The EURGBP exchange rate looks weak and may test recent lows with German economic data.

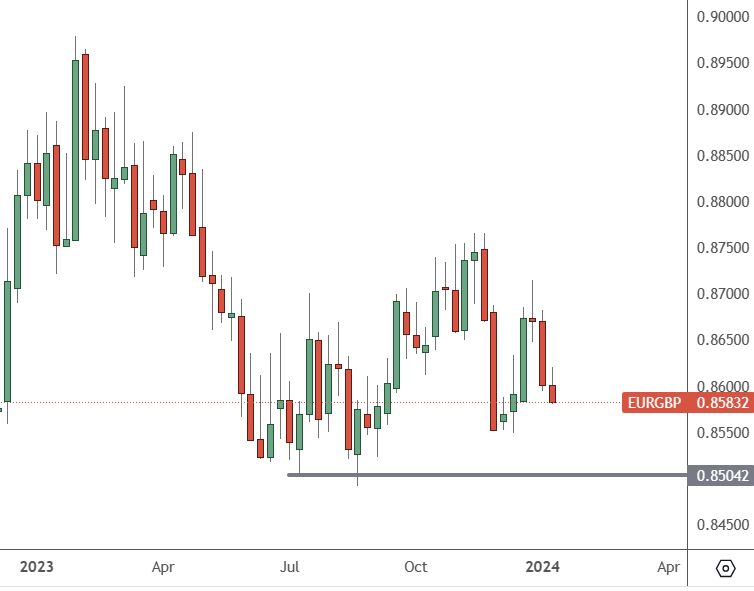

EURGBP – Weekly Chart

The previous support in EURGBP was 80 pips below 0.85. That could be the target this week after last week’s selling on the weekly timeframe.

Monday will bring German GDP data at 5pm HKT, which could catalyse a lower move. In 2022, the German economy was running at an annual growth of 1.9% but has slumped to -0.3% as higher interest rates take their toll. A weaker global economy has also damaged the country’s formerly robust export economy.

Thursday is also a big data day for the pair, with German inflation at 3pm HKT, alongside UK employment. ZEW sentiment for Germany and Europe will follow at 6pm.

Inflation is expected to rise again from 3.7% to 3.2%. UK unemployment is expected to increase by 1 basis point.

The attention will continue to be on interest rates, but this time, it will be rate cuts for the Bank of England and Europe. The pace at which they cut rates could spur their economies to better growth and boost their currencies.

The ECB Chief Economist Philip Lane does not see rate cuts soon.

“The December inflation number broadly confirms our assessment from the December meeting and our December projections,” Lane said, adding that officials “are going to be looking at the incoming data” but said interest-rate cuts aren’t “a kind of near-term topic”.

“When we have developed sufficient confidence that we are firmly on our way back to 2pc inflation”, the topic of rate cuts “will come to the forefront”.

ECB President Christine Lagarde took a similar stance, saying:

“I think that rates, barring any further shocks or unexpected data, will not continue to go up. And if we win our fight against inflation, and if we are certain that inflation will indeed be at 2%, at that point rates will start to go down”.