What is Bitcoin halving, and when will it happen in 2024? Whether you’re new or experienced with Bitcoin, understanding this event is crucial for navigating the crypto market. In this article, you will learn the essential facts about Bitcoin halving, its effects on the cryptocurrency ecosystem, what past events suggest about future price movements, and practical FAQs.

Table of contents:

1. What Is Bitcoin Halving?

2. Why Does Bitcoin Halve? Is It Important?

3. When is the Next Bitcoin Halving?

4. 4 Impacts of Bitcoin Halving

5. Past Bitcoin Halving Events & Bitcoin Price

6. How to Trade the Bitcoin Halving

FAQs

What Is Bitcoin Halving?

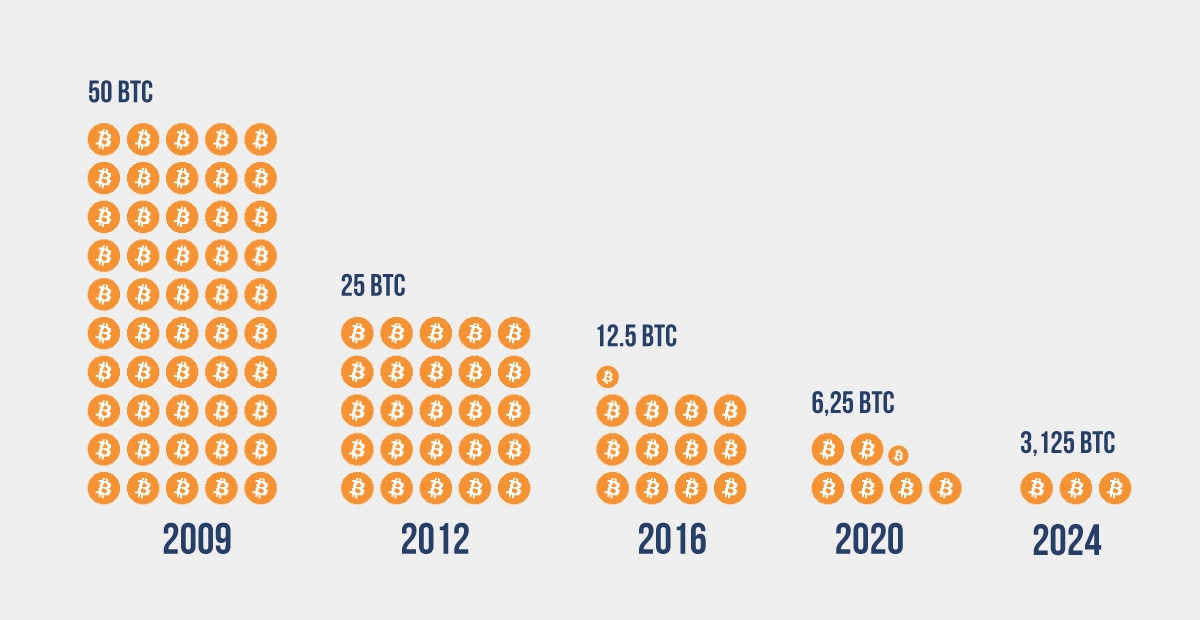

The “halving” is a programmed event in the Bitcoin protocol that reduces the prize given to miners for creating new blocks by 50%. Such halving events take place almost every 4 years and reduce the production of new Bitcoins to moderate inflation, essentially forming a bedrock part in maintenance of the economic model for Bitcoin. In that connection, this means that with time, the total amount of Bitcoin in circulation can never surpass 21 million coins.

Why Does Bitcoin Halve? Is It Important?

Bitcoin halving serves a dual objective: firstly, it regulates the issuance of new bitcoins, replicating the limited availability and deflationary nature of valuable metals such as gold, and secondly, it incrementally reduces the rewards distributed to miners. This gradual reduction prolongs the viability of the reward system. By managing the supply in this manner, Bitcoin aims to safeguard against inflation, positioning itself as a possible safeguard against the depreciation of traditional fiat currencies.

Example: Compare with the purchasing power of the US dollar that has decreased most significantly over time due to inflation.

When is the Next Bitcoin Halving?

The forthcoming Bitcoin halving is projected to take place in 2024. Although it’s challenging to pinpoint the precise timing owing to the fluctuating rates at which blocks are found, projections based on prevailing patterns suggest it might occur around April. Upon this event, the reward for mining a block will decrease from 6.25 to 3.125 bitcoins, signifying yet another significant phase in Bitcoin’s evolution.

