Market Highlight

U.S. equities closed lower on Thursday as investors consolidated positions ahead of Q3 earnings season amid a lack of economic data and fresh market catalysts. The Dow Jones fell 0.52%, the S&P 500 lost 0.28%, and the Nasdaq Composite slipped 0.08%. Concerns over the ongoing U.S. government shutdown and broad risk-off sentiment pushed the U.S. Dollar Index higher for a fourth consecutive session, topping the 99 mark to its strongest since August 1. The euro weakened 0.61% to 1.1555, briefly touching 1.1545, its lowest since early August.

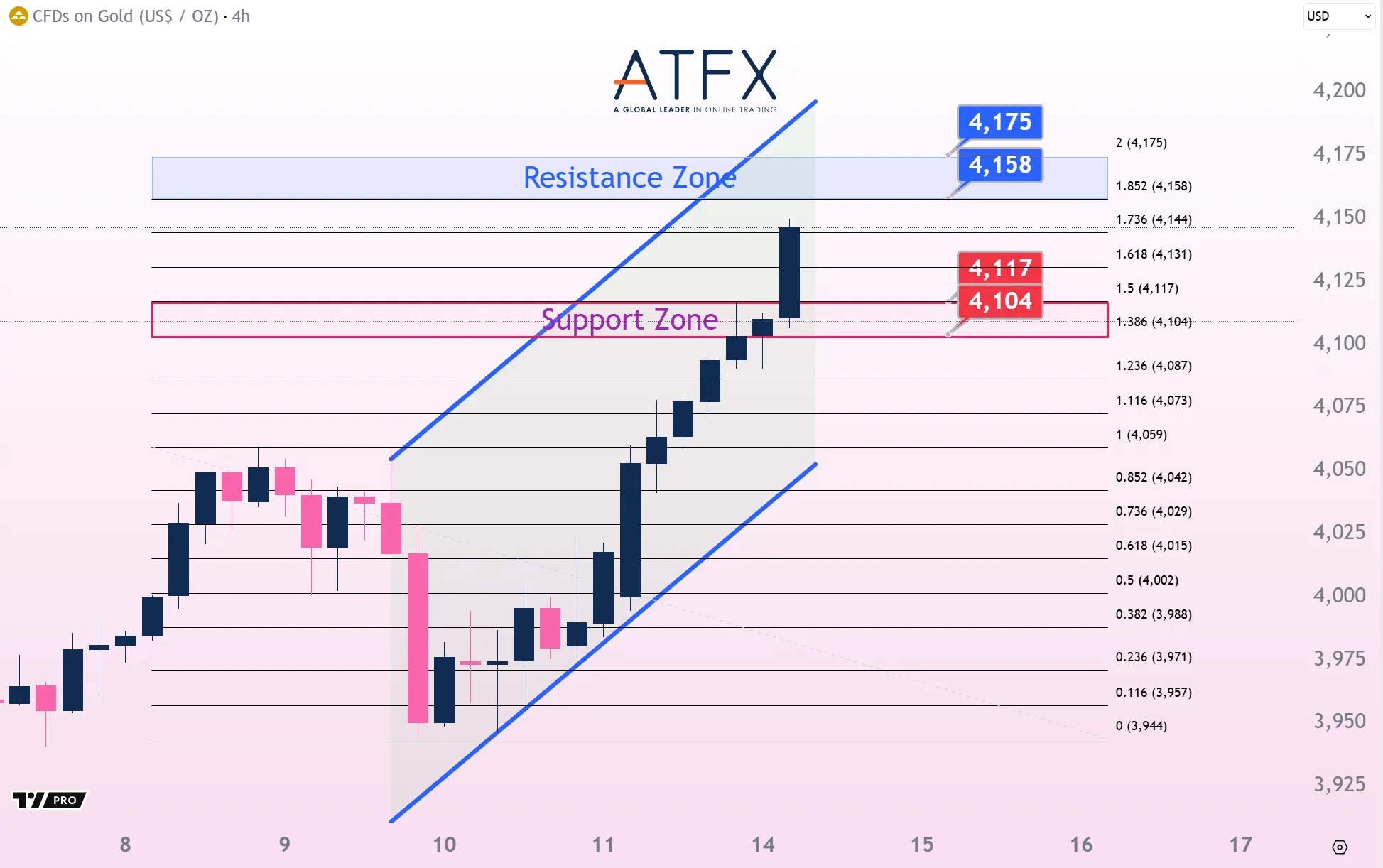

Gold prices tumbled 2% overnight, falling back below the $4,000 per ounce milestone reached in the prior session, as the stronger dollar and profit-taking followed the ceasefire agreement between Israel and Hamas. Crude oil prices also settled lower, ending their recent winning streak, after the ceasefire deal eased supply disruption concerns.

