Investors have been trading precious metals for centuries, with silver being a prime example. Silver’s popularity as a traded metal was due to it being a reliable safeguard against economic downturns and inflation, and it also provides a variety of trading options. In this article, you will learn how to trade silver.

Table of contents:

- What is silver trading and why should you trade silver?

- Understand the basics of silver trading

- Choose your preferred method of trading silver

- Choose the right silver trading platform

- Create your silver demo trading account

- Develop an effective silver trading strategy

- Transition to live trading and place your first trade

- Always monitor your trades & update your trading strategy

- Common trading mistakes and how to avoid them

Ready to practice silver trading without putting in real money?

What is silver trading and why should you trade silver?

Silver trading involves buying and selling silver assets with the goal of making a profit. Traders may buy physical silver, but more often, they trade derivatives that track the price of the underlying metal.

Why should you consider trading silver?

- Silver, like other precious metals, is considered a safe haven asset, acting as an insurance policy against times of economic uncertainty.

- Silver’s versatility in numerous industrial applications makes its demand more robust than other precious metals.

- Silver is more affordable to the retail investor than gold, providing easier access to the precious metals market.

Learn more about: Is silver a good investment? 5 pros & cons of silver investment

Understand the basics of silver trading

Before diving into silver trading, you need to understand several fundamental aspects:

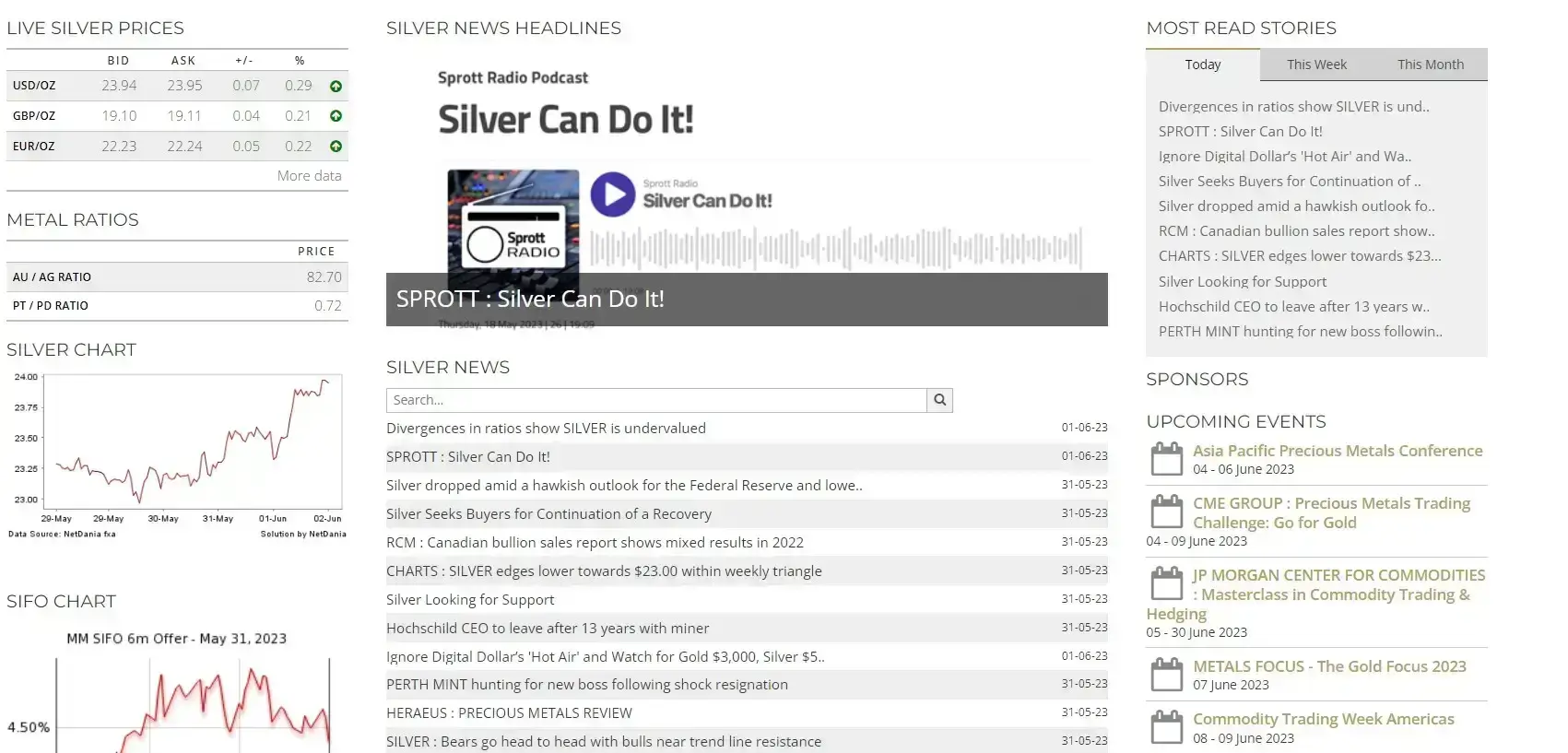

I. Correlation between gold and silver:

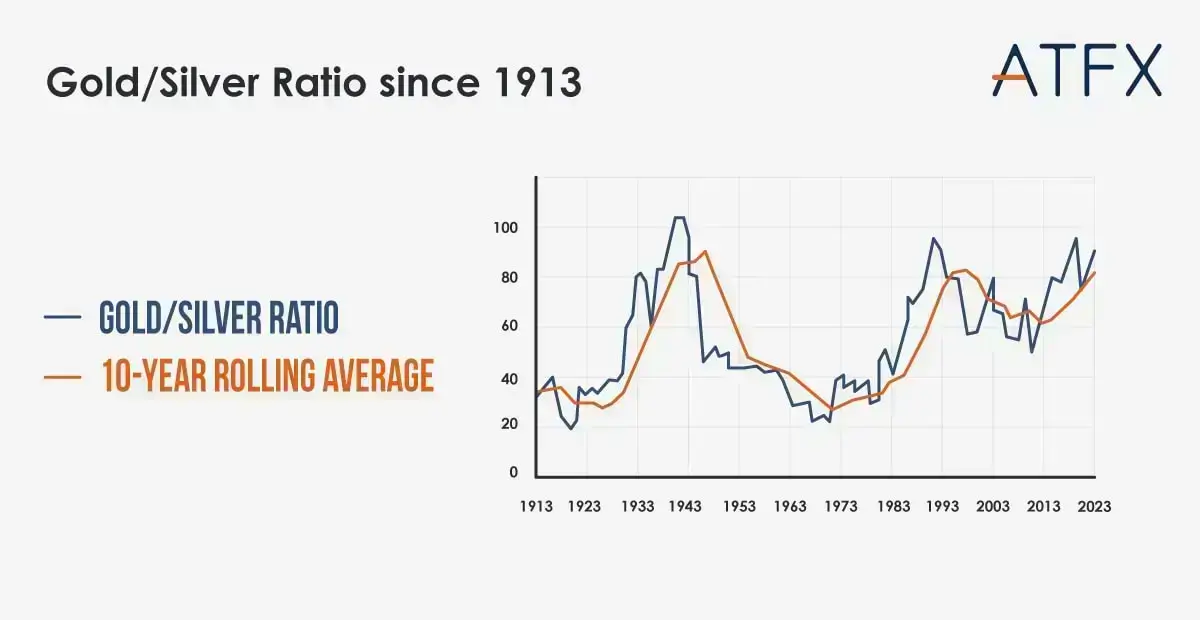

In the past, the prices of gold and silver have moved in the same directive, and then not necessarily at the same rate. But gold-silver ratio is a wonderful tool used to decide the comparative value of the two metals.

II. What is the gold-silver ratio?

This ratio indicates to the traders on how many ounces of silver it will take to buy an ounce of gold. For instance, if the ratio is 70:1, an ounce of gold equals seventy ounces of silver. Traders use this ratio to distinguish viable buying or selling in the market.