4 Impacts of Bitcoin Halving

The consequences of Bitcoin halving exceed the immediate decrease in the volume of new bitcoins being released into the market; they permeate various facets of the cryptocurrency landscape. Let’s delve into a more detailed examination of its effects:

Market Speculation and Price Volatility

Bitcoin halvings often ignite extensive speculation and discussion about Bitcoin’s future value. With the supply of new bitcoins diminishing and presuming demand stays steady or grows, fundamental economic theories indicate a possible rise in price. Nonetheless, the market typically foresees the halving occurrence, resulting in heightened price fluctuations before and following the event.

Example: In the year leading up to the 2020 halving, Bitcoin’s price grew substantially, climbing from around $3,500 in early 2019 to over $8,000 by the time of the halving in May 2020. This was followed by a significant bull run, peaking at over $64,000 in April 2021.

Impact on Mining and Network Security

Mining profitability is directly affected by halving events. The reward for mining a new block—previously the primary incentive for miners—halves, potentially leading to a temporary exodus of less efficient miners due to decreased profitability. This can impact the network’s hash rate and security in the short term. However, reducing competition and subsequent adjustments in mining difficulty typically restore equilibrium over time.

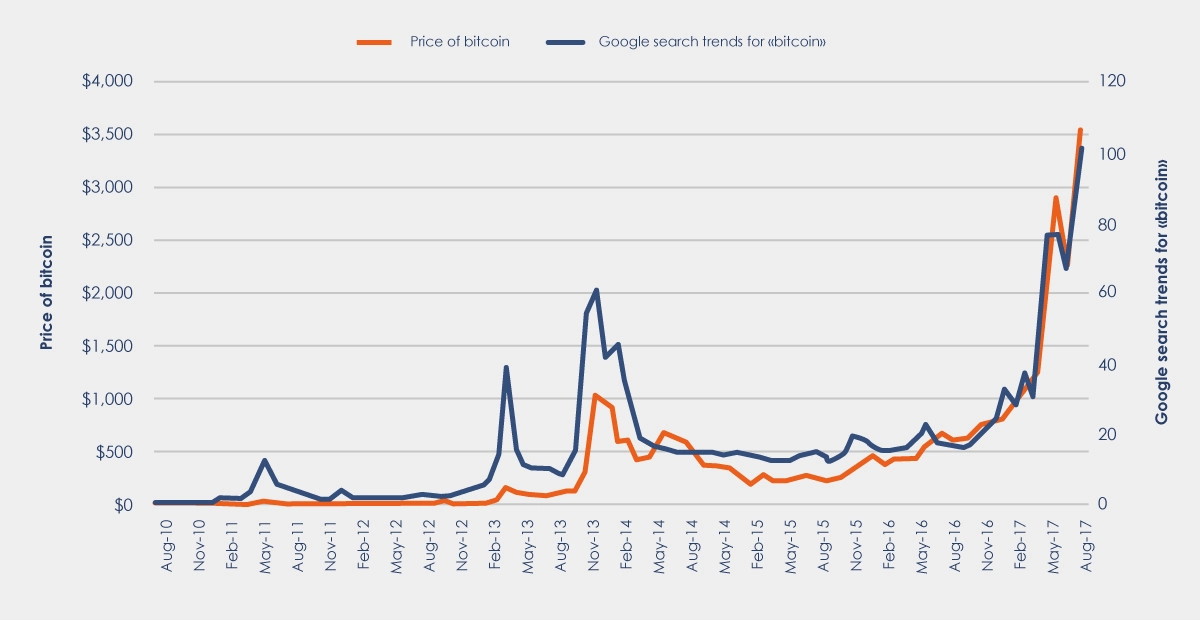

Changes in Public Interest

Halving occurrences frequently align with surges in public curiosity and media attention towards Bitcoin. Such heightened visibility may draw in fresh investors and participants to the Bitcoin network, aiding in its sustained expansion and acceptance as both a value reserve and a transaction means.

Example: Data from Google Trends on the phrase “Bitcoin” revealed notable increases in search interest during the months preceding the 2016 and 2020 halvings, aligning with times of heightened media exposure and community discourse.

Long-Term Implications

The enduring impacts of Bitcoin halving stand out as particularly crucial, highlighting Bitcoin’s deflationary characteristic. By slowing down the rate of new Bitcoin generation, halving occurrences guarantees Bitcoin’s rarity, reinforcing its status as “digital gold.” This limited availability is a key factor in why numerous investors view Bitcoin as a protection against inflation and an essential element of their investment strategies.

