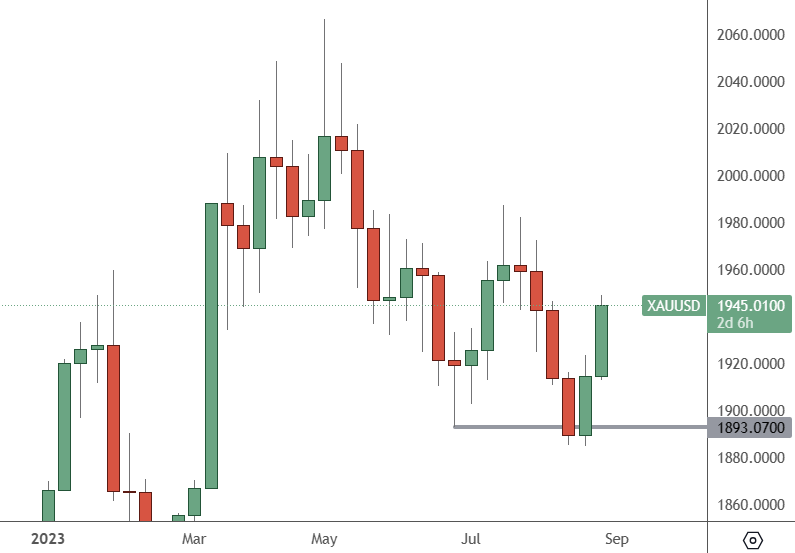

The price of gold has formed a low near the $1,893 price level and is pushing higher for a second day to $1,945.

XAUUSD: Weekly Chart

Gold prices have been declining since a high in April and have mounted a rally after last week’s support level held.

Gold has been supported by a rally in risk assets, but the precious metal has been spurred this week by softer data from the US economy. GDP growth for the second quarter was expected to be 2.4% but came in at 2.1%.

There was also weaker jobs data from the world’s largest economy, with the Bureau of Labour Statistics saying job openings for July came in at 8.82 million, well below the expected 9.46 million, while consumer confidence also slowed on Tuesday.

The CME FedWatch Tool now shows a reduced likelihood of a Fed interest rate hike in September at just 13.5%, while odds for a November hike stand at 43%. Traders are now looking at the US nonfarm payrolls report for August, which could confirm a slower jobs market. That has been one of the focus areas for the Fed, as strong jobs also led to wage inflation.

The latest consumer confidence poll by the Conference Board (CB) showed worsening sentiment in the August report. A reading of 106.1 was below the forecast of 116 and July’s 114, underscoring a growing unease among consumers. Dana Peterson, chief economist at the Conference Board, said, “Consumers were once again preoccupied with rising prices in general and for groceries and gasoline in particular.

The World Gold Council reported the following in its July ETF report:

“Physically-backed gold ETFs saw net outflows of US$2.3 billion in July, equivalent to a 34 percent reduction in holdings. Total assets under management (AUM) increased by 2% m/m to US$215 billion with a rebound in the gold price. ETF outflows slowed from June by 39%, with overall year-to-date flows at -US$4.9bn at the end of July.