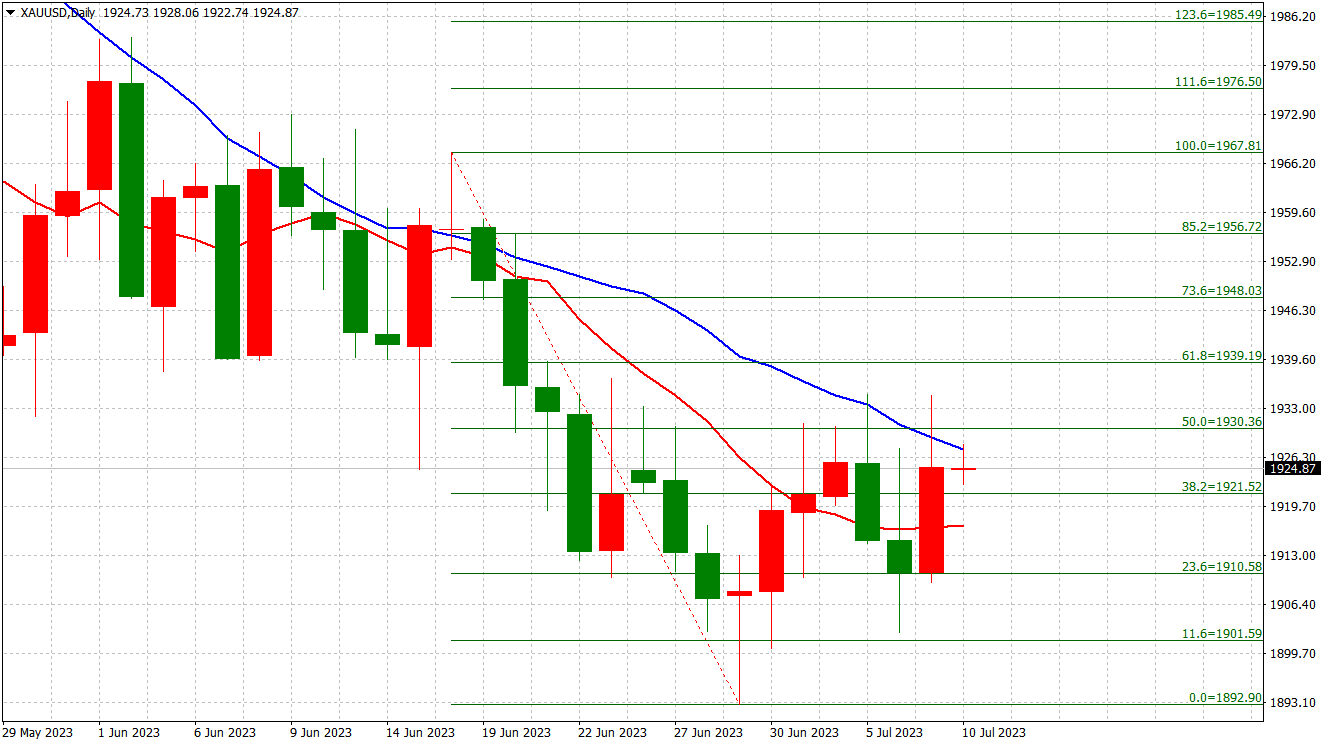

XAUUSD: Day Chart

Last Friday, the Nonfarm payrolls report caused the dollar to drop to its lowest point in two weeks. Meanwhile, the price of gold reached above $1,934 and saw its first weekly gain in four weeks. This week, the market focuses on Wednesday’s US inflation data release.

The market expects the US June inflation YoY to be 3% from 4% last month. The Core inflation YoY is 5%, improving from 5.3% last month. The US inflation rate may guide the FOMC’s interest rate decision at the end of July. Suppose the US June Core inflation YoY remains at 5.3%; the market will expect a rate hike of 25 bps. However, if the inflation rate is much higher than last month, the market will expect the rate hike to be 50 basis points, and the dollar will strengthen and put pressure on the gold price.

The current outlook for the gold price is not too negative, but things could worsen if it falls below the support level of $1,920. The support breakout may test $1,900.

Although this support has held up until now, if the situation continues, bears may be able to attack the $1,880 level. If the market weakens further, sellers are expected to focus on the $1,850 level, close to the 200-day simple moving average and the 50% Fibonacci retracement of the November 2022–May 2023 rally. If the market continues to fall, the next area of concern is the $1,800 level.

In the event of a bullish turnaround, there are several hurdles to overcome to be confident that the worst is over and better days are ahead for the precious metal. That said, the first resistance worth watching appears at $1,975. Successfully piloting above this barrier could inject optimism into the market and pave the way for a retest of the psychological $2,000 level. While bulls may struggle to push prices above this area, a breakout could keep the dream of new highs alive.