Remember that depending on one’s temperament and trading choices, the best forex trading strategy for someone else might not work for another.

Adapt and Refine Your Strategy

The forex market is constantly changing and active. Therefore, it is crucial to maintain flexibility and willingness to adjust your trading method. You can periodically evaluate and monitor your trading strategies to maintain effectiveness and respond to market conditions and trading experiences. Keeping a trading diary can help you make informed decisions about what works and what doesn’t.

By considering these factors, you can choose a forex trading strategy that works best for your situation and boosts your chances of trading success.

Learn more about how to trade Forex for beginners.

Why Choose ATFX

ATFX offers both a demo account and a live account to meet your needs. As a trader, you can test your forex trading strategies risk-free with our demo accounts before entering the real world and generating income. Now is the time to begin your trading journey and apply what you have learned with ATFX! As a trader, you may use ATFX to improve your knowledge of forex trading strategies for genuine market success.

Furthermore, ATFX allows traders to trade Forex and ETFs, shares, indices, and commodities at lower spreads! MetaTrader 4 (MT4) & MetaTrader 5 (MT5) are popular trading platforms among traders. ATFX offers some of the market’s most competitive spreads and lightning-fast execution, allowing traders to maximise their MetaTrader 4 and MetaTrader 5 experience.

Learn what MetaTrader 4 (MT4) is & how to use it in 10 easy steps.

How to Open a Live Trading Account & Start Trading with ATFX

Step 1: Open Your Account

Complete the Live Trading Account application form. Once identity verification is complete, the account will be set up.

Step 2: Fund Your Account

Deposit funds from a credit card, e-wallet or bank transfer to start trading.

Step 3: Start Trading

You can now start trading on every device, including PC, Android, iPad, iPhone or via the web browser.