What is a Forex Broker?

A forex broker is an intermediary or a bridge between retail traders like you and the large, decentralised forex market.

These brokers offer a platform where individuals can access the market, trade currency pairs, and potentially earn profits from online forex trading.

Types of Brokers in Forex

Broadening your understanding, you’ll discern various brokers populating the forex domain:

- Dealing Desk Brokers: Often termed market makers, these brokers present fixed spreads and typically assume the opposite stance of your trades.

- No dealing desk brokers, also known as ECN brokers – provide traders with direct market access to negotiate against peers and major financial entities. They are praised for their low spreads.

The choice between them should align with your trading strategies and preferences.

How to Choose a Forex Broker for Beginners Forex Trading

Handpicking the right forex broker is comparable important as selecting the best forex currency pair to trade. It can either craft a journey of excellence or lead you into a maze of confusion.

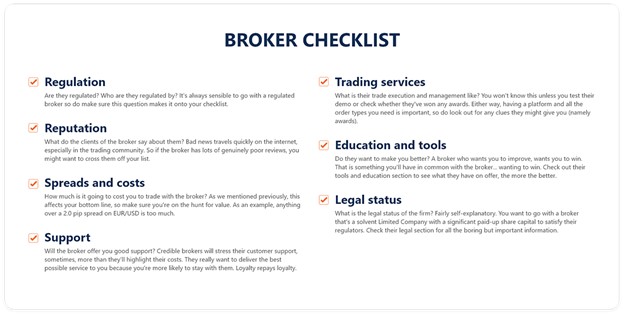

The most basic broker checklists are regulation, reputation, spreads and costs, support, trading services, education and tools and legal status.

We interviewed and surveyed our trader clients to identify their primary criteria for choosing a forex broker. The following are their first concern when selecting a forex broker.

- Regulation & Licenses

- Thin Spreads and Low Commissions

- Low Minimum Deposit

- Hassle-free Deposits & Withdrawals

- Responsive Customer Support

- Fast Execution

In addition, we have concluded the 16 Factors to consider when choosing a broker in forex trading.

Regulation & Licenses

A broker’s regulatory stance not only safeguards your investments but weaves a fabric of trustworthiness.

Always peruse the broker’s website and check with the regulatory entity for license validations.

Ensure that the forex broker has the appropriate license to carry out such forex service in your country and has met the regulations from the regulator.

For example, forex licenses from the Australian Securities and Investments Commission, the UK Financial Regulatory Authority, Cyprus Securities and Exchange Commission and so on.

Legal & History Status of Broker

A broker’s past history can reveal information about its operations & company. Previous legal issues or financial controversies should raise concerns.

Always perform due diligence about the broker company profile to ensure is a legit broker. If the broker with a long history of the establishment is giving a signal or impression that the business is trusted in the trader community.

Trustworthy forex brokers prioritise transparency and will state on their website, such as term & conditions, trading policies, pricing policies, personal privacy, financial products policies and others.

Reputation & Reviews

Go through the broker’s website and navigate online to check the reputation and reviews of the broker to identify the trustworthiness of the broker.

For example, forex forums like Forex Factory, authority news publishers like Bloomberg talk about the broker, authentic trader article, websites or video mentions about the broker and also a review site like Trustpilot.

Be sure to evaluate the reputation and reviews unbiased, as only take into account of the authentic source about the broker.

Responsive Customer Support

Whether it’s a trading anomaly or a simple query, the broker’s customer support must be agile in responding to customer’s questions.

Multiple communication channels should be available be it emails, phone lines, or live chats, to augment their reliability.

For example, customers are unable to log in to the client portal due to forgetting their password. Customer service needs to act quickly to resolve the issue so that customers are able to carry out the trade.

Hassle-free Deposits & Withdrawals

Deposit should be quick and easy, as traders need the funds to execute the trade and withdrawal should be hassle-free as well.

Brokers must have withdrawal and deposit systems, offering clarity on processing fees, time periods, and potential circumstances.

For example, any surcharge, maximum or minimum for deposit and withdrawal. The time frame for withdrawal should take within a day or any circumstances should take a longer time for example, bank processing time.

Deposit and Withdrawal Options

For a trader, transactional flexibility options are paramount. Whether it’s traditional bank transfers, debit cards, credit cards like MasterCard, Visa, etc., cryptos like USDT or digital e-wallets, a diverse transactional palette enhances the trading experience.

Low Minimum Deposit

A low minimal deposit entry barrier is beneficial, and It lets them test the forex waters. It encourages more traders to start trading with a low minimum deposit and progressively increase their deposit when familiar with the broker platform.

Account Types

A one-size-fits-all approach doesn’t resonate with forex trading. Different Brokers often offer varied account types to cater to different traders’ demands needs. Whether it’s high-leverage margin accounts or basic for novice retail traders, the broker’s offerings should resonate with your trading.

For example, ATFX offers standard, edge and premium live trading account types to fulfil different traders’ trading strategies and risk management needs or based on different countries needs.

Margin & Leverage

Margin and leverage can be a double-edged sword where it accentuates profits and losses alike. It’s crucial to tread cautiously, understanding its inherent risks, especially if you’re a beginner in the trading community.

