The United States government heads for midterm elections, and voters will decide on the power split for the next two years.

Historically, a shared power outlook in a Democrat White House has been good for stocks.

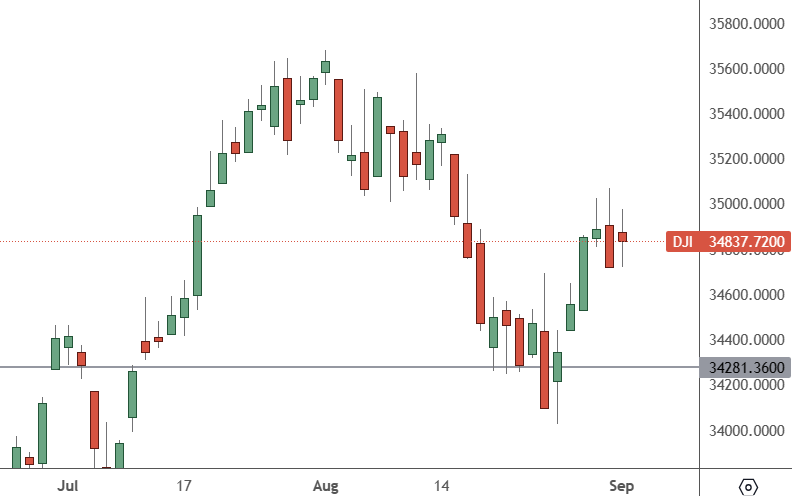

US30 – Daily Chart

The daily chart on the Dow Jones 30 index shows a potential near-term high in the market.

Traders are awaiting inflation data, but the midterm results may lead the way.

A split house is likely favourable for stocks as it has been historically. But a Democrat majority would bring more tax pressure, anti-business, and big spending.

The oil industry is an example of government overreach after the President slowed production and now wants it ramped up to ease the price of oil.

“It’s time for these companies to stop war profiteering, meet their responsibilities in this country and give the American people a break and still do very well,” Biden said. “If they don’t… they’re going to pay a higher tax on their excess profits and face higher restrictions.” The President said he would “work with Congress to look at these options that are available to us and others.”

That could mean a windfall tax and hurt the stock market. It is unsure if Democrats can build bipartisan consensus for penalties when the Republicans, who are in a pole position to take the house, are openly hostile to “stifling” taxes.

This week’s economic data will rest on inflation data from the United States economy. A dip from 8.2% to 8% is expected, which could slow the Federal Reserve’s rate hike plans.

Billionaire Elon Musk added a statement supporting the Republican party to the election mix. “To independent-minded voters: Shared power curbs the worst excesses of both parties, therefore I recommend voting for a Republican Congress, given that the Presidency is Democratic,” Musk tweeted.