European stocks may be at risk of contagion as Swiss bank Credit Suisse finds itself in the spotlight.

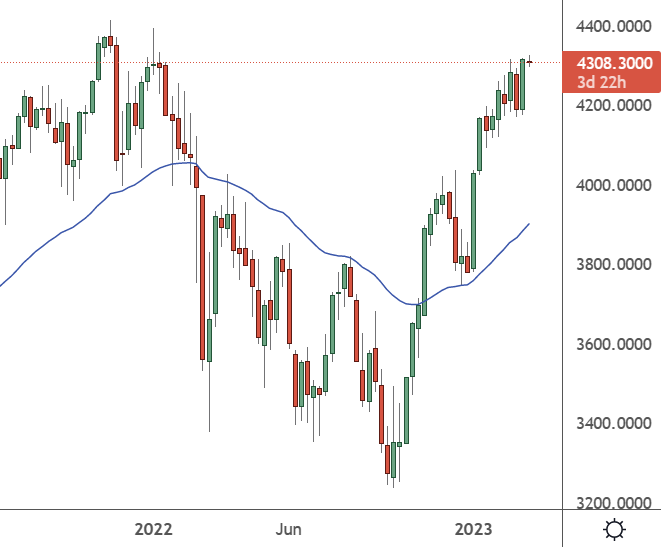

EU50 – Weekly Chart

EU50 has soared since late 2022 to trade at the 4,307 level. As it approaches the highs of 2021, investors should be wary of holding at the top.

Data out this week showed that the Swiss banking giant has seen outflows of 120 billion euros over the last month. The figure is a vast, extraordinary outflow number not receiving the attention it warrants.

On Monday, we also learned that one of Credit Suisse’s most significant shareholders has sold its entire stake in the troubled bank.

Market Begins To Lose Trust in Credit Suisse

US investment manager Harris Associates previously owned 10% of Credit Suisse. Still, deputy chairman David Herro said it began cutting its exposure in October after Credit Suisse raised £3.6 billion from investors, with Saudi National Bank becoming the most significant investor.

“There is a question about the future of the franchise. There have been large outflows from wealth management,” Herro told the Financial Times.

“We have lots of other options to invest,” he added. “Why go for something that is burning capital when the rest of the sector is now generating it?”

“We feel the plan to restructure the investment bank, while a noble cause, is cumbersome and far more costly in terms of cash burn than we expected,” Herro said.

Credit Suisse reported its biggest annual loss last month since the 2008 global financial crisis. It also warned of a further ‘substantial’ loss for this year.

European stocks have risen in a significant recovery theme from the war-hit financial markets of 2022. The end of the road may be in place for European names. The index of blue-chip European names includes large banks, and there is a risk of contagion if Credit Suisse runs into problems.

As the index nears all-time highs, investors should watch closely and look for short opportunities.