It is important to consider the margin and leverage when trading, as well as understand how to calculate them in order to optimize your trading strategies and practice effective risk management.

Speed of Execution

Investing in the forex market can be fast-paced and time-sensitive. It is important to select a broker that provides a platform that is not only easy to use but also quick, minimizing any potential losses caused by delays.

Thin Spreads and Low Commissions

The financial basis of a trade consists of spreads and commissions. Brokers make their earnings from spreads, which represent the gap between the purchase and sale values of a currency pair. Affordable spreads and minimal commissions are crucial for trading in the long run.

Trading Platform

A trader’s ultimate companion is an efficient trading platform that is packed with features and yet remains user-friendly. Trading platforms typically come in two variations: a web-based trader designed for desktop use and a mobile application specifically created for smartphones.

Platforms such as MetaTrader 4, known for their innovative and easy-to-use features, offer a wide range of versatile indicator tools that set them apart and are popular in the trading community.

With the rise of social trading which is also known as “Copy Trading” is becoming more popular where traders are able to socialise to share ideas and strategies and trade at the same time. It is like a social media and trading platform merging into one.

It is suitable for new traders or part-time traders to follow and pick their Copy Trade provider based on risk ratio and replicate their trading strategies in real-time.

Demo Account

Demo accounts are essential for novice traders as they serve as a training ground. These accounts replicate real-life trading situations without any financial risks, enabling users to understand the intricacies of the trading platform and refine their strategies.

It ensure that the traders are familiar with the new broker trading platform before they open trades on a live trading account.

Varieties of Financial Asset Instruments

In addition to most traded foreign currency pairs, brokers with foresight expand their range of options. They include commodities, indices, stocks, and other assets, providing traders with a diverse trading environment.

- Major Forex Currency Pairs – EURUSD, USDJPY, GBPUSD & etc

- Minor Forex Currency Pairs – AUDCAD, EURAUD, GBPAUD & etc

- Exotics Forex Currency Pairs – EURHUF, USDCNH, USDSGD & etc

- Commodities – metals like Spot Gold/US Dollar XAUUSD, oil like US WTI Crude Oil USOIL.MMMYY, gas like US Natural Gas Futures Contract NGAS.MMMYY & etc

- Stock Indices – US 500 Spot Index SPX500, US 30 Spot Index US30, Australian 200 Spot Index AUS200 & etc

- Forex Indices – US Dollar Futures Index USDX_MMMYY

- Shares – US Shares, German Shares, Hong Kong Shares & etc

- Cryptocurrency – Bitcoin/US Dollar BTCUSD, Ethereum/US Dollar ETHUSD, Litecoin/worldUS Dollar LTCUSD & etc

Educational Resources

The world of forex trading requires constant learning and practising. Knowledgeable brokers offer various educational resources such as webinars, video tutorials, informative articles, market analysis and more to enhance their trader’s trading knowledge and keep them updated about the market situations.

- Market News

- Financial Events

- Trading Strategies Articles

- Video & eBook

- Trader Magazine Market Outlook

- Webinar

- Seminar

Research and Analysis Tools

When it comes to forex trading, decision-making relies heavily on data. Brokers equip traders with a range of analytical tools, such as interactive charts, calculators, and advanced indicators.

These tools empower traders by enabling them to interpret market trends, anticipate possible changes, and strategically position their trades.

- Trading Central – Get trade signals for the most popular markets delivered directly to your MT4 account.

- Autochartist – Assists traders by automatically detecting chart patterns and trading prospects in the financial markets through technical analysis.

- Economic Calendar – Provides traders with information on upcoming economic events to assist in planning market strategies.

- ATFX Support & Resistance Indicator – helps traders identify important price levels for determining when to enter and exit trades.

- ATFX Position Size Calculator – Assists traders in determining the ideal trade size for effective risk management.

Frequently Asked Questions – FAQs

What makes a good forex broker?

An outstanding forex broker effortlessly combines operational transparency, competitive pricing, a strong trading platform, and reliable customer support. They always provide value by offering a variety of trading tools and a vast collection of educational resources, guaranteeing that both inexperienced and experienced traders have everything necessary for success.

How do I choose a broker on MetaTrader?

When selecting a broker that works well with MetaTrader, it is important to prioritize the broker’s reputation, adherence to regulatory requirements, and the range of trading options they provide. It is recommended to verify their past performance on reputable awards, review sites and user forums.

Can I trade forex without a broker?

While it is theoretically impossible for individuals to trade in the forex market without brokers, brokers provide the essential infrastructure that connects retail traders to the vast market.

They offer platforms, tools, and insights that make the trading process less complicated, allowing even average traders to understand and participate. It is not advisable for newcomers to venture into forex trading alone, as brokers can greatly assist in navigating the forex world.

Can I have accounts with multiple brokers?

Traders often choose to diversify their accounts by maintaining relationships with multiple brokers.

This allows them to benefit from different tools, platforms, and markets, thereby optimizing their trading strategies and mitigating risks associated with specific platforms.

How do I verify a forex broker’s license?

To verify and confirm a broker’s license, visit their official website. Trusted brokers prominently showcase their regulatory credentials.

To ensure further assurance, compare this information with the official database of the regulatory body mentioned.