The Fed’s interest rate decision, which is the main highlight for investors this week, will be announced later tonight. The market expectations of a 75 basis point rate hike are more than 80.5%. However, due to the poor performance of the latest U.S. economic data, the expectation of an aggressive rate hike of 100 basis points has dropped to 19.5%.

In addition, Fed Chairman Powell’s remarks at the press briefing will also be keenly followed by market participants, especially the Fed’s guidance on future rate hikes. The markets will be looking for a clear signal that the Fed’s rate hike in September may slow down, triggering a future slowdown in the US dollar’s current strong momentum. At the same time, slower rate hikes may be suitable for US stocks, which could stop falling and rally higher.

From the perspective of inflation data, the US June core personal consumption expenditures (PCE) price index to be released on Friday is expected to remain at a high of 4.7%. The markets are worried that US inflation has not yet peaked. According to the U.S. Bureau of Labour Statistics, the CPI in June increased by 9.1% compared to the same period last year, setting a new high in the current inflation cycle. If inflation continues to rise, it may further push up the interest rate hike expectations in September and continue to support the US dollar’s strength.

Investors are waiting to see whether the energy price, which rose the most in June, pushing US inflation higher, may fall back in July. Many are also looking to see if there will be a significant turning point in the continuously rising U.S. CPI when the July data is released. Since the beginning of July, the trend in oil prices has been downwards but quite volatile. Earlier, oil prices fell due to market concerns that the global economic recession would affect oil demand. However, the supply side remained tight, despite market expectations, which dominated the news. The sanctions imposed by the West that have kept oil prices trading at record-highs may lead to a slight decline in the supply of Russian oil in the next few months. If Russian crude oil supplies drop further, oil prices could stop falling and rebound, but there is still significant uncertainty about the future.

As the Fed’s latest interest rate decision was released, the market also paid attention to the second quarter economic data released by the United States. The market expects the initial value of the annualised quarterly rate of real U.S. GDP growth in the second quarter to be 0.9%, while the previous value was -1.6%. If the final result meets the market’s expectations, the U.S. economy will end two quarters of negative growth. However, this does not mean that the possibility of a recession is gone. On the contrary, continuous interest rate hikes will increase the possibility of a recession in the U.S., making it difficult for the economy to improve. If the result is worse than expected, it may trigger shocks in the US stock market.

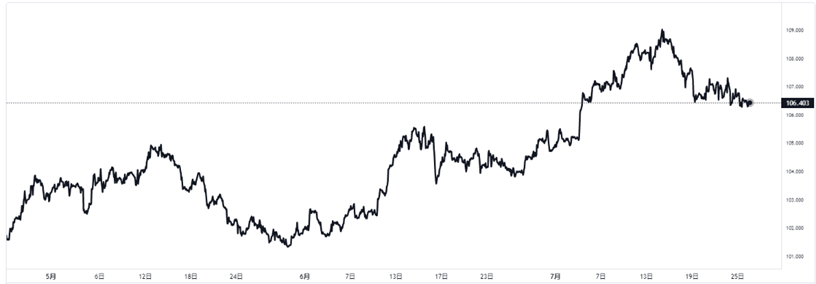

The sluggish economic data and the increased risk of recession have cooled the market’s expectations for the Fed to keep raising interest rates. Still, it has also increased the market’s risk aversion. Hence, the dollar remains high and volatile under the dual effect of rate hikes and risk-aversion. It is expected that after the interest rate decision, the future trend of the US dollar will become more apparent. If the Fed’s determination to curb inflation is still expressed at the meeting, it may further support the US dollar. Still, the US dollar may fall back if the Fed signals a potential end to rate hikes to support the markets. However, the US dollar is still supported by investor expectations that the Fed will keep raising interest rates. Moreover, the pace of US interest rate hikes is still ahead of other major central banks (including the European Central Bank, which has just started raising interest rates). Therefore, the US dollar may remain robust and volatile unless economic data drags it lower.

In general, considering that the 75 basis point rate hike has been fully priced in by the market, the market wants to know how much room there is for future rate hikes. The prevailing stance among Fed officials would require at least a rapid increase in the rate target to approach neutral levels before deciding how many more hikes can be accommodated.

The Fed’s decision also depends on inflation, as price pressures could start to subside given the recent pullback in energy prices, which would give the Fed more room to raise rates at a slower pace. Furthermore, the economic drag from rising interest rates and the labour market’s performance is still uncertain; hence, the Fed may be more cautious in providing interest rate guidance.

The market’s focus this week is clearly on the US, where several crucial releases are expected. In addition to the interest rate decision, the second quarter’s real GDP data and the June PCE price index are released. Investors are also watching Q2 earnings releases from large US technology stocks, which have a significant impact on markets. . If the technology giants report a decline in their performance during Q2, the results are likely to drag the markets lower, but positive earnings should lift the markets. Several crucial data points this week may increase the volatility of the US stock market. Hence, we urge investors to be cautious in the markets and not rush into trades that could quickly turn into losers on the data releases.