The yen extended its decline, pushing the USD/JPY pair to a fresh nine-and-a-half-month high on Wednesday. The rally in USDJPY reflects growing pressure from the Japanese government on the central bank to maintain loose monetary policy, which is overshadowing signals of a potential interest rate rise.

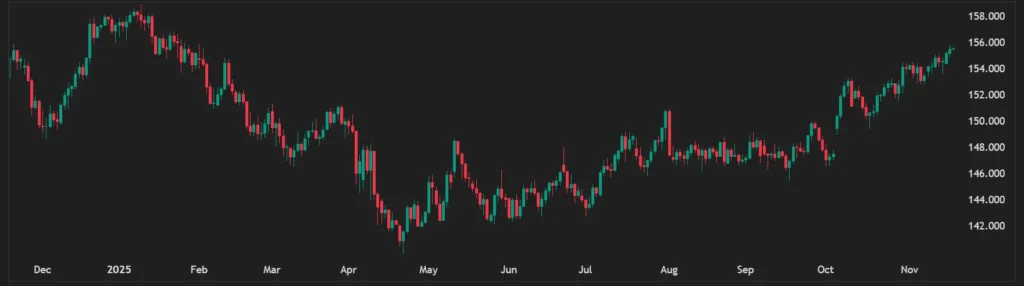

USDJPY – Chart

The pair strengthened to near ¥155.50 in early Asian trading, a level not seen since late January. This movement highlights a widening gulf in monetary policy expectations between Japan and the US, with investors awaiting the release of minutes from the Federal Reserve’s latest meeting for further clues on the path for American interest rates.

The yen’s slide within the USD/JPY exchange rate comes despite Bank of Japan Governor Kazuo Ueda hinting at the possibility of raising interest rates as soon as next month. However, his comments have been met with public disapproval from Sanae Takaichi, Japan’s vice-premier, who has urged the central bank to maintain low interest rates to support the government’s reflationary efforts.

Takaichi’s intervention has fuelled market expectations that the BoJ may be forced to slow its pace of policy normalisation, a prospect that continues to weigh heavily on the Japanese currency and support the USDJPY.

Across the Pacific, the dollar found support as traders scaled back bets on aggressive interest rate cuts from the Fed this year. Hawkish commentary from several US central bank officials, including vice-chair Philip Jefferson, who said the Fed should proceed “slowly” with further reductions, has bolstered the greenback.

Recent US labour market data underscored the resilience of the American economy. Initial jobless claims came in at 232,000 for the week ending October 18, while a separate report from ADP Research showed employers cut just 2,500 jobs a week on average during the four weeks to November 1.

The contrasting pressures on the two central banks highlight the divergent economic outlooks, with the Fed remaining in a “higher-for-longer” holding pattern and the BoJ navigating a delicate exit from its long-standing ultra-loose policy, a dynamic that continues to drive the USD/JPY.