III. What drives the price of silver?

A. Supply and Demand:

Like any other commodities, the fundamentals of supply and demand play a crucial role in deciding the price of silver. If the silver demand surpass supply, the price will increase. To the contrary, if the supply exceed demand, the price will drop.

B. Geopolitical Events:

Political unrest, wars, or significant government policy changes can cause fluctuations in silver prices. These events can affect investor sentiment and can lead to increased demand for safe-haven assets like silver.

C. Industrial Demand:

Silver has numerous industrial applications, including in electronics, solar energy, and medicine. As such, changes in industrial demand can significantly impact silver prices. For example, a boom in the solar industry could increase demand for silver and potentially drive up prices.

D. Market Sentiment:

Traders’ perceptions and attitudes towards the economy and silver also play a critical role in price movements. If traders are optimistic, silver demand may increase, driving up prices. If investor sentiment is bearish, demand could fall, leading to lower prices.

E. Strength of the U.S. Dollar:

The price of silver is inversely related to the strength of the U.S. dollar. When the dollar is strong, silver becomes more expensive for investors buying the metal using other currencies, which could decrease demand and lower the market price. Conversely, a weaker dollar could lead to higher silver prices.

Learn more about what drives silver prices.

Choose your preferred method of trading silver

I. Silver CFD Trading

How it works: With CFDs, you agree to exchange the price difference of silver when you open the contract and when you close it. Instead of owning physical silver, you’re simply making speculations on future price movements.

Pros & Cons: Allows flexible trading and leverage, but risks include the potential for higher losses and overnight holding costs.

II. Silver futures

How it works: In a futures contract, you agree to buy or sell a specific amount of silver at a certain price, to be settled on a future date. It’s a binding contract that can be traded on futures exchanges.

Pros & Cons: Offers hedging potential and daily settlements. High leverage may lead to larger losses and the market can be complex for beginners.

III. Physical silver

How it works: This involves buying physical silver, like coins or bars, with the intention to sell them later at a higher price. You’re responsible for the storage and security of the silver.

Pros & Cons: Provides direct asset ownership and inflation protection. Drawbacks include storage, insurance costs, and lower liquidity.

IV. Silver ETFs

How it works: Silver ETFs are securities designed to track the price of silver. When you buy shares in a silver ETF, you’re buying a piece of a fund that owns physical silver.

Pros & Cons: Offers easy access to the silver market without storage issues and can be included in retirement plans. ETF fees and price discrepancies can be drawbacks.

V. Silver options

How it works: Silver options are contracts that give the holder the right, but not the obligation, to buy or sell a certain amount of silver at a predetermined price before the contract expires.

Pros & Cons: Provides flexibility in trading and limits risk, but options can expire worthless if not executed on time.

Summary table

Silver CFDs Silver Futures Physical Silver Silver ETFs Silver Options Ownership No direct ownership No direct ownership Direct ownership Indirect ownership via fund No direct ownership Accessibility High (via CFD brokers) Medium (via futures exchanges) High (numerous physical retailers) High (via stock exchanges) Medium (via options exchanges) Trading Flexibility High (long or short positions) High (long or short positions) Low (can only take long position) Medium (depends on fund’s rules) High (long or short positions, various strategies) Leverage Yes Yes No No Yes Risk Level High High Low Medium High Potential for Returns High High Medium Medium High Choose the right silver trading platform

A comprehensive trading platform will not only provide a seamless experience but also offer a range of tools and resources to help you make informed decisions. Here are some factors you should consider:

I. The Silver Trading Options Offered

Different platforms offer different methods of trading silver. Some may allow you to trade physical silver, silver futures, silver ETFs, silver options, or even digital silver. Make sure the platform you choose supports the type of silver trading you’re interested in.

Learn more about silver trading offered by ATFX

II. Fees and Commissions

Every platform has its fee structure. Some may charge a fixed commission per trade, while others might have a percentage-based fee. Also, look out for any hidden fees such as inactivity fees or withdrawal fees. Always opt for a platform with a transparent and reasonable fee structure.

