Market Highlight 03/02/2026

US stocks ended Monday’s trading session on a positive note, shaking off AI trade worries as earnings flooded in and Federal Reserve uncertainty swirled. The dollar held gains as positive economic readings and shifting expectations for Federal Reserve policy outweighed concerns about another US government shutdown. The greenback gained overnight after US manufacturing data from the Institute for Supply Management (ISM) showed a return to growth. However, a key jobs report may be delayed due to an impasse in Washington.

Gold and silver prices extended their downtrends on Monday following a heavy selloff over the weekend. Spot gold last dropped by USD230 or 4.7% to USD4,664 per ounce. WTI crude oil fell more than 5% on Monday after U.S. President Donald Trump said Iran was “seriously talking” with Washington, signaling a de-escalation of tensions with the OPEC member.

Key Outlook 03/02/2026

The Reserve Bank of Australia (RBA) will announce its interest rate decision today, which is expected to resume its rate-hiking cycle after three rate cuts last year, raising the rate from 3.60% to 3.85%, making it the first major central bank to raise rates this year. Following the decision, RBA Governor Bullock will hold a monetary policy press conference, where further signals on the rate-hike path may be provided.

[Financial data and events of significant concern]

- 11:30 RBA Interest Rate Decision ***

- 12:30 RBA Press Conference ***

- 23:00 US JOLTs Job Openings DEC **

Tomorrow

- 05:30 API Crude Oil Stock Change ***

- 06:00 AU Services & Composite PMI Final JAN **

- 09:45 CN Services & Composite PMI JAN **

- 16:55 EU GERMANY Services & Composite PMI Final JAN **

- 17:00 EU Services & Composite PMI Final JAN **

- 17:30 GB Services & Composite PMI Final JAN **

- 18:00 EU CPI YoY Flash JAN *** (Forecast 1.7%, Previous 1.9%)

- 18:00 EU PPI MoM DEC ** (Forecast 0.3%, Previous 0.5%)

- 21:15 US ADP Employment Change JAN *** (Forecast 40K, Previous 41K)

- 22:45 US Services & Composite PMI Final JAN **

- 23:00 US ISM Services PMI JAN ***

- 23:30 EIA Crude Oil Stock Change **

Markets Analysis 03/02/2026

- Resistance: 1.1830/1.1890

- Support: 1.1711/1.1653

EUR/USD extends losses as last week’s sell-off fuels safe-haven flows into the US Dollar. Euro gains capped despite improved German Retail Sales and higher PMI remaining in contraction territory. EURUSD attempted a partial rebound this morning, with the 20-day moving average expected to provide key support around 1.1750, but resistance lies above the 10-day moving average at 1.1850.

- Resistance: 1.3744/1.3807

- Support: 1.3605/1.3543

GBPUSD dips as the Dollar stays bid on Warsh’s Fed pick, with investors positioned ahead of a busy week of UK data and the Bank of England’s first policy decision of 2026. GBPUSD rebounded this morning with the support of the 10-day moving average. Therefore, it may gather momentum towards 1.3700.

- Resistance: 156.51/157.35

- Support: 154.83/153.79

The USD/JPY pair attracted some buyers to around 155.55 during the early Asian session on Tuesday. The upbeat US economic data provides some support for the US dollar against the Japanese Yen. USDJPY remains slightly bullish in the short term; it is expected to rebound towards the 156 level, although there is resistance from the 20-day moving average above the key level.

Resistance: 63.48/64.63

Resistance: 63.48/64.63- Support: 60.71/59.79

WTI Oil price tumbled at the start of the week, weighed down by easing geopolitical tensions in the Middle East. Comments from Donald Trump revive the prospect of a deal with Iran, a key player in global Oil supply. The 10-day moving average has become a resistance level; the decline may extend to $60.

- Resistance: 4940/5066

- Support: 4691/4534

- Resistance: 86.49/92.15

- Support: 73.83/68.27

After dropping over 4% amid rattled rate-cut bets following President Trump’s nomination of Kevin Warsh as the next Fed Chair, gold rose more than 3% on Tuesday,

as market participants braced for an absence of key economic data this week due to a partial US government shutdown. Gold prices is attempting to recover some lost ground. Currently testing above the 20-day moving average, a break above this level could open the way for a test of the $5,000 level.

- Resistance: 49641/49782

- Support: 49177/49034

US equities rose on Monday as Wall Street began a new month of trading, with investors looking past the recent losses in silver and bitcoin. Dow surges 500 points, marking the largest gain in over a week, breaks above the 10-day and 20-day moving averages and returns above the 49,000 mark. With the possibility of approaching record highs.

