The EURCAD exchange rate is indicating a potential correction from recent highs, and Tuesday’s data could provide the necessary fuel.

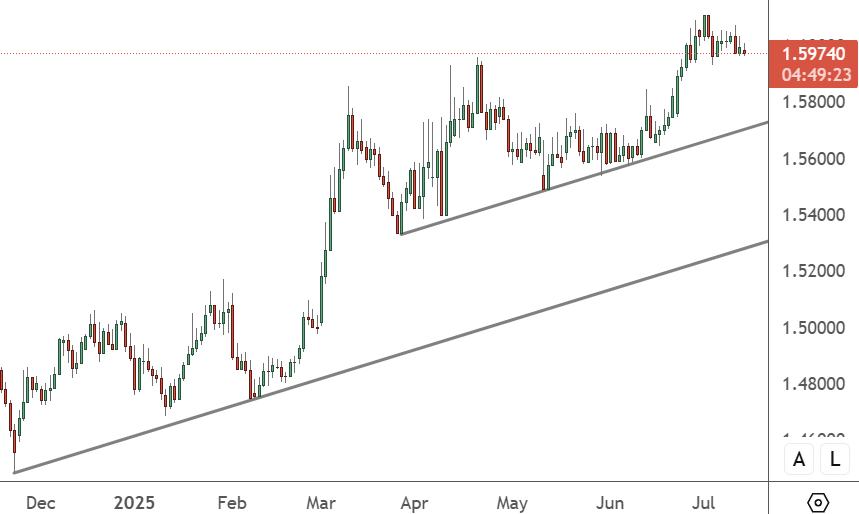

EURCAD – Daily Chart

The EURCAD has moved strongly to test the 1.6000 level and is showing potential for weakness. A move to 1.5800 would test the uptrend support, with 1.5300 being a potential target below.

There is data for the pair on Tuesday with the release of ZEW economic surveys for Germany and the eurozone. Sentiment regarding the economy has improved in recent months, and the figures are likely to be strong enough to support the euro.

The data is released at 5 pm HKT, and Eurozone industrial production is also released, posting growth of 0.9% last month, up from -2.4%. Another good figure would convince traders that the recovery is secure.

There will be evening data in the form of Canadian consumer price inflation numbers at 8:30 pm HKT. A reading of 1.9% last month, up from 1.7% showed that some stubbornness in prices is still evident.

That will wrap up the data for the pair this week, as the focus will turn to the G20 meeting. This means the EURCAD will likely trend into the weekend based on Tuesday’s data. The strength in the Canadian jobs market on Friday has boosted the dollar, but with 83,000 jobs added, the unemployment rate remains high at 6.9%.

However, analysts polled by Reuters had expected the unemployment rate to increase to 7.1% from 7% in May, with no new jobs added. It was also the final jobs report before the Bank of Canada’s monetary policy decision on July 30, and it could support the Canadian dollar if inflation remains higher.

European markets opened weaker on Monday after U.S. President Donald Trump threatened the region with a 30% tariff on imports. EU trade ministers were set to meet on Monday morning to discuss the latest surprise announcement, but there has been caution over any retaliation.