The UK stock market was higher for a second week despite a gloomy outlook for the property sector.

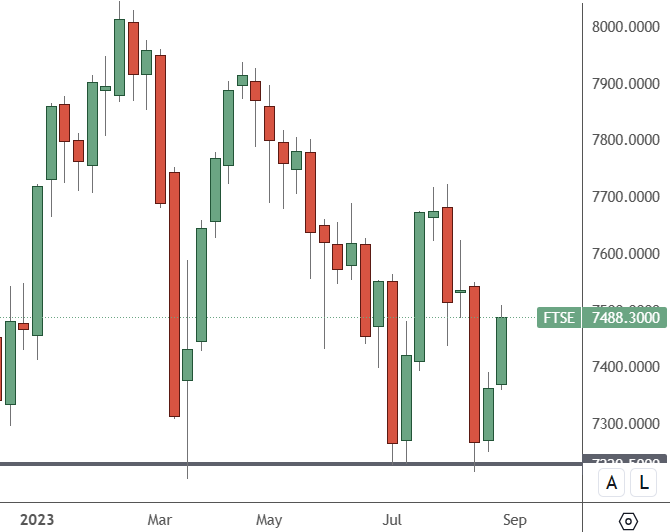

FTSE 100: Weekly Chart

The FTSE 100 closed last week at 7488 after a second week in the green and will need to see further strength this week to confirm the bullish trend.

The market was higher in London, even as fresh data from online real estate portal Zoopla projected the biggest dip in housing sales for a decade in 2023. The monthly monitor found that sales volumes were down 20% compared with 2022 and forecast sales to be the lowest since 2012 by the end of the year.

Housing prices have dipped as mortgage rates rise due to a period of persistently high inflation and central bank rate hikes.

“It is the number of sales that have been hit hardest by higher borrowing costs, especially among mortgage-reliant buyers,” said Richard Donnell, director at Zoopla.

The report also said that house price growth has slowed to its lowest rate in 12 years as people are priced out of the market by rising mortgage rates. According to the data, buyer demand fell by more than a third in the month ending August 20.

Meanwhile, the Bank of England data said mortgage approvals dipped 10% in July, to 49,400 from 54,600 in June. June saw mortgage rates hit fresh highs.