Oil prices covered some loss on Monday as the hope of a debt ceiling deal in the US, the world’s biggest oil user, will spur more demand, but fears of further interest rate rises and that OPEC+ will leave output quotas unchanged, capped gains.

While the debt ceiling deal has spurred buying in riskier assets such as commodities, major oil producers will meet on June 4; whether they might increase their output cuts amid an overall price slump since the middle of April is still being determined. Additionally, expectations are for US interest rates to rise further, potentially crimping economic growth and oil demand.

Last weekend, US President Joe Biden and House of Representatives Speaker Kevin McCarthy agreed to suspend the $31.4 trillion debt ceiling and cap government spending for the next two years. Both leaders expressed confidence that Democratic and Republican lawmakers would support the deal. The US House Rules Committee said it would meet on Tuesday afternoon to discuss the debt ceiling bill, which needs to pass a divided Congress before June 5.

Investors are also closely watching whether the Organization of the Petroleum Exporting Countries (OPEC) and its allies, including Russia, known as OPEC+, will change their output quotas.

Also, last week, Saudi Energy Minister Abdulaziz bin Salman warned short sellers betting that oil prices will fall to “watch out,” in a possible signal that OPEC+ may further cut output.

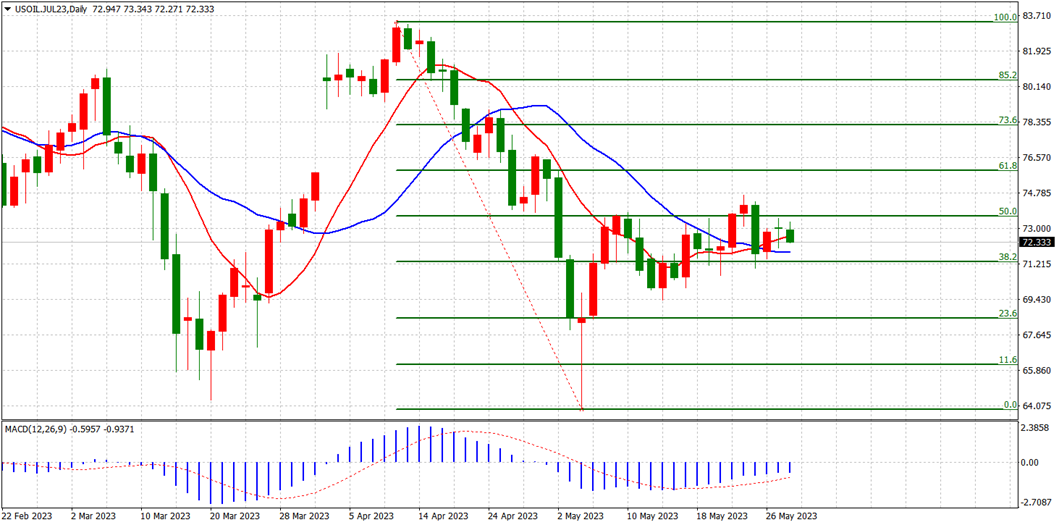

Crude Oil Forecast

This week’s key data releases include the US ISM manufacturing index, due on Wednesday, and the ADP employment report, due on Thursday. The ISM manufacturing index is a widely watched indicator of economic activity in the manufacturing sector. At the same time, the ADP employment report provides a preview of the non-farm payrolls report. Suppose these data show strength, it may support the oil price reaching a higher level. But, conversely, they underperform, and as a result, the oil price would be under pressure.

By Technical, the USOIL price action shown in range trading is limited to around $71 and $74, waiting for any breakout. According to the MACD in the daily chart, it is upward. Suppose the MACD breakout the 0 levels; it would show the USOIL further upside.