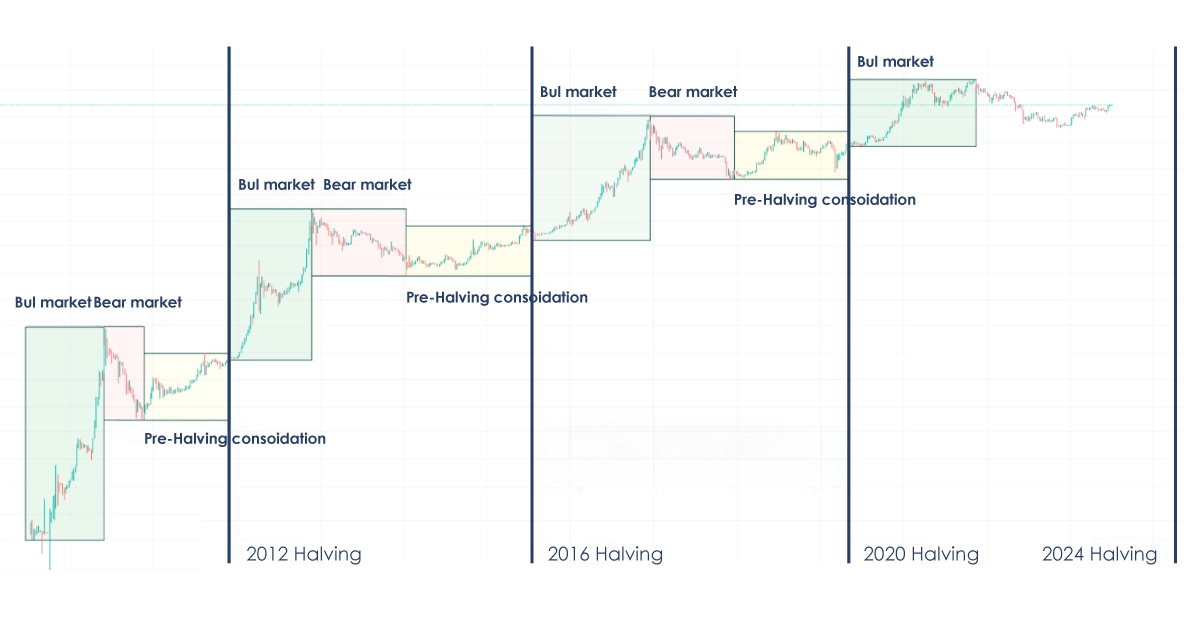

Past Bitcoin Halving Events & Bitcoin Price

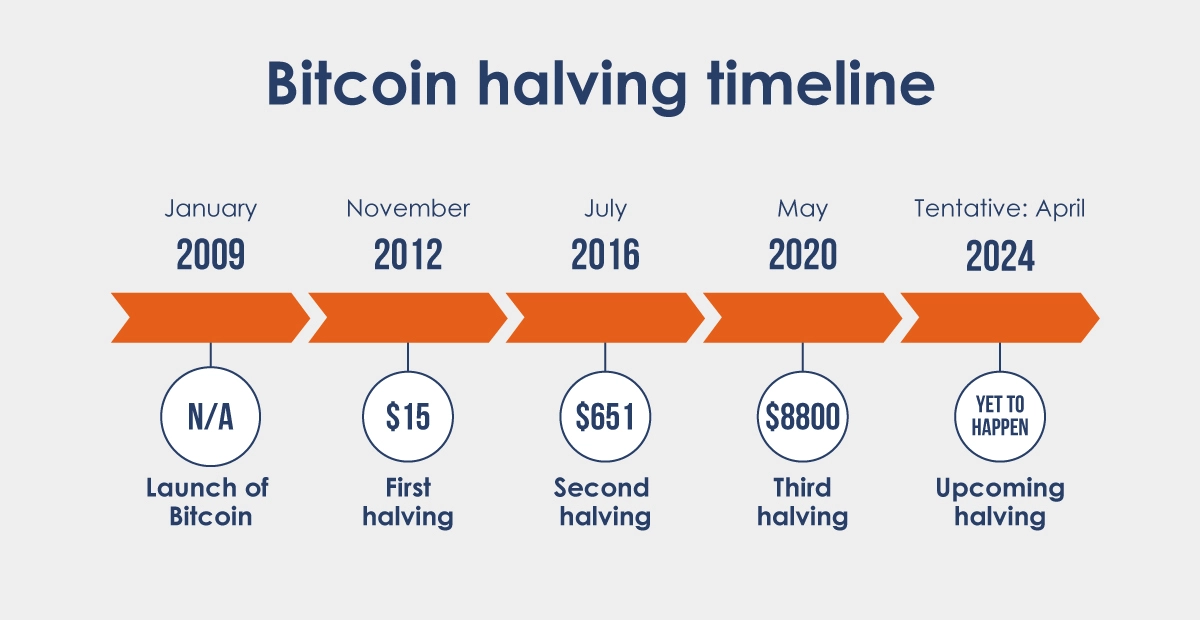

To date, there have been 3 major halving events:

Halving Event | Date | Block Height | Reward Before | Reward After | Price 1 Year Before Halving | Price at Halving | Price 1 Year After Halving |

1st Halving | Nov 28, 2012 | 210,000 | 50 BTC | 25 BTC | $2.55 | $12.35 | $1,100 |

2nd Halving | Jul 9, 2016 | 420,000 | 25 BTC | 12.5 BTC | $260 | $650 | $2,518 |

3rd Halving | May 11, 2020 | 630,000 | 12.5 BTC | 6.25 BTC | $7,100 | $8,787 | $56,000 |

There are 2 key observations:

Reward Reduction:

Each halving event has successfully halved the block reward, as per Bitcoin’s protocol, decreasing the rate at which new bitcoins are generated.