III. Customer Support

Reliable customer support can be a lifesaver when you encounter issues or have questions. Check if the platform offers 24/5 customer support. Look for reviews or testimonials about the quality of their service.

IV. Regulatory Compliance

Make sure the platform is regulated by a recognized financial authority. This offers a level of protection for your investment and ensures the platform operates under strict guidelines. For instance, ATFX is regulated by 4 leading authorities, providing a robust safety net for traders. No matter where you are in the world, you can have the confidence that your investments are well protected.

Read more about ATFX regulatory compliance that keeps your trading safe.

Create your silver demo trading account

Begin by opening a demo account on the ATFX broker’s website. A demo account allows you to practice silver trading risk-free without risking your hard-earned money.

Complete the registration process by verifying your identity and providing the required documents. There’s no obligation to deposit real money until you are ready to move on to a live trading account.

You can take your time and play around with the platform’s features and tools to ensure familiarity with the platform, leading to a smooth trading experience once you move on to the next stage.

Develop an effective silver trading strategy

Crafting a successful silver trading strategy involves doing research, acknowledging market patterns, and some trial and error. The objective is to develop a system that collaborates with your financial goals, tolerance for risk, and trading style. Here are the steps to developing an effective silver trading strategy:

I. Set Clear Goals

Define what you want to achieve from your silver trading. This could be anything from capital growth, hedging against inflation, or diversifying your investment portfolio. Your goals will determine your trading strategy.

II. Develop a Risk Management Plan

Decide in advance how much of your investment capital you’re willing to risk on each trade. A common approach is not to risk more than 1-2% of your portfolio on a single trade. Also, consider setting stop-loss orders to automatically sell when the price drops to a certain level to limit your losses.

In the example above, the red part indicates stop loss at the previous high to avoid further losses.

III. Plan Your Entry and Exit Points

Before you enter a trade, know where you plan to get out. Stick to your plan when deciding on a price target or specific date, and try not to let emotions sway your decisions.

