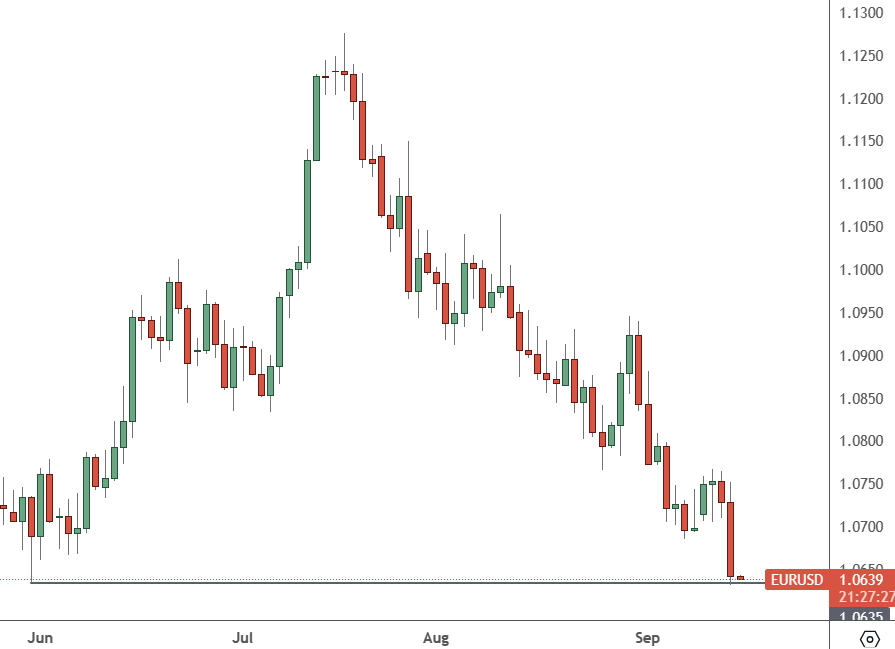

EURUSD dumped 100 pips on the release of US ISM services data on Wednesday and has European GDP data ahead.

EURUSD: Daily Chart

The EURUSD dropped from 1.08 to 1.07 and may gravitate to the 1.064 resistance with weaker GDP data.

The greenback found a bid after stronger-than-expected ISM services data from the United States economy.

The fastest pace of rate hikes in decades temporarily slowed activity in the services sector, but the ISM services index rose to a six-month high in August as the price-paid measure climbed for a second straight month.

Traders saw this as a positive for the US dollar and potential further rate hikes as activity remains strong in the sector. The ISM index rose in August to 54.5, growing at the fastest pace since the 55.1 reading in February. Gains were broadly split around the economy, with new orders, employment, prices, and production all moving higher at a faster pace in August.

Services purchasing managers continue to talk of a tight labour market, saying, “The labour market remains very competitive,” which indicates that wage growth will remain supported and troublesome for the Fed.

European shares were lower on Wednesday for a sixth straight session, with weaker German economic data raising fears of a further slowdown. German industrial orders dropped more than expected in July, pulling back after sharp gains in the aerospace sector the previous month.

“The market is focusing on the prospects of a continued weakening in the macro momentum within Europe and even the prospect of a mild recession in the coming quarters,” said Thomas McGarrity, head of equities for RBC Wealth Management.

Thursday will bring another test for the European economy with the release of GDP for the third quarter in the Eurozone. A weak number, possibly hinted at from the German data, could see the euro testing lower support.