Price Trends:

Before Halving: The price 1 year before each halving shows a gradual increase as Bitcoin gains more attention and adoption.

At Halving: On the day of the halving, the price reflects the market’s immediate reaction, which has varied across events.

After Halving: The price 1 year after each halving has historically seen significant price increases, highlighting the event’s impact on Bitcoin’s market value.

How to Trade the Bitcoin Halving

Trading the Bitcoin halving can be approached in several ways, 2 popular methods include trading Bitcoin directly through exchanges or using Contracts for Difference (CFDs) to speculate on Bitcoin’s price movements.

To trade the bitcoin halving with us:

Learn more about CFD trading

Open a live account or practice on a demo account

Set up your trade

Monitor and close your position

Benefits of Trading Bitcoin with CFDs:

Leverage: CFD trading provides its users with the leverage option, whereby one can handle large positions with relatively small amounts of capital. This can increase the possibilities of the trader to profit but, sure enough, respectively increase the risk for loss.

Short Selling: With CFDs, the trader can make a bet on both upward and downward movements of the price; hence, there is an open possibility to make money from falling markets by short selling.

No Need to Own Bitcoin: Trading CFD negates the conditions of directly owning or keeping Bitcoin, and therefore it does not require having a digital wallet with its risks of security breaches and hacking incidents.

Access to Global Markets: Many CFD brokers provide access to a variety of markets for traders to speculate on price changes in varied cryptocurrencies rather than just Bitcoin. Check out the types of brokers and learn how to choose the right broker .

FAQs

Will Bitcoin’s price go up or down after halving?

While the previous halves have heralded notable pumps in the price, predicting the exact impact of a future halving, to an extent, contains some unpredictability, as other factors do influence. These include market sentiment, global economic conditions, and the regulatory environment that may well change and alter the price trajectory of Bitcoin. In general, halvings have invoked a bullish response based on the diminishing supply of new bitcoins being added into the world through these events.

What happened to Bitcoin’s price in the past when it halved?

Historically, with every Bitcoin halving, it brought forth a surge in price volatility. For example, post the 2016 halving, the value of Bitcoin surged from around $650 to $2,518 by mid-2017.

What will happen when all the Bitcoins are mined?

Reaching the limit of 21 million Bitcoin, no more new bitcoins will be created, and therefore miner earnings would flow only from transaction fees. This transition is in place to support the lasting sustainability of the Bitcoin network and provide never-ending drive for miners.

Example: Consider the transition of major payment networks like Visa, which rely on transaction fees for revenue. Bitcoin could sustain its operations and security through transaction fees alone, without minting new coins.

Does Bitcoin halving influence the transaction fees on the network?

Due to the reduced block reward, the halving can indirectly affect transaction fees. As miners receive less Bitcoin for each block mined, they may prioritise transactions with higher fees, potentially increasing average transaction fees during periods of high demand.

Is Bitcoin halving good or bad?

Bitcoin halving aims to decrease the pace of new bitcoin creation, instilling scarcity within the ecosystem akin to rare metals. This deflationary process is typically seen as beneficial for Bitcoin’s long-term value, although it may lead to temporary fluctuations in its price.

What risks come with Bitcoin halving?

Hazards encompass heightened fluctuations in price around the time of the halving and its possible effect on miner earnings. Should Bitcoin’s price fail to rise adequately to compensate for the diminished block reward, certain miners might temporarily halt their activities, potentially impacting the network’s hash rate and security.

Is it still worth to mine Bitcoin after it halves?

Profitability for miners post-halving depends on Bitcoin’s price, operational costs, and technological efficiency. Historically, Bitcoin price increases have offset the block reward reduction, keeping mining profitable for efficient operations.

Should Bitcoin holders worry about the halving?

Bitcoin investors ought to brace for heightened price fluctuations surrounding the halving. Yet, historical patterns indicate that halvings tend to precede phases of bullish market behaviour, potentially rewarding those who hold for the long term.

What should I do to prepare for the halving?

For most Bitcoin participants, no particular measures need to be taken to anticipate the halving. Investors and traders may want to factor in the event’s possible influence on market dynamics as they devise their strategies, whereas miners should assess its repercussions on their activities.