- Resistance: 25979/26090

- Support: 25522/25413 Support

Wall Street also turned its attention to Nvidia as questions over the artificial intelligence trade loomed. NAS100 gained 0.56% on Monday, recorded its biggest gain in nearly two weeks, and after breaking through the main moving averages on the daily chart, the rebound momentum has further strengthened, and it is expected to target the 26,000 level.

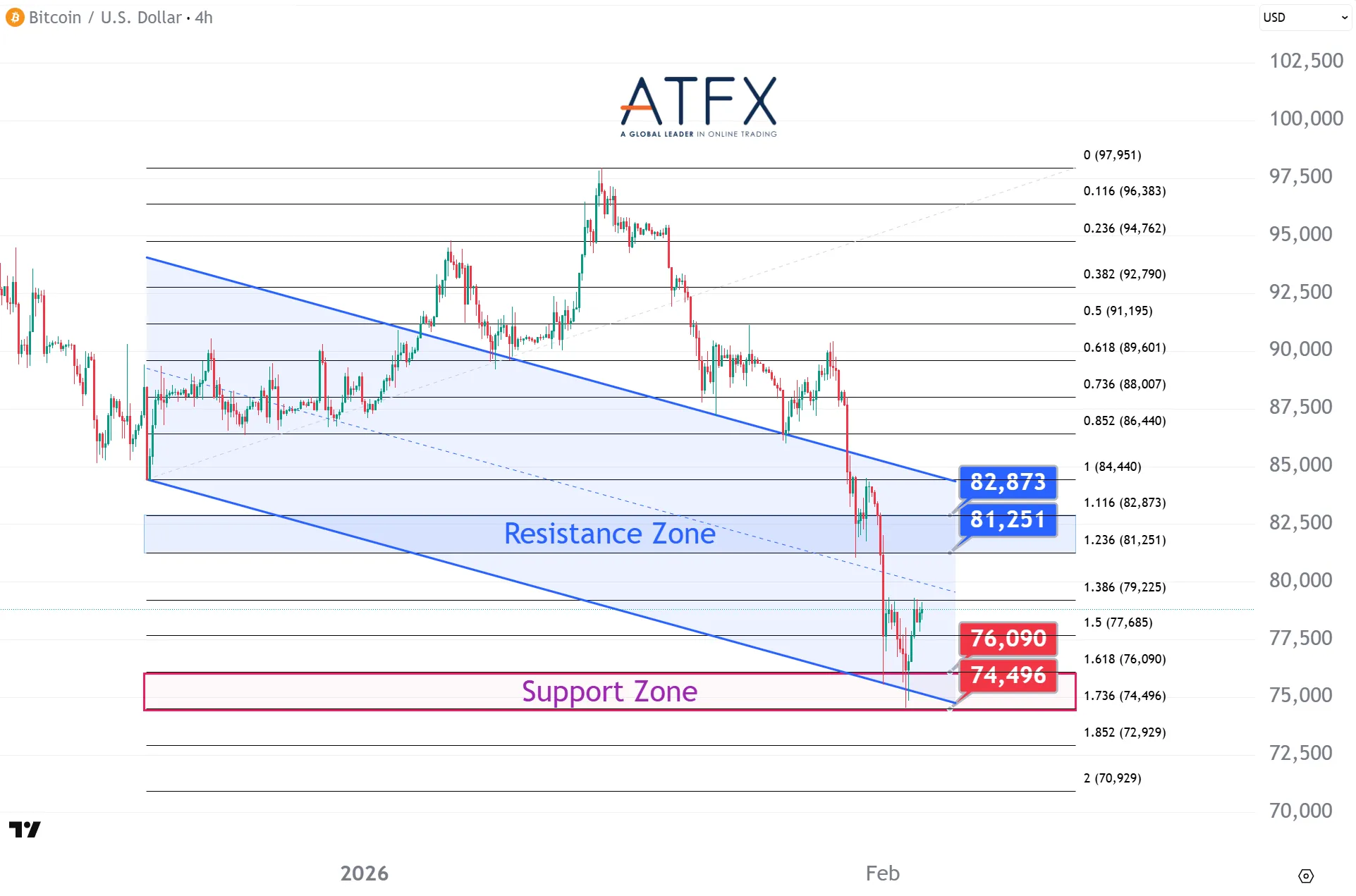

- Resistance: 81251/82872

- Support: 76090/74496

Bitcoin dropped below $80,000 for the first time since April, a sign investors were taking more risk off the table following Friday’s sharp declines in gold and silver. Currently, BTCUSD is consolidating in the lower range. If the price breaks through the upper range resistance, it may move above $80,000.

Enjoy trading! The content is for reference only. Please ensure that you understand the risk.

Resistance: 63.48/64.63

Resistance: 63.48/64.63