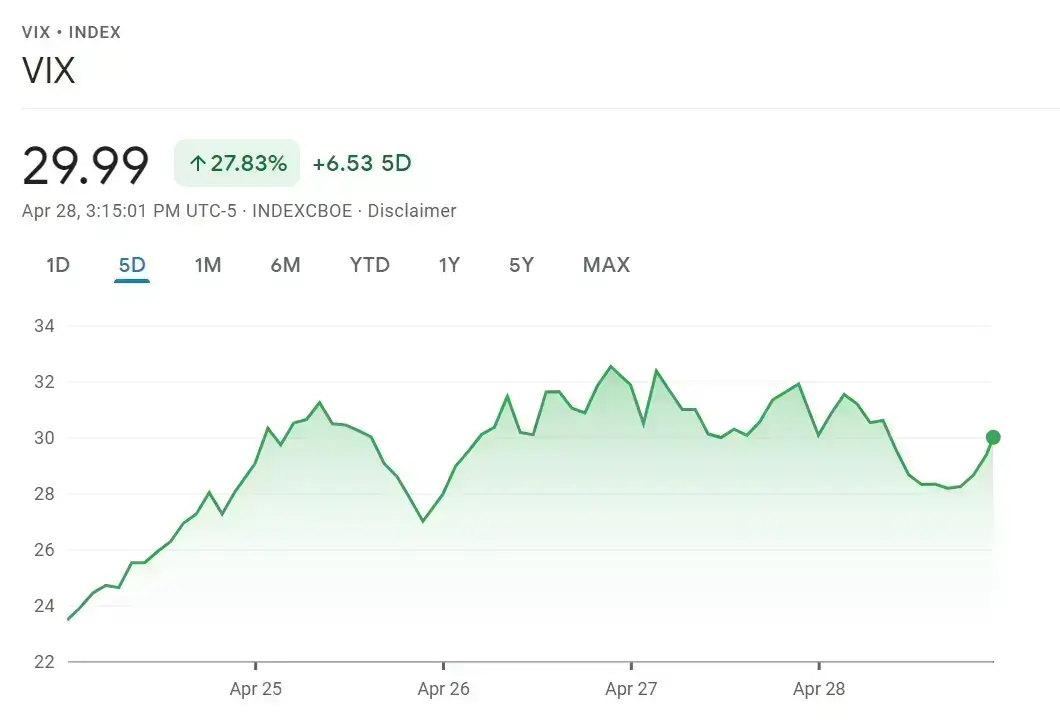

近日,美股大幅走低,VIX恐慌指數一路飆升,在過去5天飆升了約28%。 由於“恐慌指數”是衡量市場對未來30天波動性預期的一種重要方法,其急劇飆升也讓市場對於美股未來的走勢充滿了擔憂。 與此同時,美股本周迎來財報季,陸續有近180家標普500指數的成分企業將在近期公佈財報,包括谷歌母公司Alphabet、微軟、蘋果及亞馬遜等眾多科技巨頭,因此市場對於這些公司Q1表現也格外關注,並把他們視為支撐近期美股反彈的重要動力。

美股下行的主要原因是市場正在消化美聯儲日益迫近的加息消息,正如早前美聯儲主席鮑威爾表示,該局準備必要時在下次會議上加息0.5個百分點。 很明顯美國主要官員對加息的態度比更早前的講話更加激進,美聯儲更加鷹派的加息舉動讓市場感到不安,對於美聯儲在年內大幅加息的預期持續升溫,對於美股產生下行壓力。