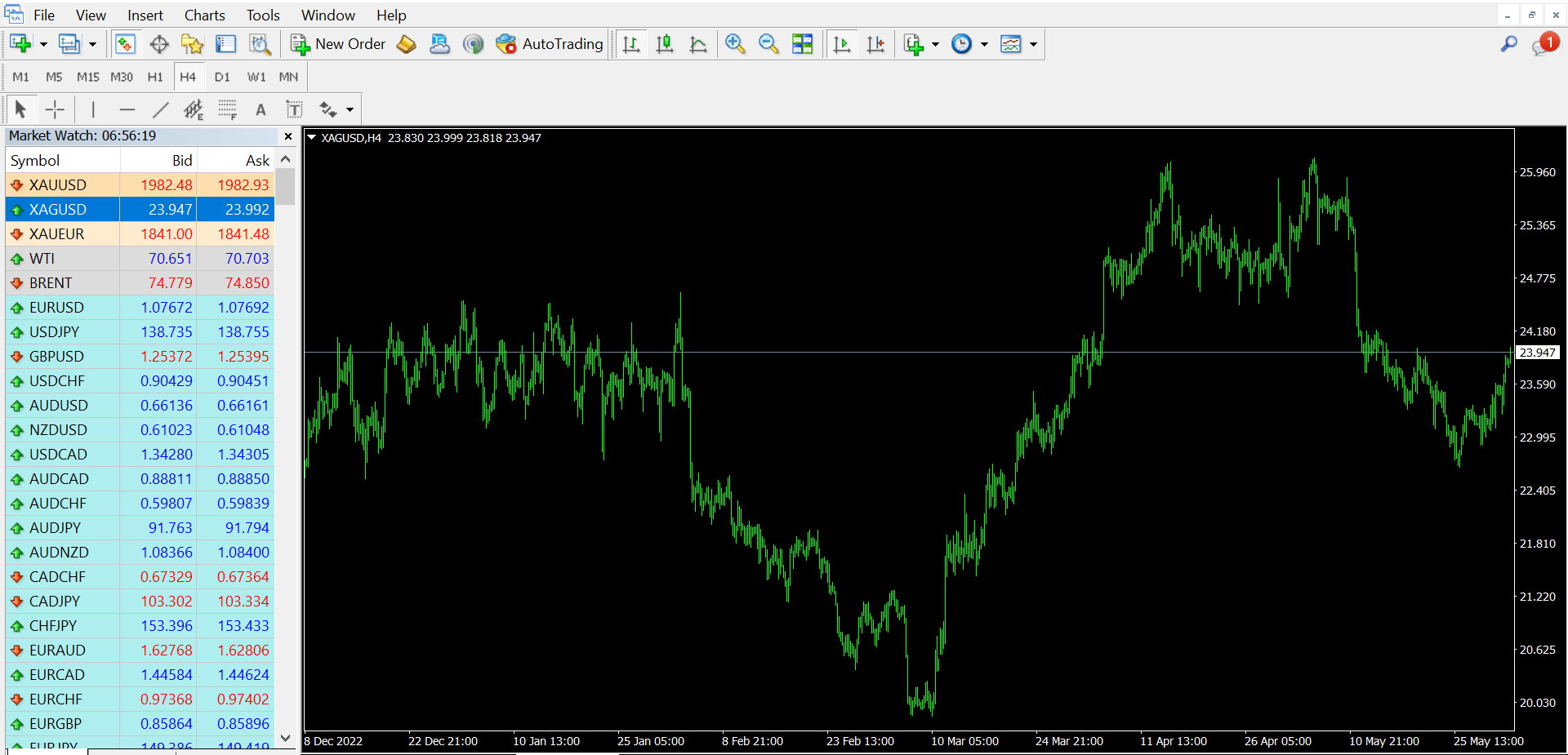

In the example above, we can set buy entry when MA5 crosses above MA12, and set buy exit when MA5 crosses below MA12.

IV. Analyze and Choose

Use technical analysis and fundamental analysis to determine when to buy or sell silver. Technical analysis involves studying price charts and patterns, while fundamental analysis involves evaluating economic factors and market trends.

V. Test your strategy on a demo account

Utilize your ATFX demo account to execute trades based on your strategy. The risk-free environment allows you to monitor and analyze your trades, identifying areas for improvement. Demo trading will give you a feel for how your strategy works under real market conditions. You can make adjustments as needed based on your trading results.

