The USDCAD pair has data ahead in the form of a Bank of Canada rate decision and a speech from Federal Reserve Chair Jerome Powell.

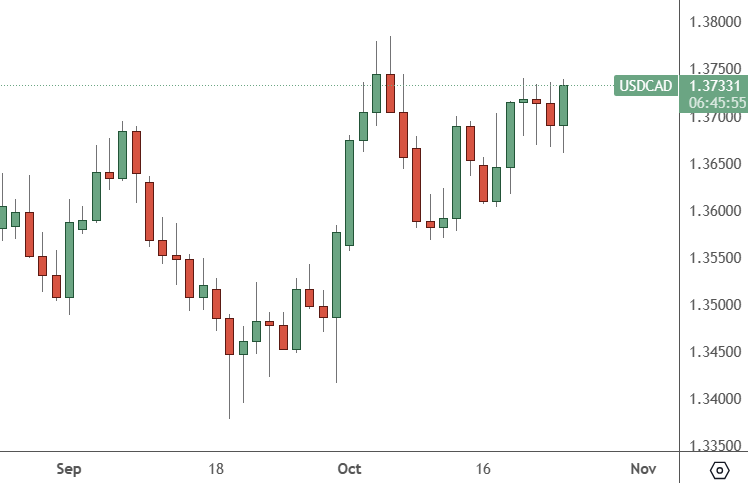

USDCAD: Daily Chart

The US dollar has shrugged off some early weakness this week to head back for the resistance at 1.38.

The Bank of Canada (BoC) is expected to leave interest rates on hold on Wednesday as the economy stalls. However, many see the central bank keeping future hikes on the table with inflation hovering higher than its 2% target.

In July, the BoC raised its benchmark rate to a 22-year high of 5% and said more hikes might be needed, but made no move in September as growth appeared to weaken. GDP data out later showed that growth in the country stalled in July and August.

“All the signs across the Canadian economy right now are pointing to a prolonged slowdown,” said Karl Schamotta at Cambridge Global Payments. A weak economy and a modest slowing in inflation “should keep the Bank of Canada on hold,” he said.

The BoC has raised rates 10 times since March of last year to fight inflation, which peaked at over 8%. Inflation in Canada was shown to have slowed unexpectedly to 3.8% in September, down from 4% in August.

The BoC decision will be followed by a speech from Fed Chair Jerome Powell. In a recent speech to the Economic Club of New York, Powell hinted that officials would extend the interest rate pause at the next meeting in November.

“We have to let this play out and watch it, but for now, it is clearly a tightening in financial conditions,” Powell said. “Higher bond rates are producing tighter financial conditions right now”.

The USDCAD may look to test the 1.38 highs before its next path is clear.