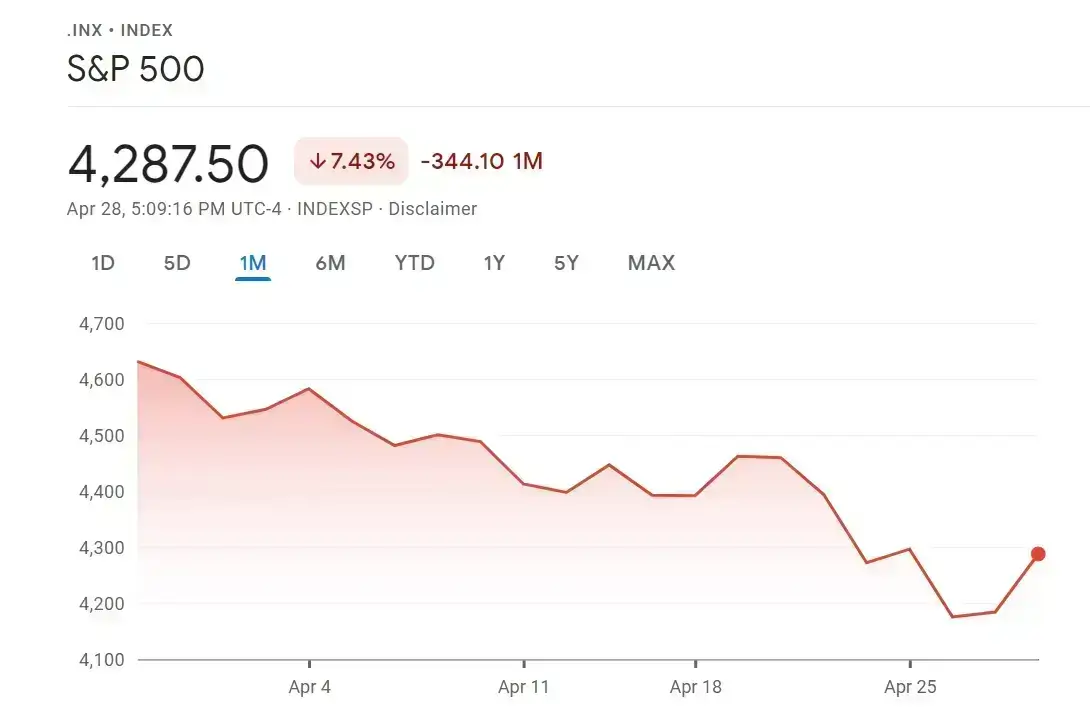

進入4月以來美股就進入了下行周期,標普500從4月1日的4545.86點跌至目前的4287.50點,下跌幅度為7.43%;納指跌幅更大,從4月初的14532.55點大跌至12790.74點,跌幅達到了近12%,美股的集體大跌讓市場的恐慌指數不斷飆升。

另一方面,股市大幅下行的原因是由於市場上充滿對美國經濟陷入衰退的擔憂,IMF將美國經濟增長預測下修至3.7%,這也推升了近期美元作為避險資產的需求。 美元匯率在近日大幅上漲,美元指數一度上漲逾0.4%,至102.23高點,為2020年3月以來的最高水準,而美元的走強也讓黃金的價格持續承壓。

短期來看,由於當前市場主要擔憂美聯儲大幅加息對美國經濟的影響,待下月美聯儲加息決定塵埃落定之後,股市近期低迷的行情有望出現緩和。 由於目前市場走勢已經消化了美聯儲加大加息力度的影響,預計若如市場預期一樣加息0.5個百分點不會令到股市大幅承壓,前提是美聯儲不會在下月會議上釋放出更加激進的加息信號,否則股市的低迷行情或許還會持續更長時間,並且金價也會繼續承壓。 整體而言,下月的美聯儲決議將成為潛在的短期市場情緒轉捩點。

不少市場分析人士預計這一輪下行週期還尚未見底,據華爾街日報稱,摩根士丹利首席投資官Mike Wilson對2022年股市下行目標位顯得有些悲觀,他對媒體表示,美國股市4月雖大幅下跌,但回調幅度可能還不夠,尚不具備持續反彈的條件。

另外,受財報季的影響市場走向仍存在較大不確定性,若經濟數據持續低迷,因擔心整體經濟放緩而拋售股票也會繼續拖累美股。 長遠來看,如何有效抑制通脹的同時不讓經濟陷入衰退成為美股未來能夠保持上行的關鍵所在。