Market Highlight 01/12/2025

U.S. equities rose on Friday in a shortened post-Thanksgiving session, with gains driven by strength in retail stocks and a rebound in tech. The U.S. Dollar Index slipped 0.09% to 99.44, posting a weekly decline of 0.61% — the largest since July 21. GBP/USD was flat at 1.3236 but notched a 1.09% weekly gain, its best weekly performance since early August.

Spot gold jumped and hit a two-week high as markets priced in a higher likelihood of a Fed rate cut in December. Gold rose 1.8% to $4,230.37/oz, the highest since Nov. 13, with a substantial 4% weekly gain. Silver surged to a record high of $56.52/oz. Oil futures edged lower as investors weighed geopolitical risk premiums amid stalled Russia-Ukraine peace talks, while watching Sunday’s OPEC+ meeting for clues on potential production adjustments. Oil prices still gained about 1% on the week, although both benchmarks logged a fourth straight monthly decline in November — the longest streak since 2023.

Key Outlook 01/12/2025

This week’s key guidance centers on the United States, with markets watching Fed Chair Jerome Powell’s speech, the release of the U.S. PCE inflation report, and several PMI readings — all of which could influence expectations for a potential rate cut this month. Today, attention first turns to the global final manufacturing PMI data for November. The U.S. ISM Manufacturing PMI is expected at 49 (previous 48.7).

Key Data and Events Today:

- 09:05 BoJ Gov Ueda Speech ***

- 16:50 EU GERMANY Manufacturing PMI Final NOV **

- 16:55 EU Manufacturing PMI Final NOV **

- 17:30 GB Manufacturing PMI Final NOV **

- 22:45 US Manufacturing PMI Final NOV **

- 23:00 US ISM Manufacturing PMI NOV ***

Tomorrow:

- 09:00 Fed Chair Powell Speech ***

- 18:00 EU CPI YoY Flash NOV **

- 18:00 EU Unemployment Rate OCT **

Markets Analysis 01/12/2025

EURUSD

- Resistance: 1.1631/1.1656

- Support: 1.1592/1.1573

The dollar’s sharp weekly decline on rising Fed rate-cut expectations pushed EUR/USD higher, with weak U.S. data reinforcing the move. Technically, the pair is holding above the 1.1592 support zone and attempting a breakout from the descending trendline. A sustained hold above 1.1600 could drive an advance toward 1.1631–1.1656.

GBPUSD

- Resistance: 1.3285/1.3305

- Support: 1.3216/1.3190

GBP gained 1.09% last week, its best since August—after Chancellor Reeves’ budget improved fiscal clarity and boosted sentiment. Broad USD weakness also supported GBP/USD. Technically, the pair is holding above the 1.3216 demand zone, with a bullish structure favouring a push toward 1.3285 if this support holds.