Transition to live trading and place your first trade

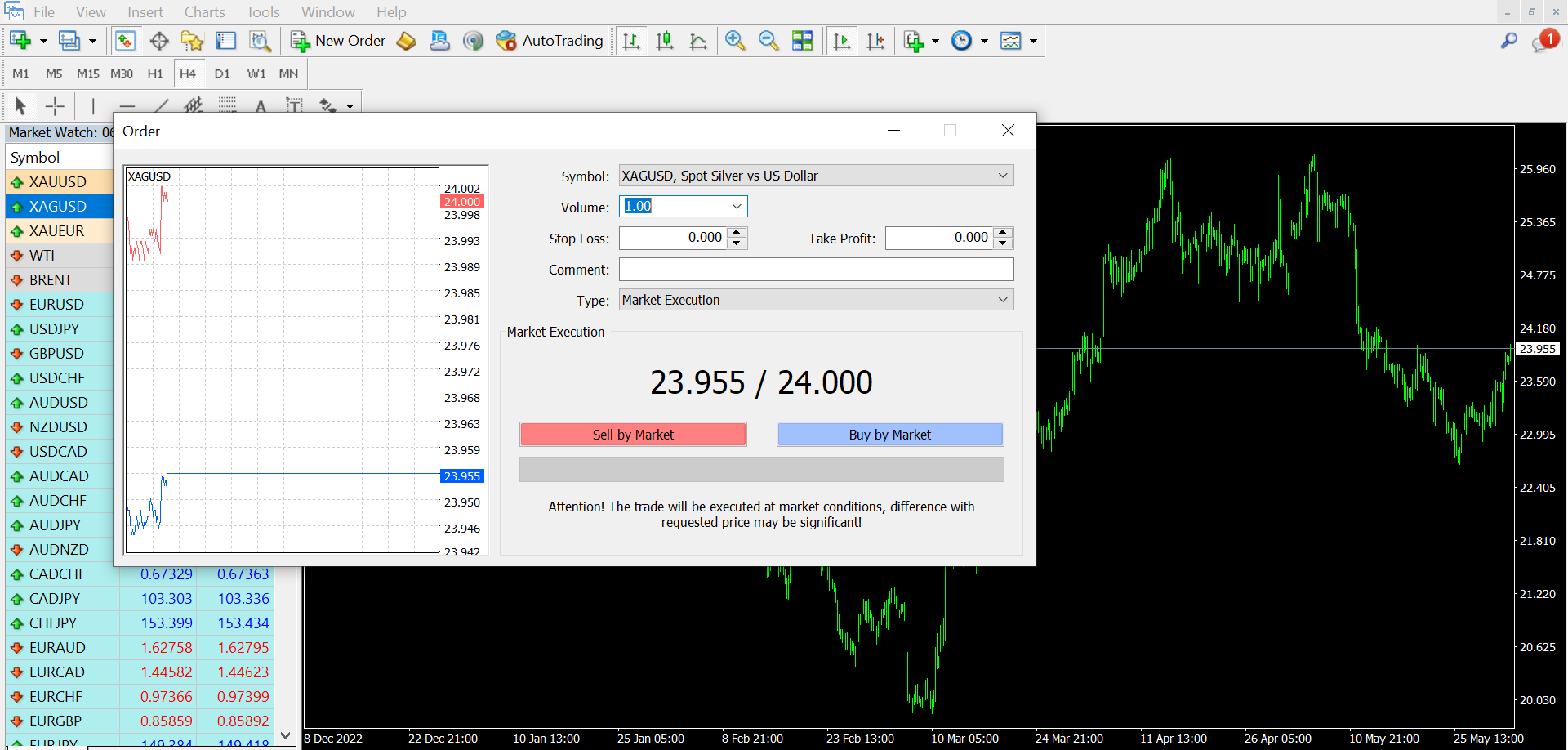

Once you feel confident in your trading strategy, open a live trading account with ATFX.

Deposit your initial investment capital and apply your refined strategy and risk management techniques to live trades. Start with a small amount to minimize your risk exposure as you gain experience in the live market environment.

Always monitor your trades & update your trading strategy

Stay updated with changes in the silver market using ATFX’s learning resources. Check our blog posts for the newest market news, and watch our YouTube channel for more ideas about trading.

Always check how your trades are doing. Change your plan if needed based on what’s happening in the market and how you’re growing as a trader.

To achieve success in the trading world, continuous learning and adaptation to changing market conditions are crucial to your long-term success as a trader.

Common trading mistakes and how to avoid them

I. Trading Without a Plan

Jumping into trades without a clear plan is a common mistake. Without a strategy, you’re more likely to make impulsive decisions based on short-term market fluctuations.

II. Ignoring Market Trends

Some traders ignore broader market trends and only focus on short-term price movements. This can lead to missed opportunities or unexpected losses.

III. Not Managing Risk

Some traders risk too much on a single trade or fail to use stop-loss orders, which can lead to significant losses.

IV. Failing to Diversify

Putting all your money into silver can expose you to unnecessary risk.

V. Not Learning from Mistakes

Some traders repeat the same mistakes without taking the time to understand what went wrong

Ready to practice silver trading without putting in real money?

Ready to dive into the world of silver trading? Consider signing up for a free demo account with ATFX to put your newfound knowledge into practice. Apart from silver trading, ATFX also offers many other financial products on a robust trading platform that allows you to practice different strategies while still learning from the available guides or the free training materials ATFX provides. So, get your demo trading account for free now!