Key Outlook

Attention turns to Canada’s September labor market report, with focus on whether employment continues to post negative growth, while the unemployment rate is expected to remain above 7%. Following the Bank of Canada’s decision to cut rates to a three-year low, weaker labor data would reinforce expectations for further easing. The central bank has stressed its cautious stance, highlighting risks and uncertainties.

Markets will also watch for the preliminary University of Michigan Consumer Sentiment Index for October, which is expected to decline for a fourth consecutive month.

Key Data and Events Today:

- 20:30 CA Unemployment Rate SEP **

- 22:00 US Michigan Consumer Sentiment Prel OCT ***

Key Data and Events Coming Week:

- Monday: JP Holiday, CN Balance of Trade, OPEC Monthly Report

- Tuesday: RBA Meeting Minutes, GERMANY CPI, GB Unemployment Rate, EU ZEW Economic Sentiment Index, IEA Monthly Report

- Wednesday: CN CPI, US CPI

- Thursday: API Crude Oil Stock Change, AU Employment Change, GB GDP, US PPI & Retail Sales & Initial Jobless Claims

- Friday: EIA Crude Oil Stocks Change, EU CPI, US Building Permits & Housing Starts, US Industrial & Manufacturing Production

Markets Analysis

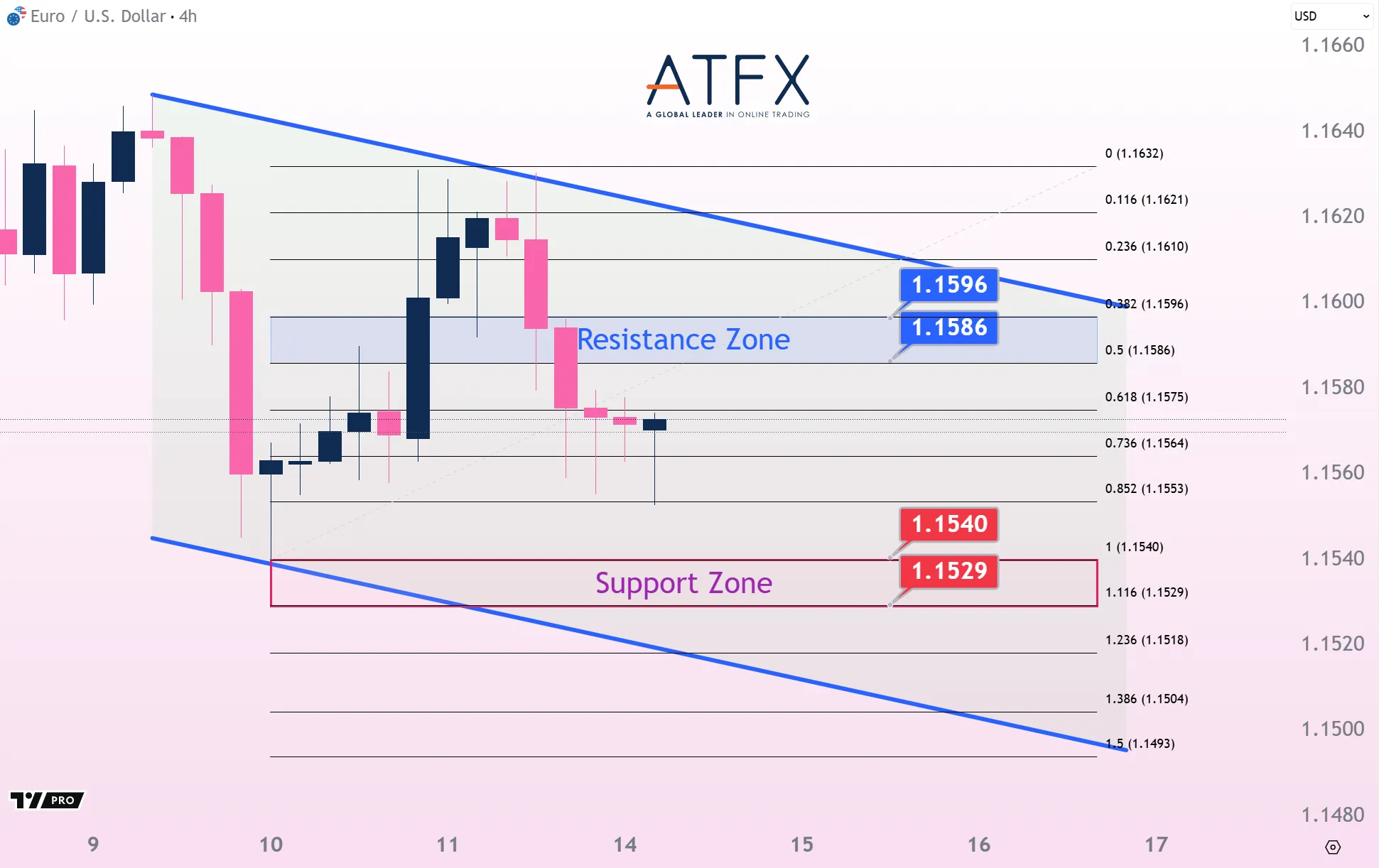

EURUSD

- Resistance: 1.1605/1.1652

- Support: 1.1531/1.1484

The euro extended losses, breaking below 1.1600 and touching 1.1540, its weakest in eight weeks. Political turmoil in France and weak German trade data weighed on sentiment, while the dollar stayed firm amid risk-off flows. Technically, EUR/USD faces resistance at 1.1605 and remains under a descending trendline, with downside pressure targeting 1.1531 if sellers hold momentum.

GBPUSD

- Resistance: 1.3353/1.3377

- Support: 1.3244/1.3221

