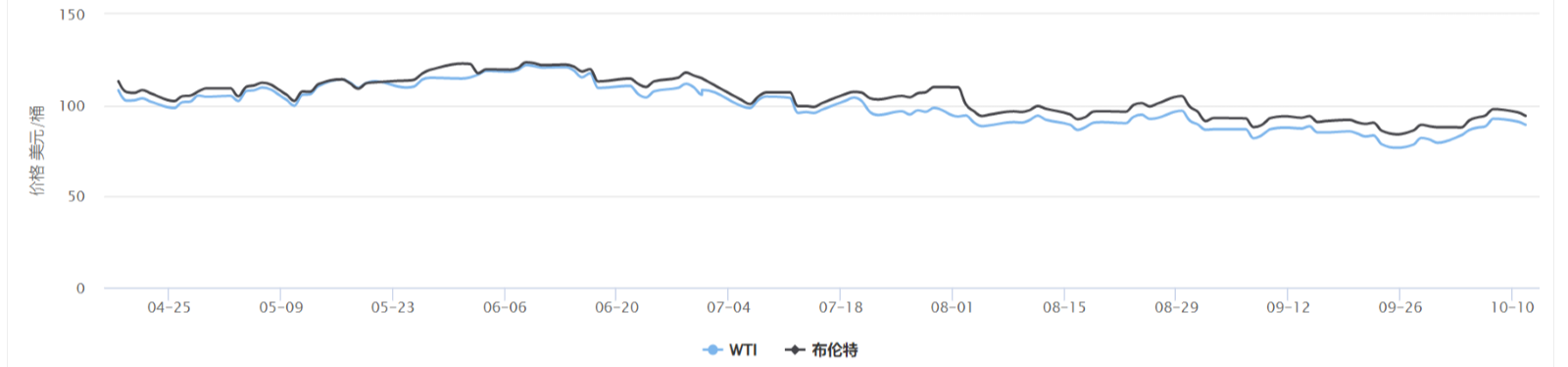

Recently, the price of crude oil has fluctuated between gains and losses. However, over the past two weeks, WTI crude oil has risen nearly 17%, reaching a new weekly high of $93.25, breaking above the $90 mark for the first time since mid-September. At the same time, oil prices recorded the largest weekly increase since February 2022, when the Russia-Ukraine conflict began, which saw Brent crude oil rise about 11%. Before the sharp rebound in oil prices that began in late September, global crude oil prices had been under continuous pressure, falling for four consecutive months since June. Therefore, what caused the sudden sharp rise in oil prices, and will future trends remain volatile?

First of all, the surge in crude oil prices has been mainly driven by changes on the supply side. OPEC+ recently announced they would cut oil production by 2 million barrels daily and set a new target for supplies in November and December. This is the largest production cut since 2020 to prevent a drop in oil prices caused by the weakening global economy. This triggered a sharp rally in international oil prices and demonstrated OPEC+’s determination to ensure that crude oil prices remain high.

As for future oil prices, from a fundamental point of view, the crude oil market has been mainly dominated by the bulls, and there are still opportunities for oil prices to rise further in the future. The global markets will remain at an oil supply deficit in the fourth quarter, according to a report by JPMorgan, with the release of more oil reserves being primarily offset by production cuts in the United Arab Emirates and Kuwait. As a result, the investment bank believes that Brent crude oil prices may reach $100 a barrel this quarter.

Recent data showed that US crude and refined oil inventories fell last week. Although President Biden said he would continue to release oil from the strategic oil reserves appropriately, Russia said it may also cut oil production in the future, indicating that oil prices still have further momentum to rise. Furthermore, the conflict between Russia and Ukraine has become more intense recently, which is also a trigger for higher oil prices.

Although oil prices have been in a continuous upward channel for a while now, the downward forces on oil prices still exist over the medium and long-term timeframes. Moreover, on Tuesday, oil prices ended the previous five consecutive daily gains, indicating that concerns about weak market demand have not subsided.

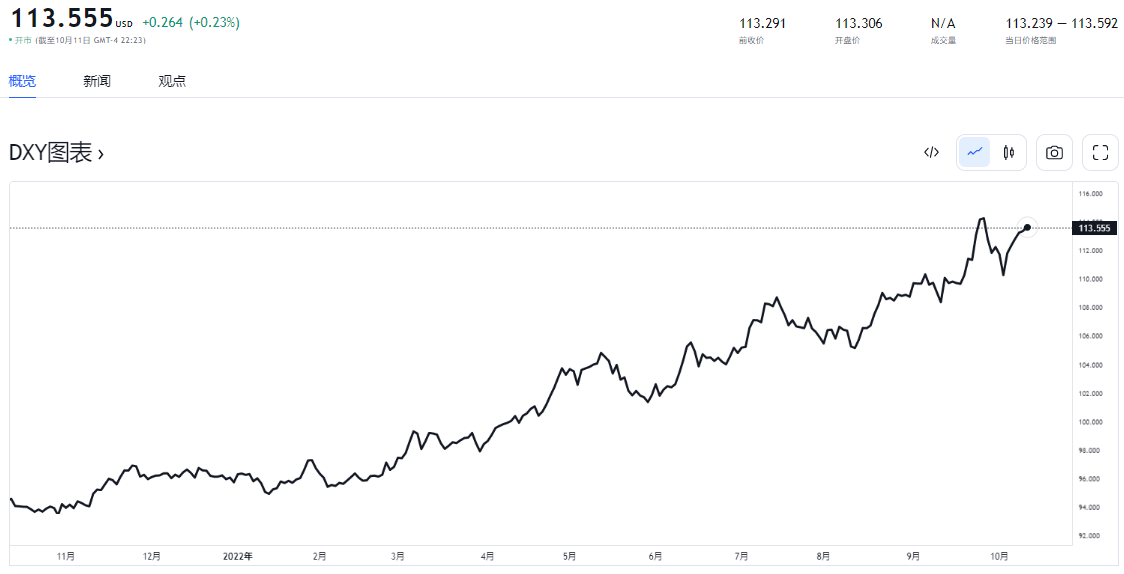

As international oil prices rise, future inflation in the United States may face pressure again. In addition, the latest non-farm payroll data was better than expected, and the pace of aggressive interest rate hikes may not stop. As a result, the US dollar has continued to rise recently, with the US dollar index fluctuating to reach a 7-day high. Coupled with the geopolitical factors, European and American stock markets have fallen as risk aversion surged, supporting the US dollar’s rally as a safe-haven currency. On the contrary, the stronger dollar put significant pressure on the prices of commodities, including crude oil, which further increased buying.

A chart showing the cost of buying crude oil in US dollars.

In the short term, the trend in crude oil prices may still be relatively robust in the remaining months of this year. However, the risk of lower oil prices has increased under the influence of market expectations of more interest rate hikes. In addition, the peak oil demand period in the winter season will find a tight supply situation, which will likely push up oil prices; hence, the battle between the bulls and bears is expected to continue. Therefore, crude oil investors must pay attention to the economic data from Europe and the United States. If the economic data continues to be weak and the market’s forecast of an economic recession intensifies, it may further drag down global oil prices.