The Australian dollar (AUDUSD) has lost significant value against its crosses in the market following the report of a massive decline in its employment change. The growing concerns over the rising tension in Taiwan seemed to have displaced more people from their jobs within the past month.

According to the Australian Bureau of Statistics, the Australian employment change fell to -40.9K against the previous record of 88.4K in June and far away from the market forecast of 25K. The unemployment rate eased to 3.4% against the last form of 3.5%. The Participation rate fell to 66.4% against the previous record of 66.8%.

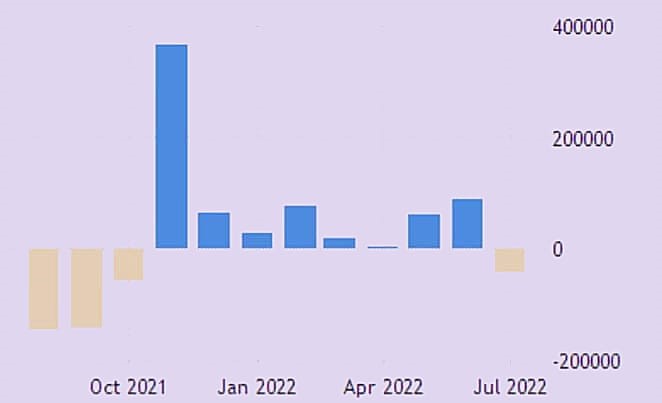

Australian Employment Change Data

Source: Australian Bureau of Statistics

This marks the first drop in the Australian employment rate within the past nine months. Full-time employment in Australia decreased by 86,900 to 9,409,400, while the part-time employment rate increased by 46,000 to 4,149,000.

The pessimistic reports from the Australian employment change have given the bears more reasons to attack the Australian dollar in all its crosses in the market, especially AUDUSD.

Hence, we saw AUDUSD pushed down from $0.6948 to a new low at $0.6917.

AUDNZD fell from $1.1060 to a new low at $1.1041.

AUDCHF fell from $0.6602 to a new low at $0.6582

AUDCAD fell from $0.8972 to a new low at $0.8936.

The bulls seemed to be pushing these pairs up again after the initial fall witnessed during the Asian session today. However, their current retracement will likely be short-lived as the growing concern over Taiwan continues to dissuade investors.

The Australian dollar’s high reading from the Australian seasonally adjusted wage price index rose by 2.6% YoY in Q2 2022, against the previous record of 2.4% in Q1 and roughly below the market forecast of 2.7%. This marks its highest reading since Q3 2014. The fact that the seasonally adjusted wage keeps rising signals that more people will likely lose their jobs within the present quarter. This will cause more decline for the Australian dollar (AUD) in the long term amidst rising inflation. This means we can expect more downside movement for AUDUSD in the long term and other crossings with the Australian dollar.

What is the Australian Employment Change Report

The Australian employment change report is an important economic data that measures the change in the number of employed people within the country. This includes both full-time and part-time workers. Employed people here is a broad term that covers all workers receiving a monthly payment from an employee, whether government or private sector.

The employment change report is an essential economic report that significantly influences the country’s currency. Thus, an increase in the employment change signals a healthy economy and attracts more investors to invest in the economy. This would mean a bullish trend for the currency. At the same time, a reduction in the employment change signals a poor performance from the labour market and points to an unhealthy economy. This will scare investors leading to the dumping of the currency.

What is the difference between the Australian Employment Change and the Unemployment rate?

The fact that both the Australian employment change and the unemployment rate figure are released simultaneously calls for more clarity on the difference between these two data.

While the employment change measures the number of employed people within the given period, the Unemployment Rate, on the other hand, measures the number of unemployed people within the said period. These two data put together helps to examine the strength of the labour market within the concluded month.

The unemployment rate data is usually obtained by dividing the unemployed people by the total civilian labour force. A high increase in the unemployment rate often indicates a lack of expansion within the Australian labour market.

What impact will the Employment Change Report have on the Australian dollar, especially AUDUSD?

The poor reading from the Australian employment change report is not a good sign for the Australian dollar. As the Taiwan tension increases, this becomes another solid reason for dispersed investors.

The effect of this pessimistic report is that it will weaken the Australian dollar against other currency pairs matched with it in the market. This means we can expect more downside movement for the AUD crosses such as AUDUSD, AUDJPY, AUDCAD, and AUDNZD in the coming weeks.

The bears will likely benefit more from AUDUSD, especially as the dollar index is currently bullish. This will cause more downside movement for this pair ahead of the next Fed session in September.