Sterling slid to 1.3300, its lowest since August, as risk-off sentiment and the prolonged U.S. government shutdown boosted the dollar. On the chart, GBP/USD remains capped by a descending trendline with resistance at 1.3353, while the 200-day EMA near 1.3280 and support at 1.3244 are critical levels. A break lower would extend further loss.

USDJPY

- Resistance: 153.30/153.71

- Support: 152.41/152.02

USD/JPY spiked to 153.23, its highest since February, as concerns over Japan’s new LDP leader Sanae Takaichi’s expansionary fiscal stance pressured the yen. Technically, the pair holds above support at 152.41, with resistance at 153.30. A sustained break higher could open the path toward 154.00, while failure to clear resistance may trigger a pullback.

US Crude Oil Futures (NOV)

- Resistance: 62.32/62.88

- Support: 61.05/60.48

WTI crude slid 1.7% to $61.51 while Brent dropped 1.6% to $65.22, as the Gaza ceasefire reduced geopolitical risk premium. OPEC+’s smaller-than-expected output hike offered limited support. Technically, WTI is consolidating above $61.05 support, with resistance near $62.32; failure to reclaim resistance may trigger further downside toward $60.48.

Spot Gold

- Resistance: 4032/4060

- Support: 3939/3911

Spot Silver

- Resistance: 50.81/51.22

- Support: 48.77/48.45

Spot gold pulled back nearly 2% from the $4,059 record to trade around $3,984, weighed by a stronger USD and Gaza ceasefire profit-taking. On the chart, support lies near $3,939 with resistance at $4,032; holding the uptrend line keeps bullish momentum intact, but a break lower risks a deeper correction.

Dow Futures

- Resistance: 46469/46577

- Support: 46250/46140

The Dow Futures slipped 0.52% to 46,358, underperforming peers as housing and energy sectors dragged. With earnings season approaching, investors turned cautious. Technically, price is testing support near 46,250 within the rising channel; as long as this level holds, a rebound toward 46,469–46,577 remains possible, but a breakdown risks extending losses.

