The German DAX index was down by 1.59% at the market close, but US stock indices were down further by around 2.8%.

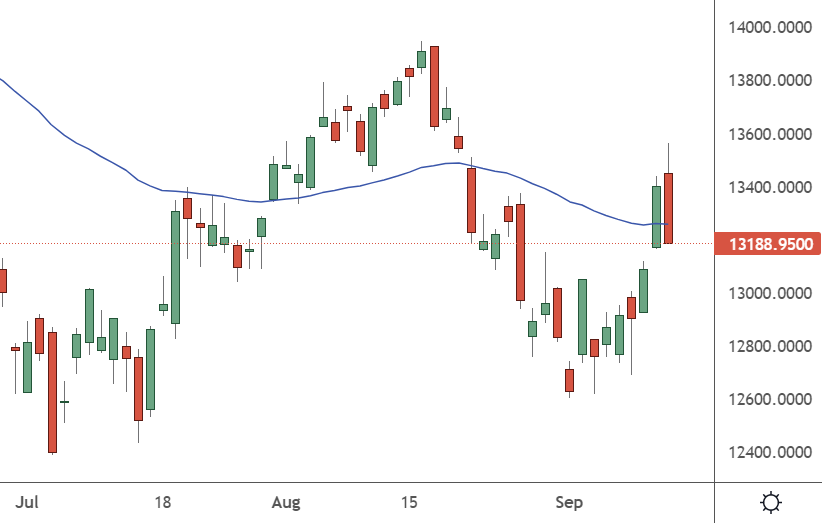

The price action in the DAX daily chart below highlights a bearish engulfing bar that should see further lows in the index, and it is also an index to play the energy market strife facing Europe.

Daily DAX Chart

The ZEW economic sentiment figures for Germany and Europe were another negative that could weigh on the outlook for the continent. Germany’s former industrial powerhouse is facing severe headwinds.

The fall in stocks today has been driven by the latest US inflation figures, with an 8.3% inflation rate in the US. Economists had expected a fall to around 8%. That increases the chances of further aggressive action on interest rates by the US Federal Reserve.

The August core CPI report in the United States was also higher than market expectations, coming in at +0.6% m/m and +6.3% y/y.

After today’s inflation figures, the markets have added another +25 bps to rate hike expectations for early 2023. Traders now expect the federal funds rate to peak at 4.31% in April 2023, before easing to 3.83% by the end of 2023, according to the futures market.

There is now a full expectation for another 75bps of rate hikes at next week’s meeting of the FOMC monetary policy committee. European inflation figures will be released on Thursday with expectations for a jump to 4.3% from 4% in core inflation.

Investors should keep an eye on the DAX during the Asian session as opportunities can arise before the European session opens.