With another strong quarter, Nvidia soothed investors’ fears over the stock market rally.

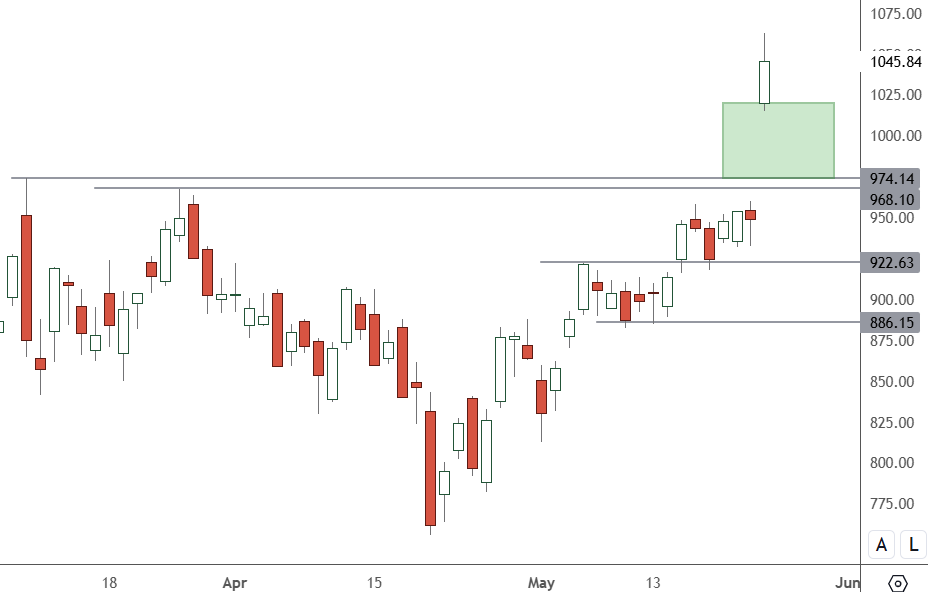

NVDA – Daily Chart

NVDA shares were trading at $1,045 in Thursday’s session after reaching a new all-time high. Thursday’s open is support ahead of the previous high of $974.

Nvidia impressed analysts with another quarter that beat lofty expectations.

The chipmaker reported earnings per share of $6.12 and sales of $26 billion for the three months ended April 30. That was higher than analysts’ anticipated $5.60 and $24.59 billion figures. Nvidia’s profits and revenues soared by 628% and 268% compared to the previous quarter.

The company’s AI-heavy data centre division again drove profits, which took in $22.6 billion of revenue last quarter, marking a 427% year-over-year increase. The latest number was also 20 times higher than the $1.1 billion the segment made in 2020.

Despite the company’s soaring valuation, shares will be cheaper after announcing a 10-for-1 stock split set for June 7. That will bring the company’s shares down from $1,000 to $100 each.

Beating another high bar for Wall Street predictions was not a big surprise after major tech firms such as Microsoft, Meta, and Alphabet announced in recent weeks that they’re continuing to pour billions of dollars into new AI infrastructure. That could set Nvidia up for future gains as the market leader.

Some investors were worried that the company might run out of steam, negatively affecting the broader market. Nvidia should continue to see support with a buoyant market. It may attract retail investors after the June stock split.

“There was no secret around Wall Street that Nvidia’s earnings would come in hot once again,” said Investing.com analyst Thomas Monteiro. “While the company didn’t repeat the same total blowout from the last few quarters in any specific area, today’s numbers remain incredibly strong”.