The price of SMCI fell 23% on Friday and may attract value investors.

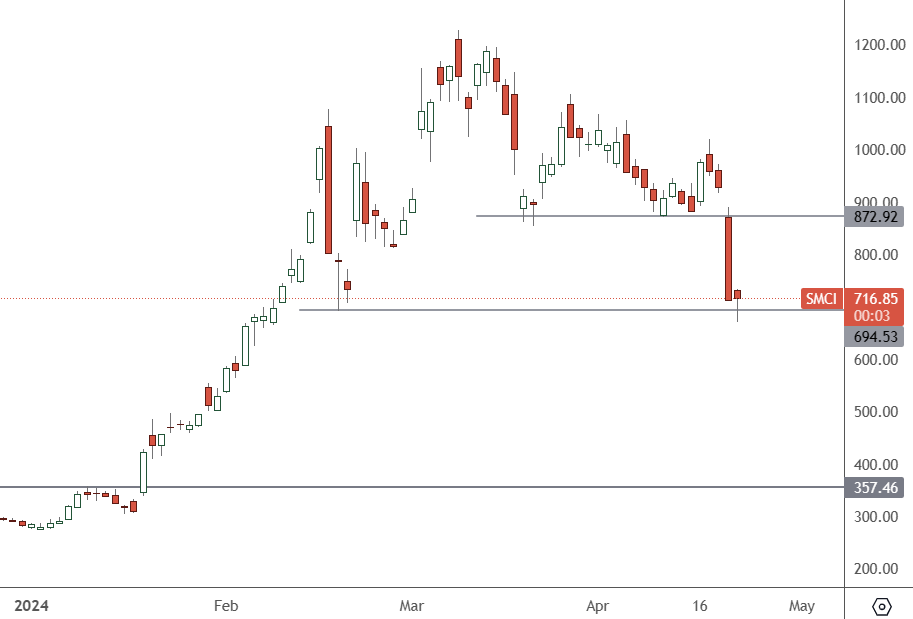

SMCI – Daily Chart

SMCI has some support at the $700 level and may attract investors looking for a bounce to the $872 resistance level.

Super Micro’s management told investors on Friday that the company will release earnings on 30 April. Traders were worried that they did not pre-release the numbers at that time. The stock had been on a big AI-fuelled rally this year and has since given up some gains. There has also been a cooling in other AI-related chipmakers, such as ASML, which is down 11% over the last week following its earnings.

However, some may see it as a buying opportunity before the earnings release.

The company’s results for the fiscal second quarter of 2024 saw them beat estimates for revenue and earnings. Net sales doubled to $3.66 billion from $1.80 billion a year ago due to new customer additions. Earnings per share of $5.59 were also up 71.5% year-over-year. They have also beaten EPS estimates in four of the last five quarters.

Super Micro’s growth has been driven by its ability to customise its server products according to its customers’ requirements. This gives the company an advantage over some of its competition and helps it time the artificial intelligence hype well. The company has good relations with Silicon Valley manufacturers, giving them an edge. Super Micro’s specialised servers and storage products are essential to building AI tools like ChatGPT or Google’s Gemini.

That should keep the company’s products in demand over the coming years. Despite the recent losses, SMCI is still up by 156% year-to-date.