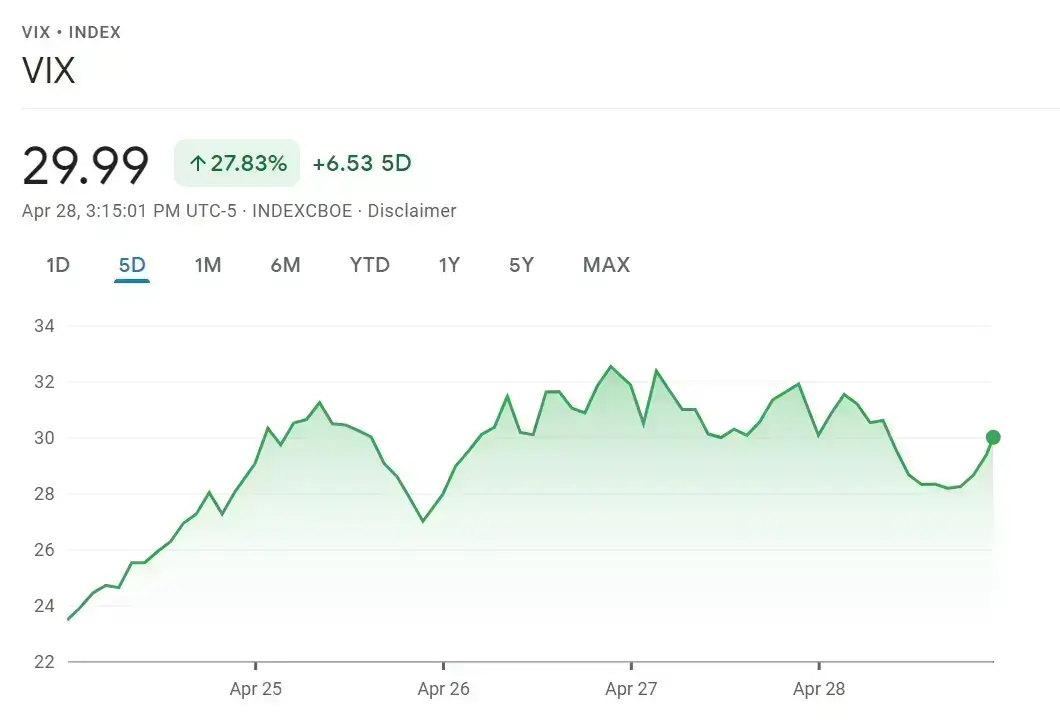

US stocks have fallen sharply, and the VIX Fear Index has soared by about 28% in the past five days. The “fear index” is a critical way to measure the market’s volatility expectations for the next 30 days. Its sharp surge has left the markets worried about the future of US stocks. At the same time, the US stock market ushered in the earnings season this week. Nearly 180 S&P 500 constituent companies will announce their earnings soon, including Google’s parent company Alphabet, Microsoft, Apple and Amazon, among other technology giants. The market is paying particular attention to the Q1 performance of these companies since they are regarded as an essential driving force supporting the recent US stock market rebound.

The main reason for the downward trend in US stocks is that the market is preparing for the Fed’s imminent interest rate hike. As Fed Chairman Jerome Powell said earlier, the Central Bank is ready to raise interest rates by 0.5 percentage points at its next meeting if necessary. Moreover, it is clear that the attitude of prominent US Fed officials to interest rate hikes is more aggressive than in earlier speeches. Hence, the Fed’s more hawkish tone towards raising interest rates has made the markets uneasy. Furthermore, many expect the Fed to raise interest rates sharply during the rest of the year, creating downward pressure on US stocks.

