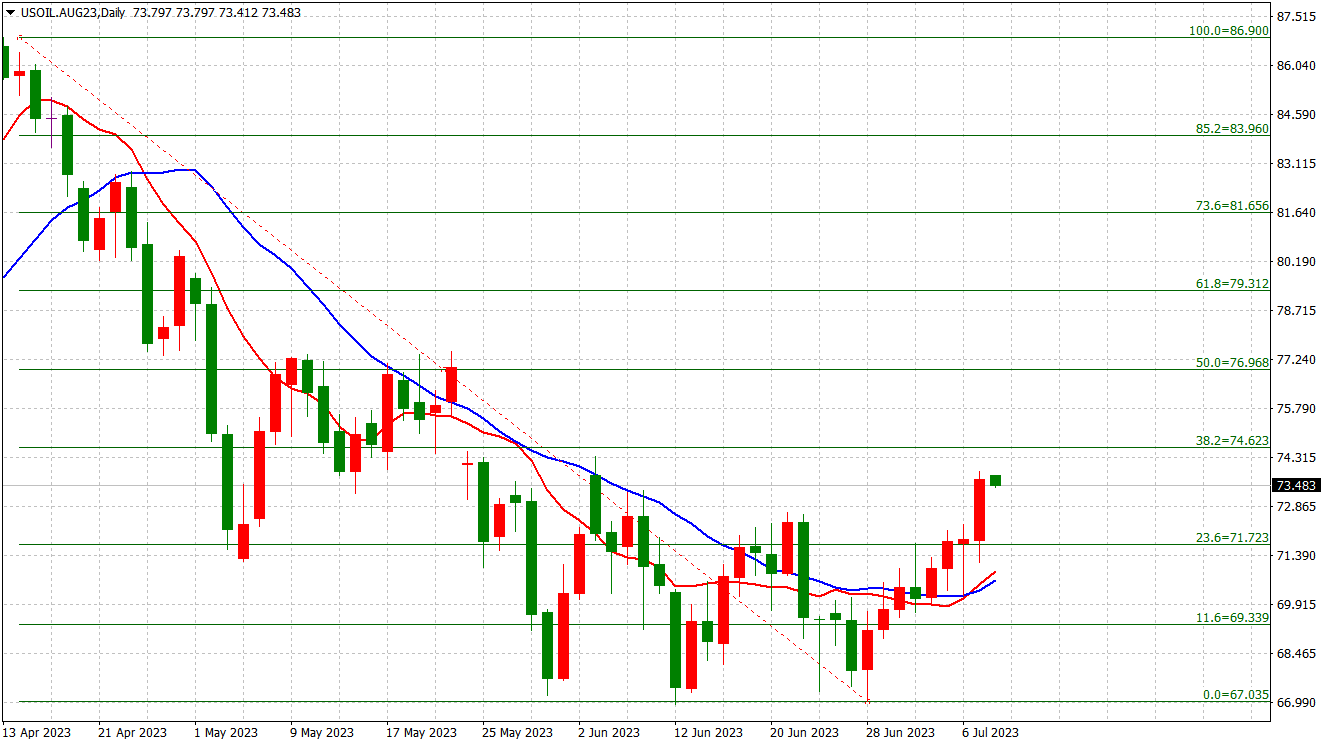

USOIL: Daily Chart

Expected crude supply cuts from Saudi Arabia and Russia supported the market. Oil prices climbed about 3% to hit a nine-week high last Friday, with weekly gains of about 5% as supply concerns and technical buying outweighed concerns that further rate hikes could slow economic growth and reduce oil demand. But Oil prices dipped in early Asian trade on Monday as oil traders may be cautious ahead of the US CPI and China’s slew of economic data this week.

The world’s two biggest oil exporters, Saudi Arabia and Russia, pledged to deepen supply cuts in August. Saudi Arabia will extend its 1 million barrels per day (bpd) output cut into August, and Russia will cut crude exports by 500,000 bpd. Instead of cutting output, Russia will be using the crude to produce more fuel to meet domestic demand, a government source told Reuters last Friday.

Saudi Arabia’s cuts are easing its oil glut as floating storage off the Egyptian Red Sea port of Ain Sukhna is down by almost half to 10.5 million barrels from mid-June, according to data from oil analytics firm Vortexa as of July 7.

JP Morgan analysts said that the non-OPEC+ supply has been keeping up with global demand, adding that OPEC+ needs to deepen its cuts by another 700,000 bpd in the second half of the year on top of the announced reductions and extend them into 2024.

The latest jobs report from the US indicates that wages continue to grow steadily and that there has been a small decrease in the unemployment rate. These factors will probably lead the Federal Reserve to proceed with its plan to increase interest rates during the July meeting.

This week, investors are keeping a close eye on the release of US inflation data, set to be announced on Wednesday. The YoY inflation rate for June is expected to be 3%, down from 4% the previous month. Meanwhile, core inflation YoY is expected to be 5%, slightly lower than last month’s 5.3%. This data will have an impact on the FOMC’s July meeting. If June Core inflation YoY remains at 5.3%, the market will anticipate a 25-bps rate hike. However, if the inflation rate is significantly higher than last month, a more aggressive hike rate of 50 bps may be expected, leading to economic fear and pressure on the oil price.