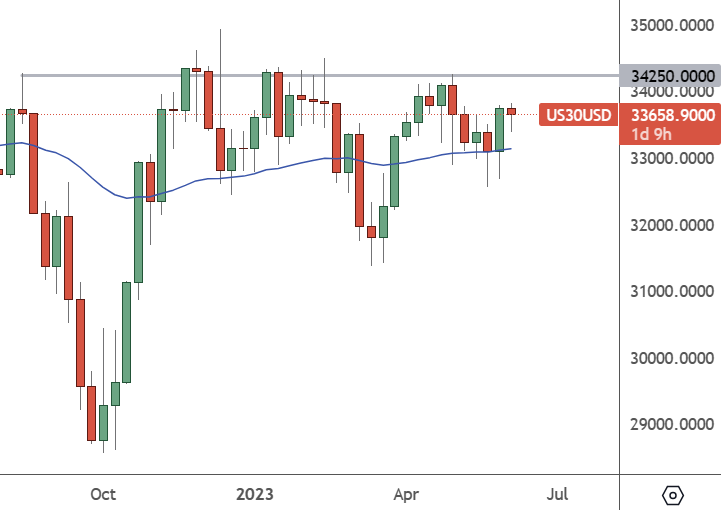

The US30 Dow Jones index has resistance ahead at 34,250, with a Federal Reserve meeting next week.

US30 – Weekly Chart

The US30 trades at 33,658 and could push higher with a bullish close this week.

US stocks were mixed this week despite some positive economic indicators. Investors are awaiting next week’s inflation data and the Federal Reserve’s latest policy meeting.

Inflation data is expected to show another cooling in consumer prices month-over-month for May. However, core prices will be watched closely, with the Fed widely expected to hold interest rates at their current level.

Investors were cautious, with the S&P 500 up almost 20% from its October 2022 lows due to gains in the largest stocks and a stronger-than-expected earnings season. They hope the US central bank is ready to end its interest rate-hike cycle.

US Stocks Forecast

Recent economic data and dovish remarks from Federal Reserve policymakers have increased the potential for the Fed to keep rates steady at its June 13-14 meeting. According to CME, Futures markets indicate an almost 80% chance that the central bank will hold interest rates in the 5%-5.25% range. However, they are pricing another 50% chance for a 25-basis-point rate hike in July.

“Having come this far, we can afford to look at the data and the evolving outlook and make careful assessments,” Fed Chair Powell said recently. He added that “the risks of doing too much versus doing too little are becoming more balanced.”

However, another Fed official, Loretta Mester, pushed back against dovish comments from other members. Mester believes the US central bank should not pause its recent rate hike path.

“I don’t really see a compelling reason to pause — meaning wait until you get more evidence to decide what to do,” she told the FT. “I would see more of a compelling case for bringing [rates] up . . . and then holding for a while until you get less uncertain about where the economy is going.”

This week, a bullish close in the US30 could see the market push ahead to resistance next week with the inflation and Fed meeting in focus.