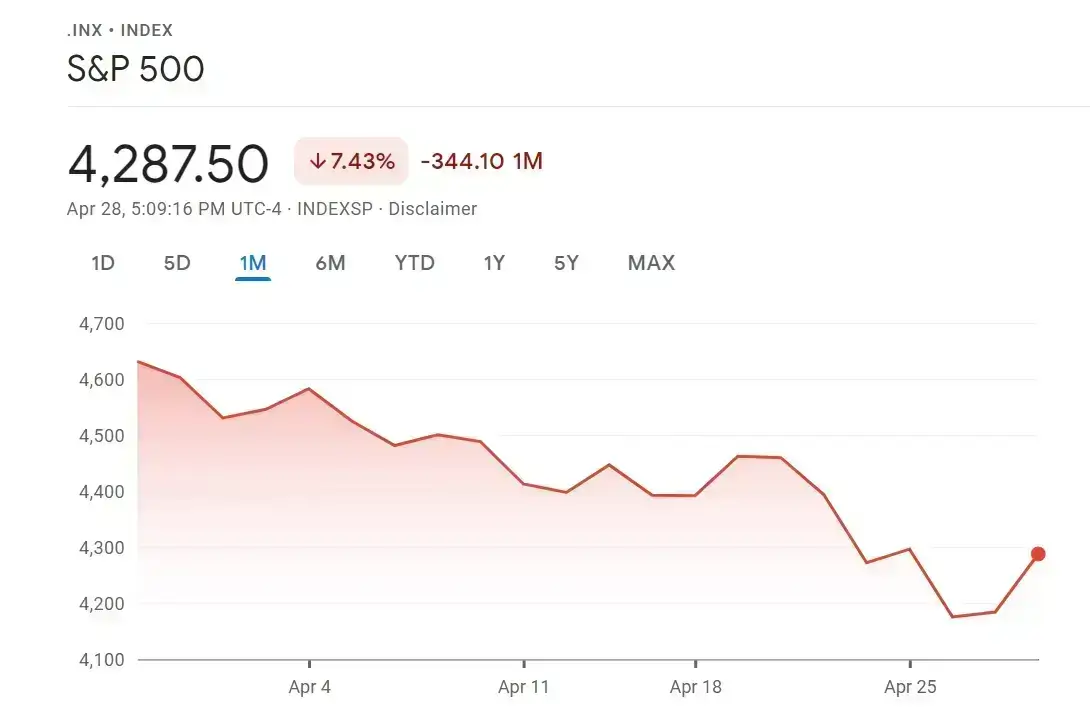

Since April, the US stock market has entered a downward cycle. The S&P 500 fell from 4545.86 points on April 1 to the current 4287.50 points, a decline of 7.43%; the NASDAQ fell much more, from 14532.55 points in early April to 12790.74 points, a drop of nearly 12%, the collective decline within the US stock market made the market’s panic index soar.

On the other hand, the sharp decline in the stock market was triggered because the IMF revised its US economic growth forecast to 3.7%, compounding the market’s fears that the US economy was in a recession, which also boosted the demand for the US dollar as a safe-haven asset in the future. As a result, the dollar has risen sharply in the past, with the dollar index rising more than 0.4% to a high of 102.23, the highest level since March 2020. The dollar’s strength has also put gold’s price under pressure.

Over the short term, the market is significantly worried about the impact of the Fed’s expected sharp interest rate hikes on the US economy. Hence, the recent downturn in the stock market is expected to ease after the dust settles on the Fed’s decision to raise interest rates on May 4, 2022. As the current market trends have already priced in the impact of the Fed’s high-interest rate hikes, it is expected that a 0.5 percentage point rate hike will not put significant pressure on the stock market. However, this requires the Fed not to release a more aggressive interest rate hike signal for its next meeting. Otherwise, the downturn in the stock market may continue for a more extended period; hence, gold prices will remain under pressure. Overall, next month’s Fed interest rate decision will be a potential turning point in the short-term market sentiment.

According to the Wall Street Journal, Morgan Stanley Chief Investment Officer Mike Wilson is pessimistic about the downward target of the stock market in 2022. In media interviews, he said that although the US stock market fell sharply in April, the correction may not be enough. The conditions necessary for a sustained rebound do not exist at the moment.

Furthermore, there is still significant uncertainty about the market’s direction due to the impact of the ongoing earnings season. Suppose the economic data remains sluggish. In that case, the selling of stocks due to fears about the overall economic slowdown will continue to drag down US stocks. In the long run, suppressing inflation effectively while not letting the economy fall into a recession may become the key to the future of the US stock market if it is to maintain its upward trend.