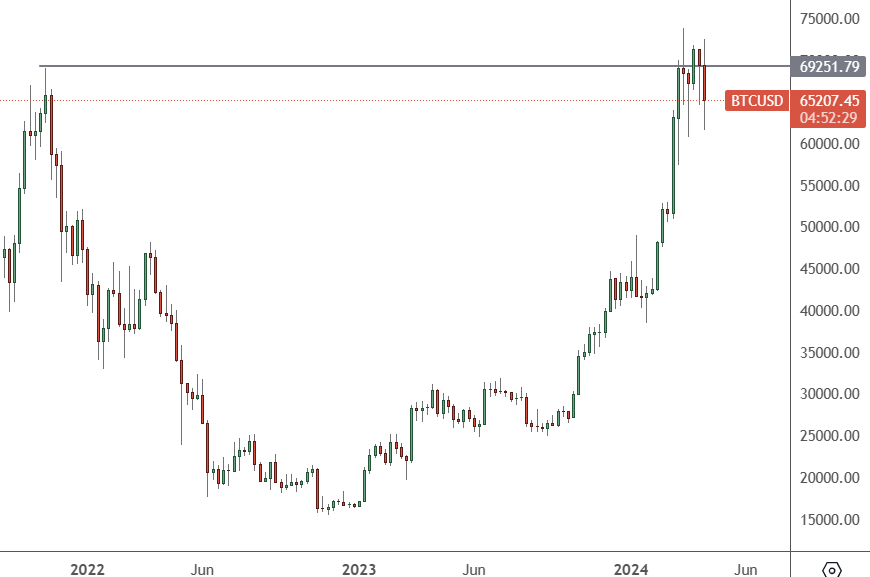

Bitcoin’s price has encountered a significant hurdle, being rejected from the $70,000 level. This development could trigger a substantial correction, underscoring the importance of this price point.

BTCUSD – Weekly Chart

BTC has found Resistance at the $70k level, and after the recent uptrend, there is potential for a swift correction.

The recent dip happened after stock markets dropped during the US trading session with rising fears of a broader conflict in the Middle East, with US authorities warning that Iran could prepare to launch a significant attack on Israel. That came true on Sunday after Iran launched drone attacks on Israel on Sunday.

A broader conflict and higher prices for oil and gold will mark the week ahead.

Bitcoin is on the cusp of a significant event, the fourth mining reward halving. This pre-programmed 50% reduction in the pace of Bitcoin supply is now a mere eight days away. The anticipation of this event could already influence the current BTC price, potentially leading to a correction in the market.

Before the pivotal event, Bitcoin’s forked coin, Bitcoin Cash, is also flashing a warning, with traders looking to reassess expectations for an immediate post-halving price rise.

Bitcoin has been following risk assets higher, but there is potential for the price of risk assets to correct with the world descending further into war.