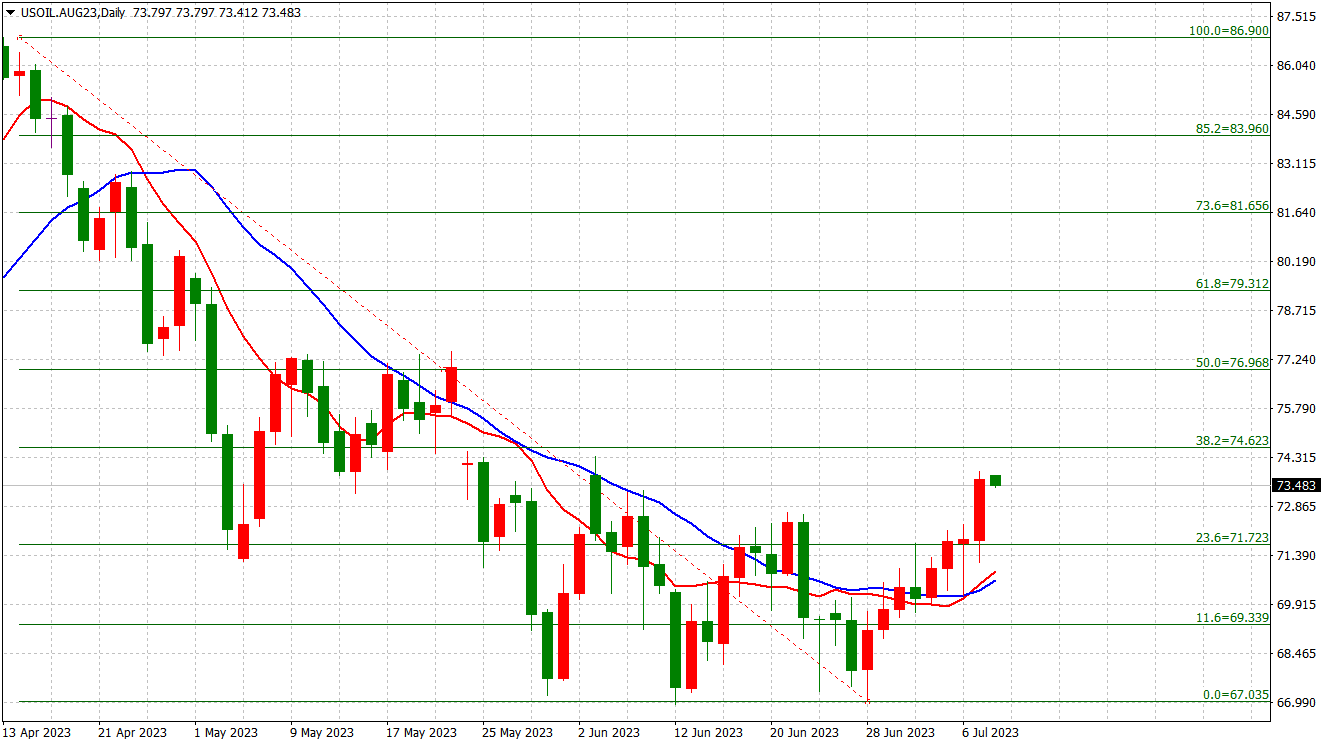

USOIL:日線圖

沙特阿拉伯和俄羅斯削減原油供應的預期支撐了市場。上週五,油價上漲約3%,觸及九周高點,週漲幅約5%,因供應擔憂和技術性買盤蓋過了進一步加息可能放緩經濟增長和減少石油需求的擔憂。但周一亞洲早盤油價下跌,因石油交易商在本周美國消費者物價指數和中國大量經濟數據公佈之前可能持謹慎態度。

全球最大的兩個石油出口國沙特阿拉伯和俄羅斯承諾在八月份加大減產力度。沙特阿拉伯將把每日 100 萬桶的減產計劃延長至 8 月份,俄羅斯將每日削減 50 萬桶原油出口。一位政府消息人士上週五告訴路透社,俄羅斯不會削減產量,而是將利用原油生產更多燃料以滿足國內需求。

石油分析公司 Vortexa 截至 7 月 7 日的數據顯示,由於埃及紅海艾因蘇赫納港附近的浮動儲存量較 6 月中旬減少了近一半,至 1050 萬桶,沙特阿拉伯的減產正在緩解其石油過剩狀況。

摩根大通分析師表示,非OPEC+國家的供應與全球需求保持平衡,並補充說,OPEC+在已宣布的減產基礎上,需要在今年下半年進一步進一步減產70萬桶/日,並將減產期限延長至2024年。

美國最新就業報告顯示,工資繼續穩定增長,失業率小幅下降。這些因素可能會導緻美聯儲在 7 月會議期間繼續實施加息計劃。

本週,投資者密切關注定於週三公佈的美國通脹數據。 6 月份同比通脹率預計為 3%,低於上月的 4%。同時,核心通脹同比預計為5%,略低於上個月的5.3%。該數據將對 FOMC 7 月會議產生影響。如果6月核心通脹同比保持在5.3%,市場預計加息25個基點。然而,如果通脹率明顯高於上月,則可能會出現更大幅度的50個基點加息,從而導致經濟恐慌並對油價構成壓力。