With the release of the 8.5% annualised CPI rate last month, the market is concerned about the US April unseasonal CPI, which will be released tonight. Therefore, the US stock market is expected to react to today’s inflation data. If the CPI data is in line with market expectations, the US stock market trend will stabilize.

The market expects the United States’ unseasonal CPI data to fall back to 8.10% in April from 8.50% in March. In addition, the quarterly adjusted US April CPI is expected to fall sharply, from 1.20% last month to 0.20%. This reflects the widespread expectation that US inflation levels are about to peak. The Fed’s latest policy move of raising the benchmark interest rate by 50 basis points to the 0.75%-1.00% range will have served to deter inflation.

Has US inflation peaked?

The Fed deployed a potent combination of strategies earlier this month to curb inflation, raising the benchmark interest rate by 50 basis points (0.50%). The latest hike came after the 25 basis points rate hike implemented in March. In addition, the Fed announced that it would start reducing its $9 trillion portfolios of bonds, allowing Treasury and mortgage bonds worth $47.5 billion a month to expire without reinvesting the amount after maturity in June, July and August. As a result, the value of bonds expiring was supposed to increase to $95 billion starting in September.

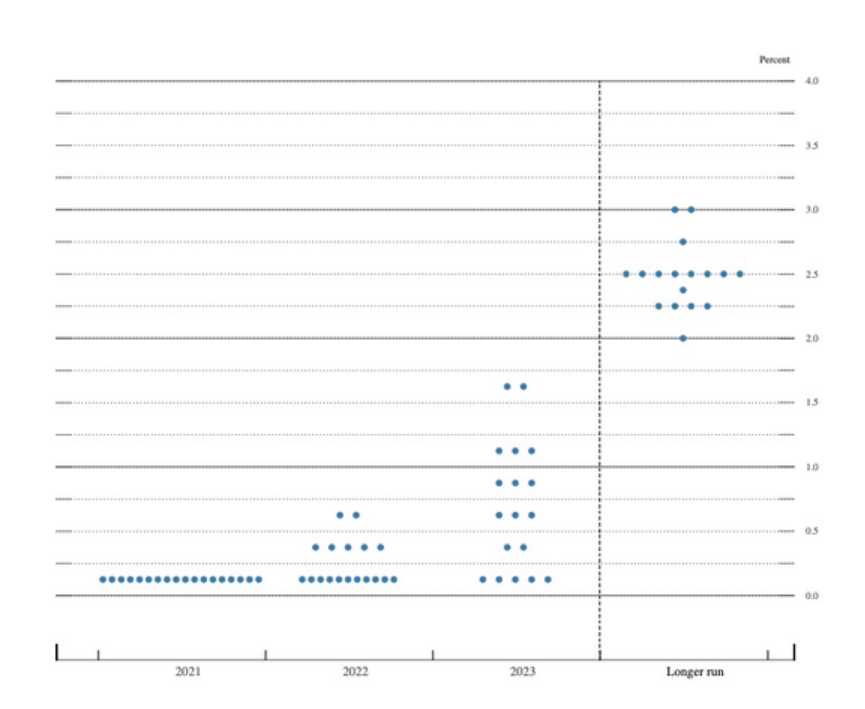

The market still expects the Fed’s future interest rate hikes to continue. According to the June dot plot, seven members are expected to vote for interest rate hikes in 2022, while 13 are expected to support interest rate hikes in 2023. However, Fed Chair Jerome Powell has stressed that the dot plot represents the expectations of each FOMC member and is not the official position of the Federal Open Market Committee (FOMC). Moreover, the FOMC has not yet discussed when it would be more appropriate to raise interest rates.

The Fed’s frequent signals about future rate hikes and the eventual 50 basis point hike helped combat soaring inflation. However, the hawkish policy stance has significantly dampened demand for assets such as cars and homes, an essential driver of current inflation.

