The GBPJPY exchange rate was looking for a move to resistance with British retail sales ahead on Friday.

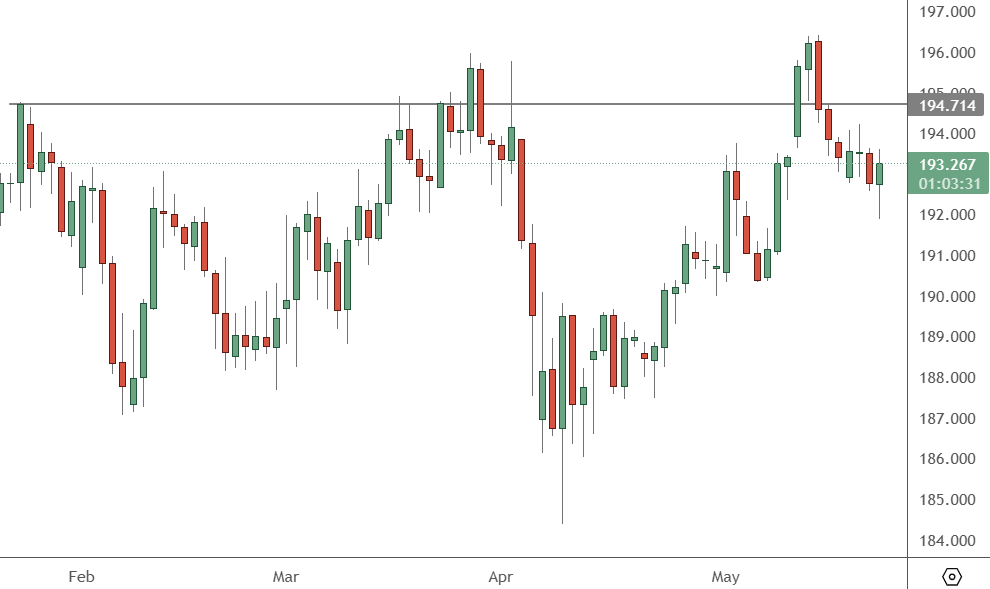

GBP v JPY has resistance at the 194.71 level which has been an obstacle for the pair in January and April. Another failure at that failure could see a correction in the pound.

British retail sales numbers are released on Friday at 2pm HKT with economists expecting to see a monthly dip of 0.4% to 0.2%. However, the yearly figure is expected to show an increase from 2.6% to 4.5%.

The British pound was trading close to its highest level against the US dollar since 2022 as hotter inflation and improving relations with Europe and the US continued to support the currency.

“The trade deals are generally good news for the pound,” said ING FX strategist Francesco Pesole. “We still think the pound is in a pretty good position”.

The latest inflation readings could also stall any future rate cuts from the Bank of England and support the pound.

The BoE’s chief economist Huw Pill said this week that a quarterly pace of cuts was “too rapid” given still strong wage pressures on inflation.

“There’s a bit of dissent building at the Bank of England,” ING’s Pesole added.

The country’s central bank lowered interest rates by a quarter point to 4.25% on May 8 in a three-way split vote, with two members favouring a bigger cut, and two – including Pill – deciding a hold was the best option. The recent positive sentiment should continue to boost the prospects for the British pound.

Meanwhile, Japan’s government downgraded its assessment of the global economy on Thursday due to the uncertainty over trade policy. In its monthly economic report for May, the government lowered its outlook for the US economy for the first time in nearly three years to say its expansion was moderating.