The US30 index continues to face pressure as ten-year bond yields climb ahead of the FOMC rate hike decision.

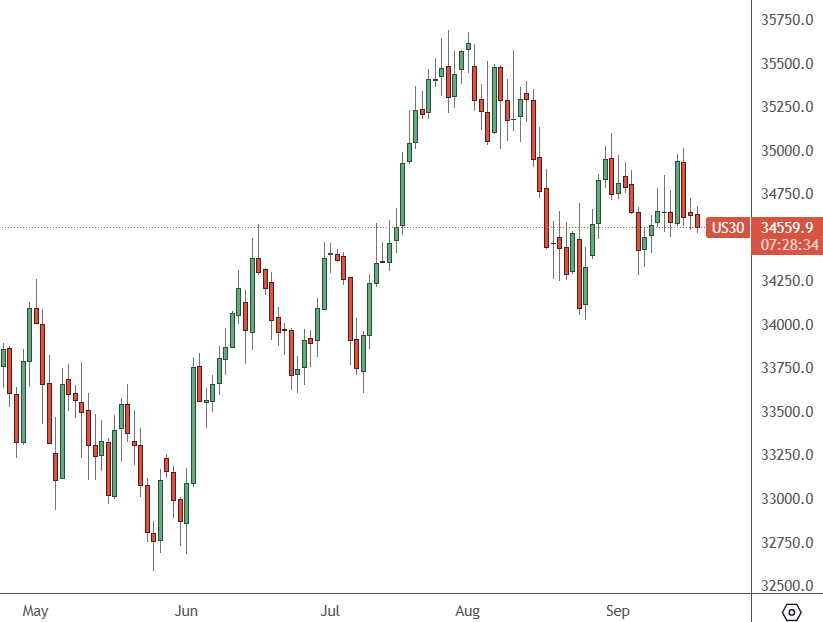

US30: Daily Chart

The US30 trades at 34,559 and may even test the August lows at 34,000 this week.

Treasury yields were higher on Monday, driven by strong economic data from the previous week and the Federal Reserve’s policy decision due on Wednesday. Recent economic indicators, such as firm inflation readings, solid retail sales, and rising oil prices, have pushed the 10-year Treasury yield towards its highest levels since the financial crisis of 2007–2008.

The market is heavily pricing in a pause in the Fed funds rate this week, according to the CME FedWatch Tool. However, the odds of an increase of 25 basis points to a range of 5.50% – 5.75% at the subsequent meeting in November are now only 28.7%. That could set stocks up for disappointment in the coming event.

Analysts from BofA Securities, including Michael Gapen, Mark Cabana, and Alex Cohen, said they see no alterations to the Federal Reserve’s balance sheet policies and predict it will hold its target range for the federal funds rate at the September meeting. This is due to recent Fed policymaker comments and market pricing.

Monday also showed a sentiment index for US home builders dropping in September, falling below the breakeven level. Traders expect that some recent economic weakness could force the central bank to pause.

On Monday, US Treasury Secretary Janet Yellen said she saw no signs that the US economy was moving into a downturn but said a failure by Congress to pass legislation to keep the government running risked slowing momentum.

“I don’t see any signs that the economy is at risk of a downturn,” Yellen told CNBC.

“There’s absolutely no reason for a shutdown,” she said. “Creating a situation that could cause a loss of momentum is something we don’t need as a risk at this point.”

Traders are fully expecting a pause from the Federal Reserve on Wednesday, and stocks would be rattled by any change in that outlook.