Market Highlight 12/01/2026

U.S. nonfarm payrolls for December rose by 50,000, below market expectations of a 60,000 increase. However, the unemployment rate edged down to 4.4%, below forecasts of 4.5%, suggesting the labour market has not deteriorated rapidly. Following the data release, markets bet that the Federal Reserve would pause rate cuts for longer. At the same time, the weaker-than-expected jobs report did little to alter expectations for rate reductions later this year. U.S. equities advanced across the board, with the Nasdaq rising 0.81%, the S&P 500 gaining 0.65%, and the Dow Jones climbing 0.48% to a record closing high. The U.S. Dollar Index rose 0.25% to 99.13, marking its second consecutive weekly gain.

Gold prices rose as investors weighed softer-than-expected U.S. employment data against broader policy uncertainty and ongoing geopolitical risks. Spot gold settled at USD 4,509.79 per ounce, up 0.76% on the day, posting a weekly gain of more than 4%. Oil prices also rose, with crude jumping over 2% on Friday as protests intensified in Iran and Russia stepped up attacks in the Ukraine conflict, fueling concerns over potential supply disruptions. On a weekly basis, U.S. crude oil recorded a gain of around 3%.

Key Outlook 12/01/2026

Markets will turn their attention this week to a series of major U.S. economic releases, including CPI, PPI, and retail sales data, which are expected to play a crucial role in shaping expectations for the Federal Reserve’s interest rate path. lsewhere, economic data such as UK and German GDP figures are likely to provide guidance on movements in the British pound and the euro. In the oil market, the OPEC monthly oil market report and the EIA’s Short-Term Energy Outlook will be closely watched for further direction on crude prices.

Key Data and Events Today:

Japan Holiday

- 17:30 EU Sentix Investor Confidence JAN **

Tomorrow:

- 21:30 US CPI YoY NOV ***

- 23:00 US New Home Sales OCT **

Markets Analysis 12/01/2026

EURUSD

- Resistance: 1.1712/1.1734

- Support: 1.1615/1.1593

EUR/USD remains pressured as weak German exports and a firmer dollar weigh on sentiment, while tariff uncertainty and geopolitical risks support safe-haven flows. Technically, the pair remains within a descending channel, capped by the 1.1712–1.1734 resistance range. A break below 1.1615–1.1593 would reinforce near-term downside risks.

