The US dollar has continued its march against the euro as investors fret about the economic outlook.

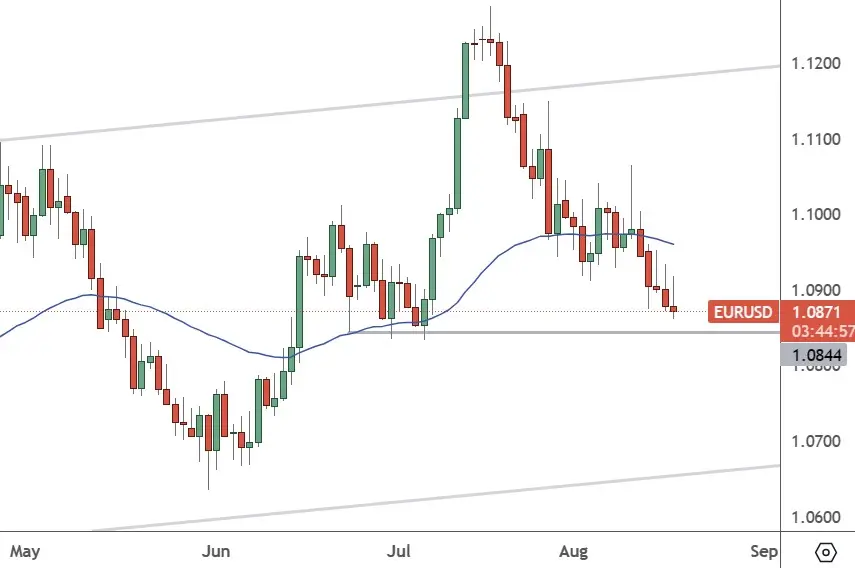

EURUSD – Daily Chart

The 1.0844 level is now in play for the EURUSD, and a break below could look to test 1.0700.

Tomorrow brings the core inflation reading for the European economy, but it is a final reading of the 5.5% print and may not deviate much. Investors are seeing the ECB and Federal Reserve pause on rate hikes, but the US economy is stronger.

European businesses have also defaulted at their highest level since 2015 as higher interest rates take a toll on small businesses. “Hawkish expectation towards central banks to keep rates higher for longer have intensified, with some pricing in a September Fed hike after all… even strong UK wage growth figure this week fed concerns over stickier-than-expected inflation that would be much harder to bring down to target,” said Andreas Bruckner, European equity strategist at Bank of America.

European investors have been putting more money into US ETFs than in their own continent lately after this year’s surge in American share valuations. But for European stocks to improve, the eurozone needs to see disinflation and a return to growth, according to Emmanuel Cau, equity strategist at Barclays.

“The debt sustainability issue in China is also weighing because Europe is more reliant on the global growth cycle as it has an open economy and is more geared towards China than other equity markets,” Bruckner added.

European shares were lower on Thursday after some weaker company earnings were added to the mix.

Meanwhile, the latest FOMC minutes from the US central bank have shown a potential for higher interest rates in the US.

“A lot of what I think the minutes will reflect today is consensus view from the officials and whether or not they’re leaning more dovish or whether or not they’re just going to become incredibly neutral leaving the door open for potential more work on interest rate hikes,” said analysts at Schwab Asset Management.

The US dollar remains in command versus the major currencies, and the current climate of fear adds further safe haven potential.