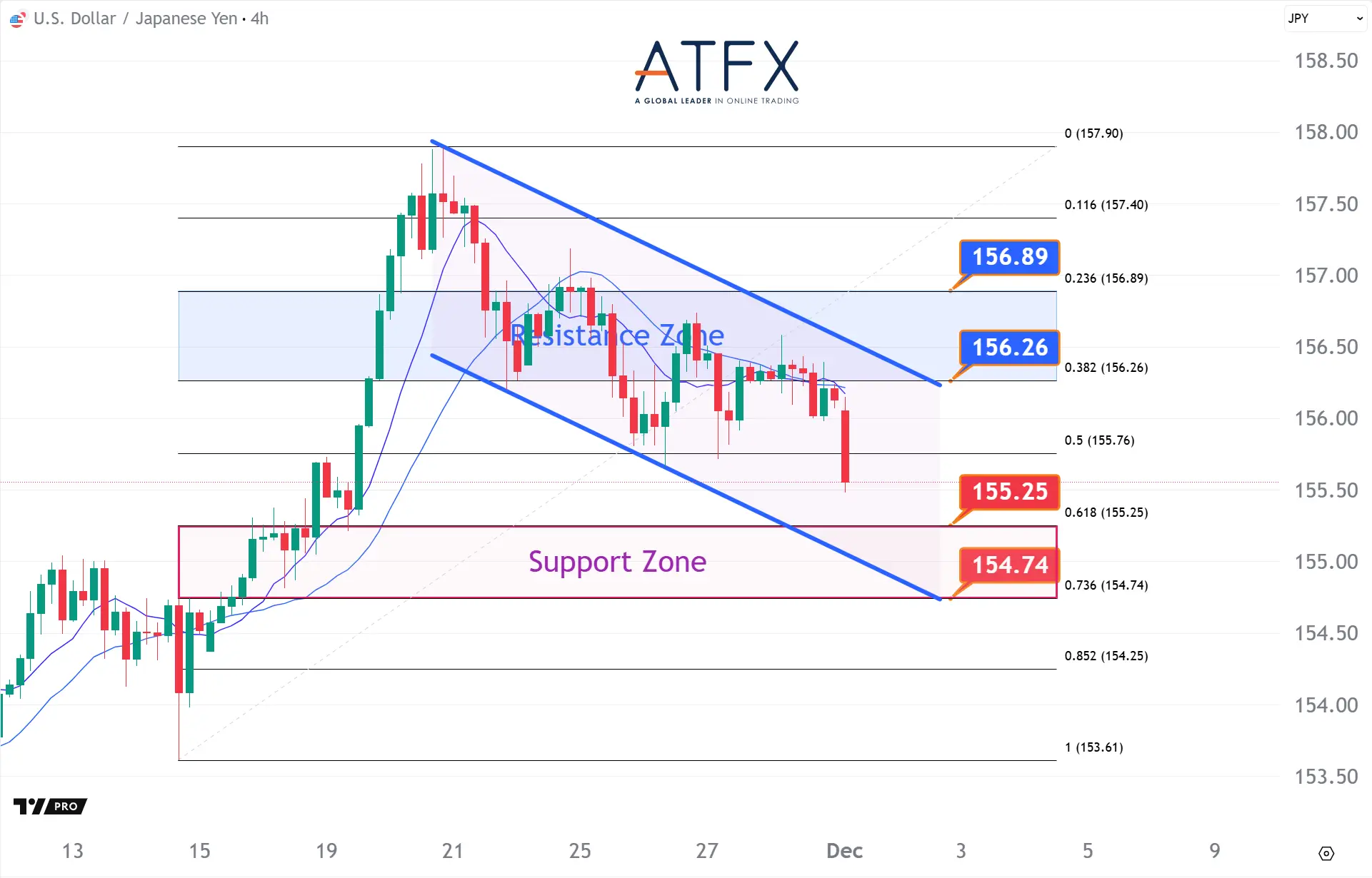

USDJPY

- Resistance: 156.26/156.89

- Support: 155.25/154.74

USD/JPY slipped to 156.09 as surging Fed rate-cut expectations pressured the dollar, while markets await BoJ Governor Ueda’s Monday speech for possible December hike signals. Technically, the pair remains capped under the descending trendline, and a clean break below 156.00 opens the door toward 155.25 support.

US Crude Oil Futures (JAN)

- Resistance: 59.91/60.35

- Support: 58.56/58.00

WTI hovered near $59.55 after a 1.64% rise, supported by renewed geopolitical risks following Iran’s seizure of a fuel-smuggling tanker; however, optimism over Ukraine–Russia peace and lingering oversupply capped gains. Technically, the price remains above the rising trendline, with $58.56 acting as key support and potential for a rebound towards $59.91–60.35.

Spot Gold

- Resistance: 4245/4274

- Support: 4180/4151

Spot Silver

- Resistance: 57.93/58.61

- Support: 55.74/55.05

Spot gold held near $4,215 after touching a two-week high at $4,226, supported by surging Fed rate-cut expectations and strong precious-metal momentum into November’s fourth straight monthly gain.

Technically, gold has broken above the descending trendline and is consolidating below $4,245; holding above $4,180 keeps the path open for a push toward $4,300+.

Dow Futures

- Resistance: 48033/48432

- Support: 47404/47087

The Dow futures climbed 0.61% to 47,716 in thin post-holiday trade, supported by strong Fed rate-cut expectations and solid retail/tech performance. Technically, the index is consolidating above 47,404 support, with momentum favoring a continuation toward the 48,033 resistance zone.

NAS100

- Resistance: 25838/26182

- Support: 25294/25020

NAS100 rose 0.65% on Friday and posted a substantial 4.91% weekly gain as tech stocks rebounded sharply, led by a 10% surge in Intel. Despite the solid weekly performance, November ended softer as investors trimmed high-valuation AI positions. Technically, NDX is holding above 25,294 after breaking its downtrend, with room to extend toward 25,838.

BTC

- Resistance: 90117/91622

- Support: 83847/82393

Bitcoin extended its rebound as BTIG said oversold conditions and seasonal strength could support a move back toward $100,000. Analysts view late November as a typical bottoming window. Technically, BTC is stabilizing above

the $83,847–82,393 demand zone, and a break above $90,000 could open the way toward resistance near $91,622 or higher.

Enjoy trading! The content is for reference only. Please ensure that you understand the risk.