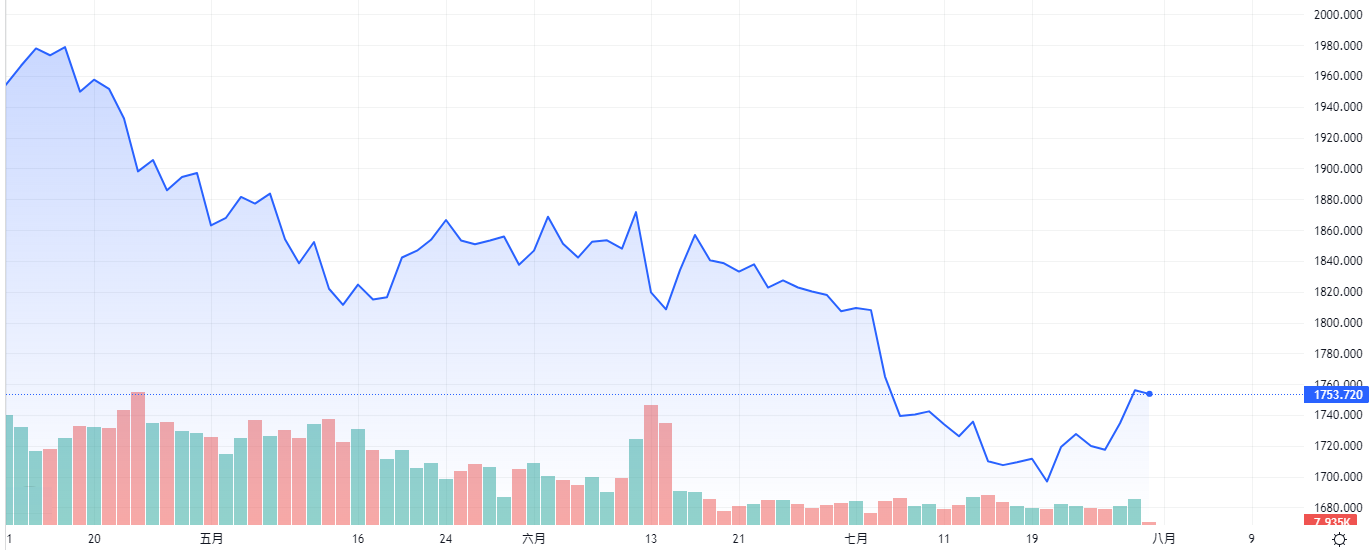

XAUUSD – In the early hours of Thursday, the Fed’s interest rate decision was finally announced, with the Fed raising rates by 75 basis points as the market expected. Therefore, the rate hike had already been priced in by the market. After the announcement of the monetary policy meeting results, the US dollar fell, and the stock market rose sharply. We also noticed that gold prices, which has been relatively sluggish recently, rose sharply after the interest rate hike announcement. Gold is currently hovering around US$1,750. Investors are also looking forward to higher gold prices in the future.

Subsequent comments from Federal Reserve Chairman Jerome Powell gave gold bulls an opportunity. He said that with the Fed’s monetary policy stance tightening further, it might be appropriate to slow the rate hikes at some point. Still, the Fed has not yet decided when to start slowing the pace of rate hikes.

However, this means the possibility of future aggressive rate hikes from the Fed is diminishing. The market will likely shift its bets on the Fed, raising interest rates by 50 basis points in September instead of 75. The market’s expectation of higher interest rates has started to cool down.

The recent economic performance in Europe and the United States has not been satisfactory, and consumer confidence is still sluggish. Although Powell mentioned to the media that there is currently no economic recession in the United States, he also said that the US economic growth would be below previous trends for some time. The possibility of a soft landing has fallen significantly. The economy’s reaction after the interest rate hike remains to be seen over the coming weeks and months. Future data releases will also need to corroborate whether record-high inflation is gradually falling. If inflation is not contained, there may be a rebound in the dollar and a decline in gold prices.

Furthermore, after entering the year’s second half, many factors support the rebound in gold prices. However, because the market has been anticipating the Fed raising interest rates, this has created continuous pressure on the gold price, allowing the bears to dominate the market. Now that the decision to raise interest rates has been made, the focus for gold investors has shifted to further interest rate hikes by the European Central Bank. Its first interest rate hike of 50 basis points exceeded market expectations. However, the interest rate hikes in the eurozone could begin to catch up with the United States. Higher rates may boost the EURUSD exchange rate and exert downward pressure on the dollar. Therefore, gold bulls may also have an opportunity to profit.

On the one hand, global risk aversion has continued unabated. Global economic recession concerns have not subsided, especially if the European and American central banks continue to raise interest rates to fight inflation. This could further reduce demand and slow down economic growth, so the risk of an economic recession will affect local currencies. More safe-haven asset seekers will flock to the gold market, which will help the recovery in gold prices. Still, the magnitude is expected to be limited. Suppose European debt risks continue to pressure the euro in the future. In that case, it is also possible that both the dollar and gold will rise.

On the other hand, financial markets have not yet assessed the risks posed by the recent rise in monkeypox virus cases in the United States and Europe. If the risk of the epidemic continues to rise, investors will become more risk-averse, which should benefit gold prices.

There are many favourable factors for gold in the year’s second half. However, the inflation situation in Europe and the United States is still tricky, and there is no apparent decline. Moreover, the energy supply shortage continues to plague European and American countries, which may limit the short-term rally in gold prices. Therefore, the key to determining the short-term trend in gold prices is still the recent inflation and economic data released by various countries. There is equal opportunity for both bulls and bears in the year’s second half.