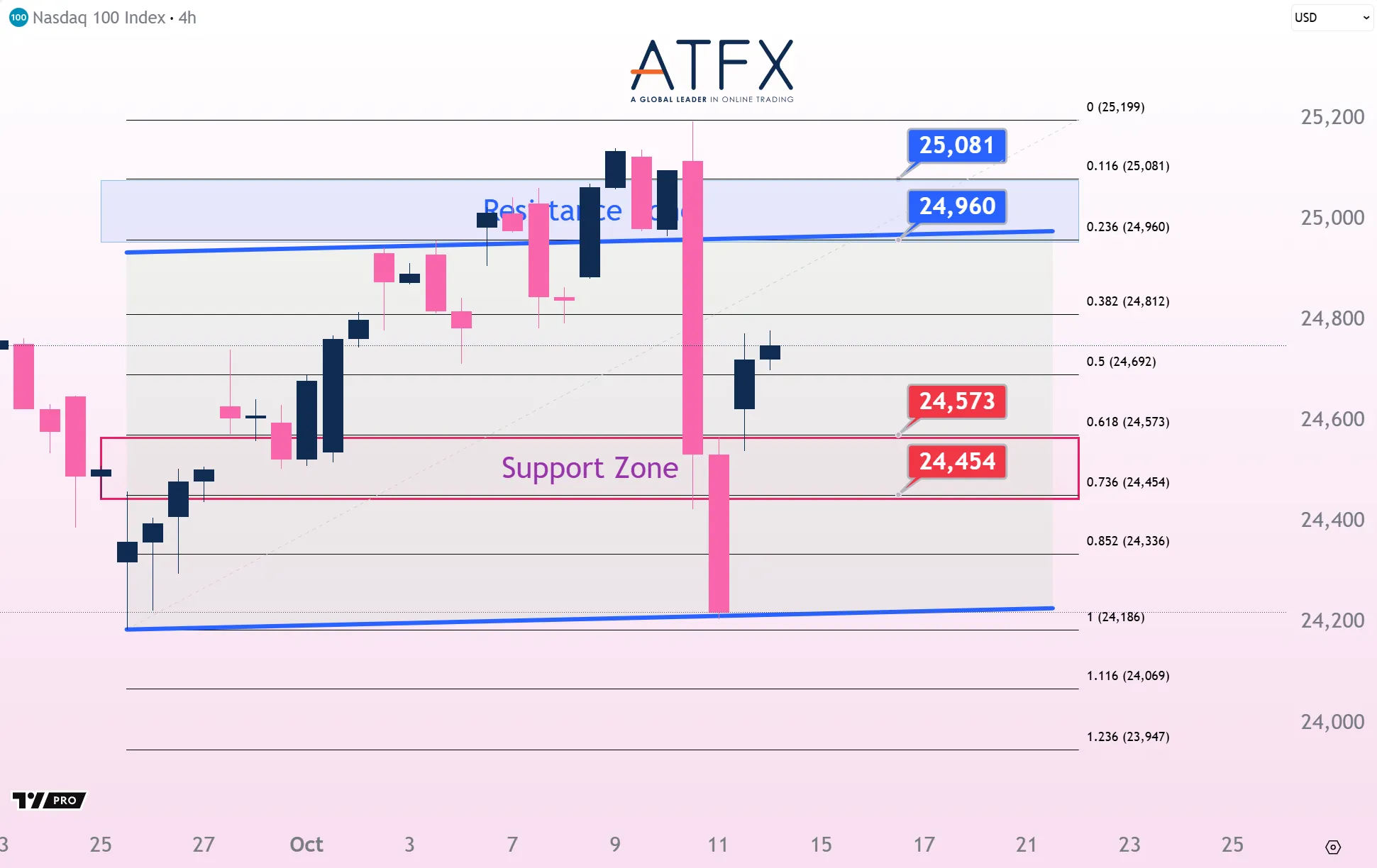

NAS100

- Resistance: 25148/25218

- Support: 24922/24851

NAS100 slipped 0.08% after record highs, as AI-driven tech momentum cooled. Investors worried about near-term correction risk. Technically, price remains within an ascending channel, with support near 24,922. Holding above this zone favors a rebound toward 25,148–25,218, while a break below could trigger a deeper pullback.

