The Chinese e-commerce retailer JD.Com saw its shares rise after beating Wall Street earnings expectations.

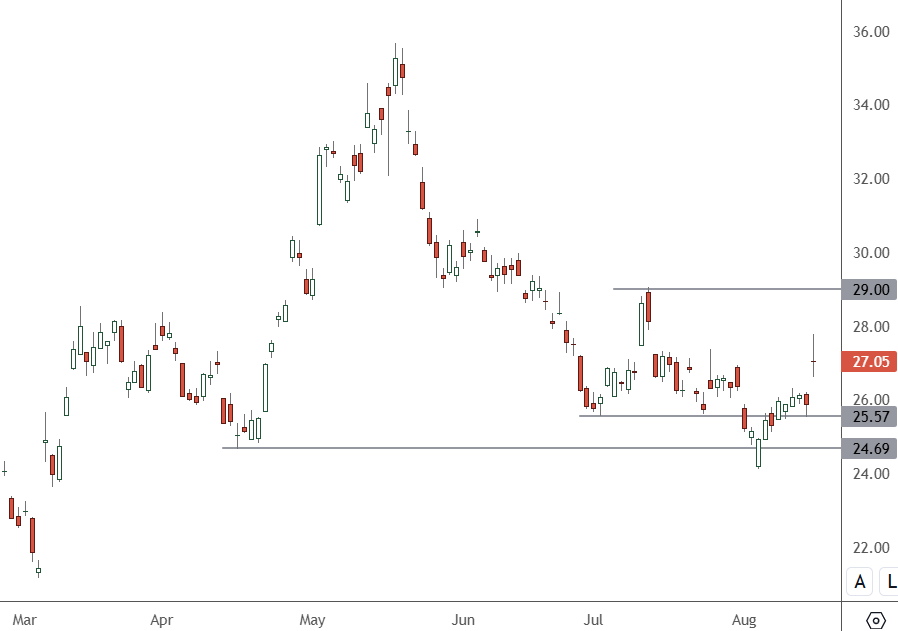

JD – Daily Chart

After the earnings release, the price of JD jumped to $27 and secured support at $24.70 and $25.57 on the ADR. The next target for gains is $29.

The company reported higher second-quarter revenue driven by gains in retail and logistics, while earnings were well ahead of analysts’ expectations.

Revenue was up 1.2% in the three months through June 30 to 291.4 billion renminbi ($40.7 billion), slightly lower than the consensus for 291.7 billion renminbi. Net income was higher by 74% to 9.36 renminbi, blowing away the Wall Street expectation for 6.19 renminbi.

JD Retail revenue grew to 257.07 billion renminbi from 253.28 billion renminbi a year earlier. Chief Financial Officer Ian Su Shan said logistics revenue was up 7.7%. In comparison, new business fell 35% due to “adjustments” in its Jingxi shopping platform.

The company’s electronics and home appliances sales fell 4.6% yearly, while general merchandise rose 8.7%, boosted by the supermarket segment. The company’s share rose around 4.6% on the news Thursday.

“Despite the mixed top-line performance, we saw broad-based profitability improvement across many categories and segments, which effectively contributed to record highs” in non-GAAP operating profit and net profit attributable to ordinary shareholders, management said. Gross margins at the firm also hit a record high of 15.8%.

The retailer’s total quarterly active customers grew at a double-digit pace year-on-year for a third straight quarter while shipping frequency and volume were also up by double digits.

Robust earnings could see JD stock climb higher from recent support.