AUDJPY can provide traders with volatility on Monday and Tuesday with a double data release.

Investors will get a look at the latest Westpac consumer confidence numbers before the release of the Japanese GDP.

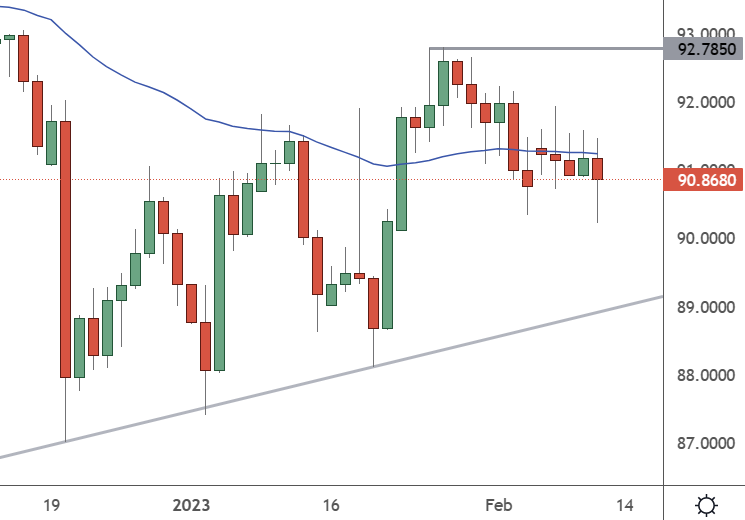

AUDJPY– Daily Chart

AUDJPY has been trading in a range with support from an uptrend at around 89. The most recent resistance for the Aussie dollar was at 92.78.

The yen gained on Friday after reports that Kazuo Ueda was set to become the next Bank of Japan (BOJ) governor. Still, the policymaker later said that the central bank’s monetary policy was appropriate.

The Nikkei reported the government would nominate Ueda to the BOJ’s top job ahead of the upcoming retirement of Haruhiko Kuroda. That sent the yen higher against all major currencies, with traders hoping for an earlier exit from the bank’s ultra-loose monetary policy.

The Bank of Japan rattled markets in December when it raised the cap on its 10-year government bond yields to 0.5% from 0.25%, which doubled the allowable cap above or below its target of zero. That has led to speculation that BOJ could adjust or scrap its yield curve control policy after Kuroda steps down.

BOJ deputy governor Masayoshi Amamiya had been the favourite to replace governor Kuroda. Still, the Nikkei has since reported that he had declined the job.

The BOJ’s exit from its ultra-loose monetary policy will still hinge on what happens during the spring wage negotiations. Japanese Prime Minister Fumio Kishida has also said they’re planning to present the BOJ governor nominee to parliament on February 14 but did not answer a question on whether Ueda would be put forward.

James Malcolm, head of FX strategy at UBS, said Ueda’s nomination should be seen as a “hawkish” outcome, given Ueda’s previous criticism of the BOJ’s monetary policy as far back as 2016.

The Aussie dollar will look for support from Westpac consumer confidence as traders look for an improvement on last month’s 84.3. That will be followed by GDP for Japan, which is expected to come in at 2% versus -0.8%. The data releases and the BOJ governor news should make for a busy day in the AUDJPY.