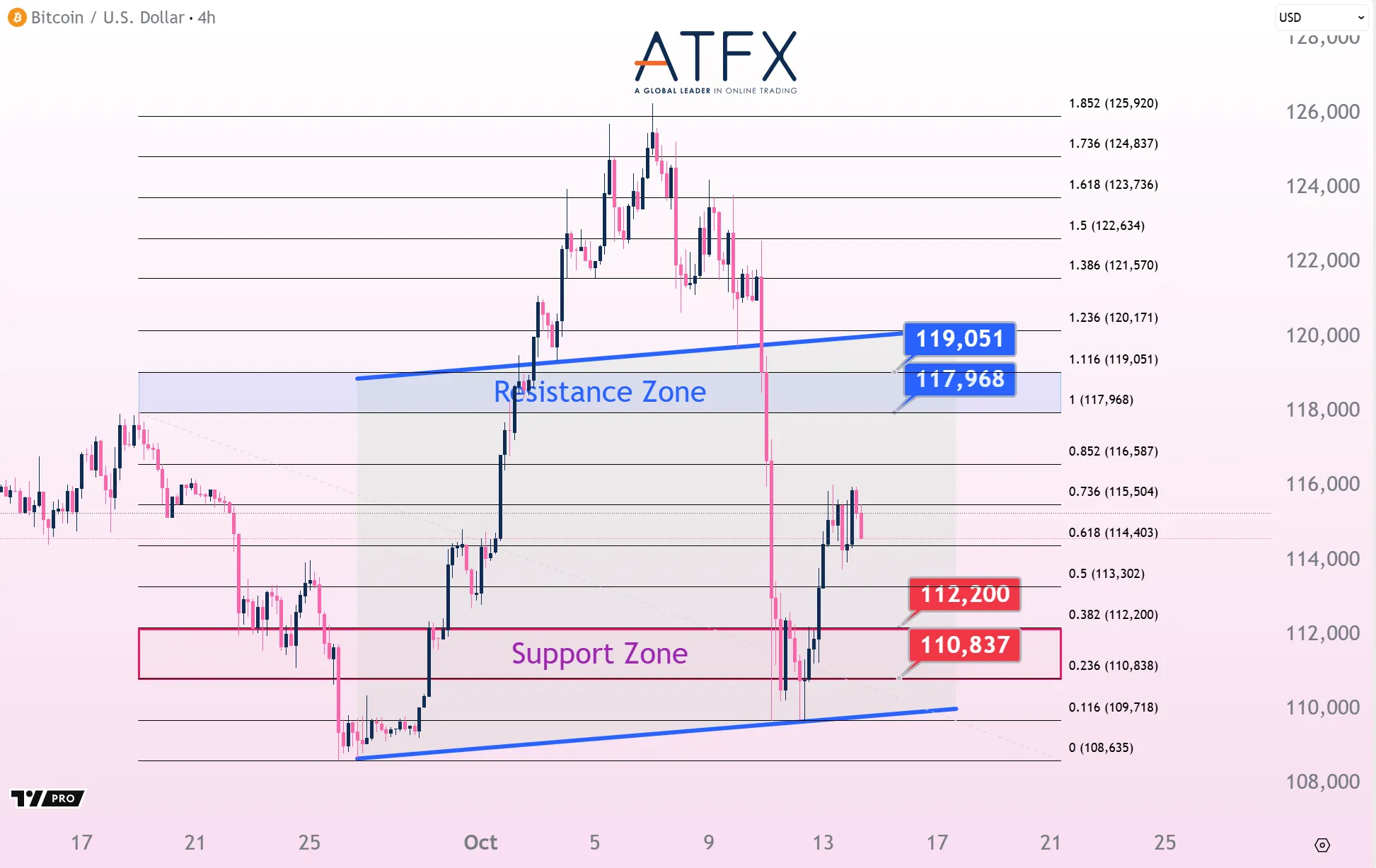

BTC

- Resistance: 123736/124837

- Support: 120170/119050

Bitcoin hovered above $123,300, consolidating below record highs. ETF inflows and expectations of Fed rate cuts continued to support sentiment, while October seasonality has historically favoured strong gains. Technically, BTC is holding near $121,400 with strong demand around $120,170. As long as this support holds, a rebound toward $123,736–$124,837 remains likely

Enjoy trading! The content is for reference only. Please ensure that you understand the risk.