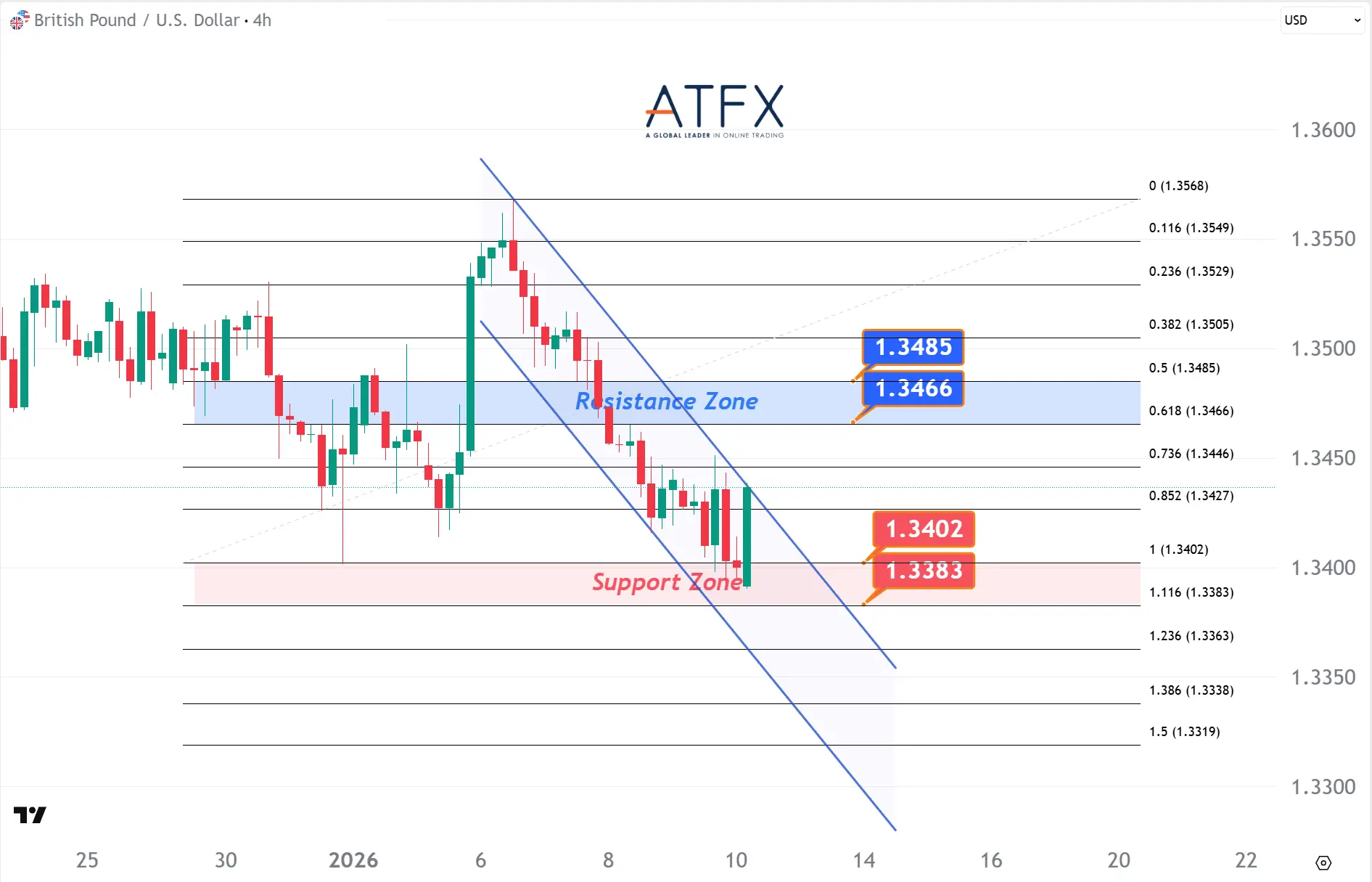

GBPUSD

- Resistance: 1.3466/1.3485

- Support: 1.3402/1.3383

GBP/USD continues to drift lower, pressured by firm USD demand as markets focus on Fed policy expectations amid a quiet UK data calendar. Technically, price is sliding within a descending channel, with rebounds capped at the 1.3466–1.3485 resistance zone. A sustained break below 1.3402–1.3383 would likely open room for a deeper pullback.

USDJPY

- Resistance: 158.02/158.29

- Support: 157.18/156.92

USD/JPY is testing the upper boundary of its rising structure, with price stalling near the 158.02–158.29 resistance zone. While the broader uptrend remains intact, repeated rejection here points to short-term consolidation or a pullback toward 157.18-156.92. Fundamentally, firm U.S. rate expectations support the dollar, while political uncertainty and an unclear BoJ policy path continue to weigh on the yen.

US Crude Oil Futures (FEB)

- Resistance: 59.59/60.06

- Support: 58.40/58.04

Oil prices rose early on Friday as protests in Iran continued to escalate, unnerving market participants that one of the biggest oil producers in the Middle East could see supply threatened. Technically, price rebounded strongly from the lower channel and is now testing the $59.59–60.06 resistance zone, with short-term momentum turning constructive. However, rising global inventories and demand-side uncertainty could limit upside follow-through.

Spot Gold

- Resistance: 4657/4688

- Support: 4510/4477

Spot Silver

- Resistance: 85.52/87.18

- Support: 80.31/78.65

Gold jumped to new record high, supported by softer U.S. jobs data and rising geopolitical risks in the Middle East. Technically, price remains within a rising channel, with dips finding buyers above the $4,510-4,477 support zone, keeping the bullish structure intact. De-dollarization trends and expectations of Fed rate cuts underpin medium-term upside.

Dow Futures

- Resistance: 50088/50405

- Support: 49064/48742

The Dow Futures edged higher on rotation into cyclicals and selective chip stocks, reflecting still-resilient risk appetite. Technically, price is consolidating within an ascending channel, holding above the 49,064–48,742 support zone. While the broader uptrend remains intact, stretched valuations and policy uncertainty are capping gains near 50,088–50,405 resistance.

NAS100

- Resistance: 26179/26449

- Support: 25290/25016

The NAS100 stayed resilient, underpinned by strength in semiconductor stocks and ongoing AI investment themes. Technically, the index remains in an ascending channel, supported above 25,290, but upside is limited near 26,179–26,449 as volatility increases. Near-term direction depends on upcoming U.S. data and Fed rate clarity.

BTC

- Resistance: 93571/94769

- Support: 89605/88386

Bitcoin is consolidating near $90,000 as ETF outflows and cautious risk sentiment cap upside. Technically, price is range-bound between $89,605-88,386 support and $93,571–94,769 resistance. A break below support would raise downside risks, while a move above resistance is needed to restore bullish momentum.

Enjoy trading! The content is for reference only. Please ensure that you understand the risk.