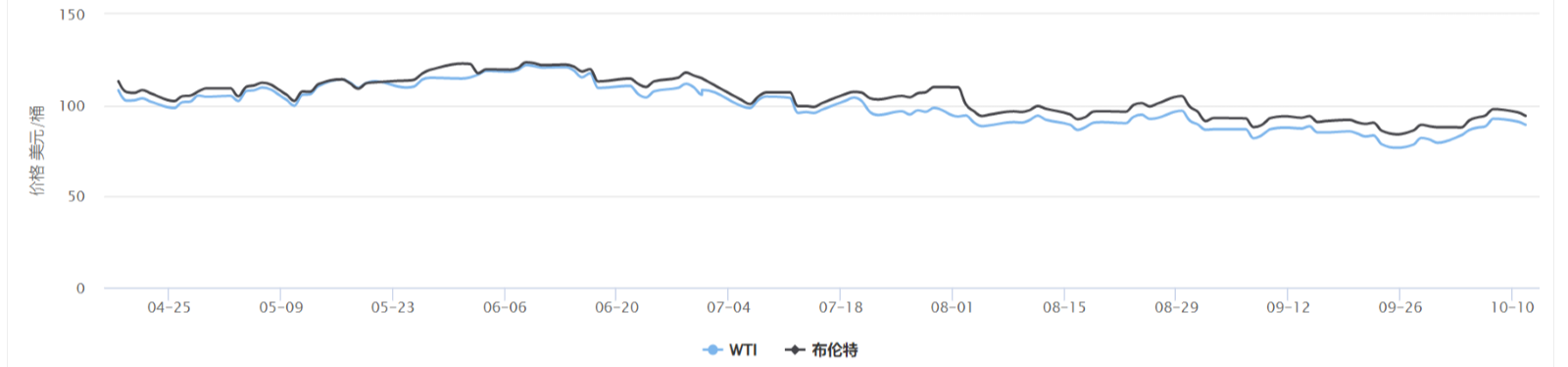

近日,原油價格走勢震盪,開啟暴漲暴跌模式。過去的兩週,WTI原油全週累計上漲近17%至週內高位93.25美元,一舉突破90.0美元關口,同時刷新自2022年2月(俄烏衝突)以來的最大單週漲幅;與此同時布倫特原油上漲約11%。在最近兩個月油價大幅反彈之前,國際油價一直處於持續承壓的狀態,自6月以來已經連續下跌了4個月。是什麼因素導致油價突然大幅急升,未來走勢是否仍會維持震盪?

首先,主要是供給側的改變導致了此次原油價格的大漲。 OPEC+近日宣布同意每日減產200 萬桶並定下11、12 月的石油供應的目標,此次為2020 年以來最大幅度減產,旨在阻止全球經濟疲弱導致的油價下跌。這一舉動令到國際油價大幅走高,同時也顯示出OPEC+盡力維持原油價格在高位水平的決心。

至於未來油價,從消息面上看近期原油市場主要被多頭佔據,未來油價仍有攀升的機會。摩根大通在一份報告中指出,更多儲備釋放在很大程度上被阿聯酋和科威特減產所抵消,第四季度市場仍將處於短缺狀態。其認為布倫特原油價格可能在本季度重新上摸每桶100美元。

數據顯示,上周美國原油及成品油庫存全面下降,儘管拜登稱將繼續適當釋放戰略石油儲備,但未來俄羅斯稱可能會削減石油產量,油價仍有進一步上升的動力。另一方面,俄烏衝突近期有更加激烈的趨勢,對於油價來說也是利好消息。

雖然油價在過去一段時間處於持續上漲的通道中,但是中長期來看,油價下行的因素仍然存在,本週二油價已經停止了此前的5連漲,反映對於市場需求疲軟的擔憂並沒有消退。

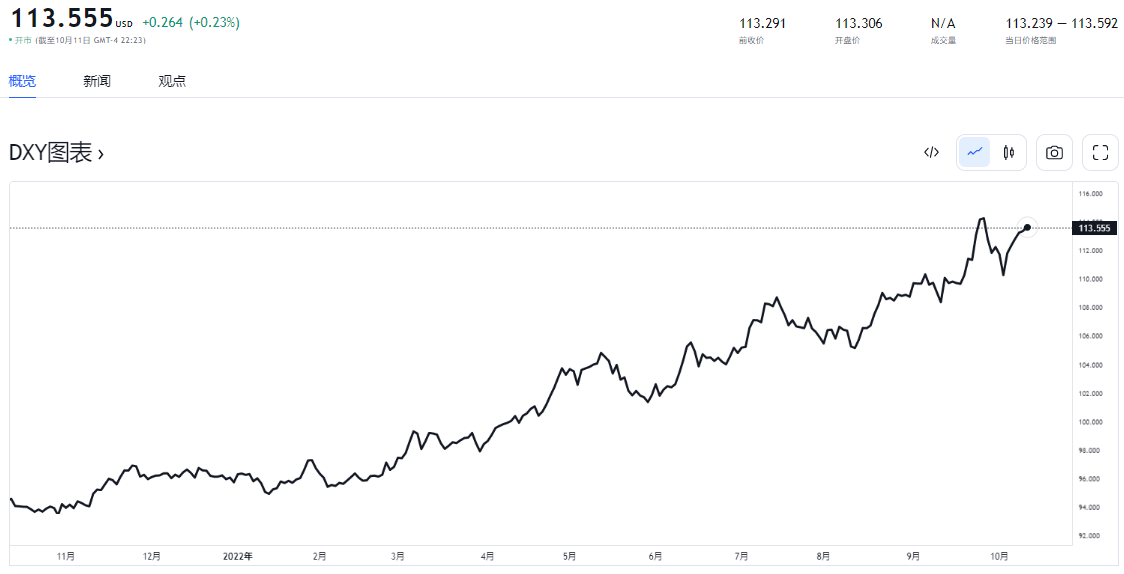

隨著國際油價重返高位,美國未來的通脹可能再度面臨壓力,加上最新的非農就業數據勝於預期,加息的步伐恐怕仍然不會停止。近期美元繼續上升勢頭,美元指數一路震盪上行,已經刷新7個交易日高位。加上地緣政治因素令歐美股市下挫,市場避險情緒隨之上漲,這支撐了作為避險貨幣美元的升勢,反之這對包括原油在內的大宗商品的價格帶來壓力,進一步增加了買家以美元購買原油的成本。

短期來看,油價走勢在今年剩下的月份中可能仍然會較為反复,一方面在市場憧憬加息的影響之下油價下行風險增加,另一方面供應端庫存和儲備不足,可能會在能源使用高峰期帶來供應緊張的局面,從而推升油價,因此多頭和空頭的博弈預計還會持續。近期原油投資者需要留意歐洲、美國的經濟數據,如果經濟數據表現持續不理想,加劇市場對經濟衰退的預測,也可能會拖累油價的多頭。