Regarding global crude oil prices, the West recently imposed the sixth round of sanctions against Russia, including a comprehensive ban on importing Russian crude oil by the end of 2022. The sanctions on Russian oil have made the trend of oil prices fluctuate as oil prices remain high. Investors are worried that global oil demand will slow down due to the continuing lockdowns in China as the country pursues a zero-Covid strategy. The lower oil demand has led to the recent decline in oil prices from their March all-time high of $129 per barrel. Saudi Arabia has also lowered the oil prices for Asian customers starting in June 2022 signalling that oil prices could fall further. Therefore, from the policy and news levels, inflation levels are showing signs of falling.

How will the future direction of US stocks change?

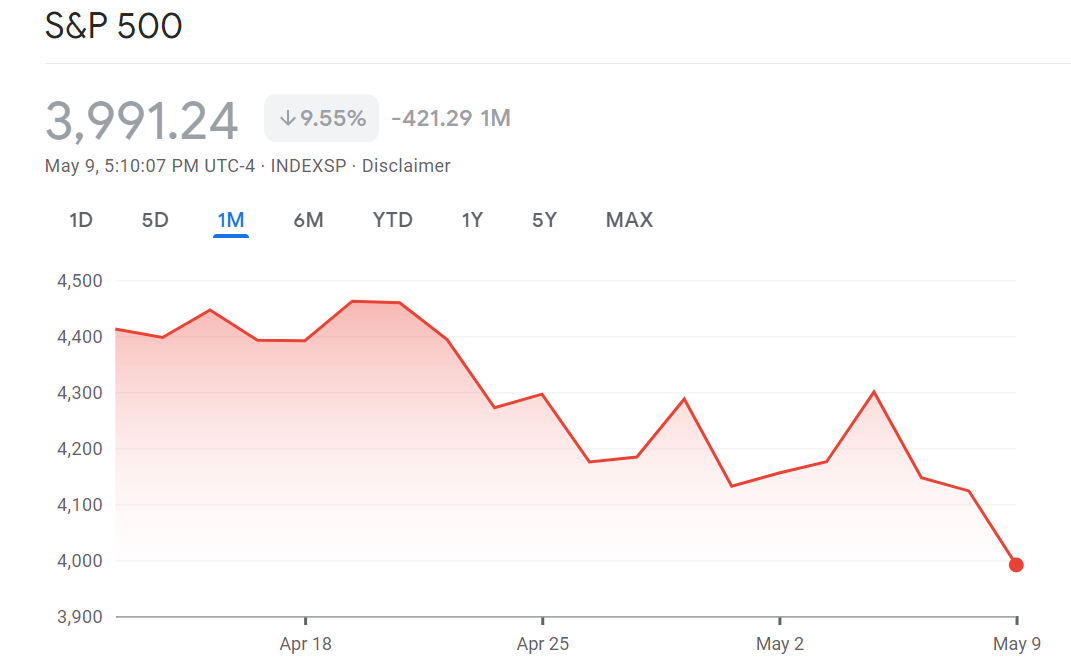

US stocks have been falling recently even as the price of 10-year Treasuries has continued to rise, reflecting anxiety about the rising prices of most goods and services. Therefore, observing the consumer price inflation data for April released today is necessary since the 10-year Treasury yields and US stocks could be positively correlated. The CPI data is expected to give impetus to the bullish trend of US stocks. Furthermore, if the CPI declines in April as predicted by the market, US stocks are likely to rebound from the current support levels, given the recent series of heavy losses witnessed across US stocks.

During rate hiking cycles, cyclical stocks such as finance, energy, industrial and raw materials typically outperform the broader market. Moreover, in the case of rising crude oil prices, energy stocks are the only sector that achieved positive returns as of last week, becoming the safe-haven asset of choice for investors, performing far better than the S&P 500 index. The cumulative increase in energy ETFs is also impressive, at 10.34%. In addition, the energy sector is also one of the sectors with the highest net purchases from funds operating in the US stock market.

However, this does not mean that there are no investment opportunities in other sectors. The current poor performance of the US stock market in the interest rate hike environment has created the right conditions for a rally in stocks that could benefit once the Fed reverses its hawkish policies.