Apple (AAPL) marked a new all-time high on Monday, and traders can now look at the potential for the Nasdaq this year.

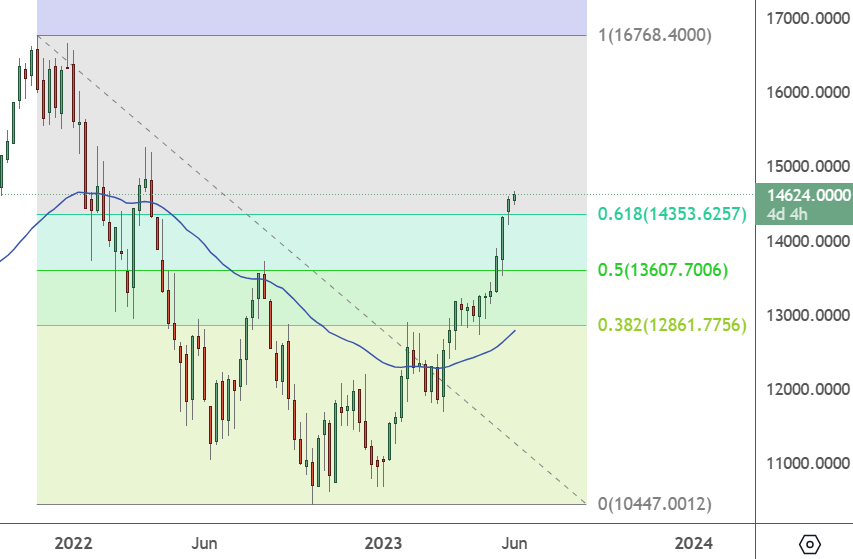

NAS100 – Weekly Chart

The NAS100 index found support at the 38% Fibonacci level drawn from the peak in 2021. With a surge through the 50% and 61.8% levels, the NAS100 can power ahead to all-time highs.

Seana Smith on Yahoo Finance Live said the rally in tech might end.

“So, this massive rally that we have seen play out in the sector is causing some on the street to warn that, hey, maybe some of this frenzy, we need to take a break. It doesn’t have enough to maintain this type of momentum. At least, that is what we’re hearing from Citi’s Chris Montague like you just said. He was out saying that this massive rally that we’ve seen, we might see it start to fizzle out just a little bit.”

When the market breaks to new highs, it usually brings short sellers, which could fuel a rally higher to a new all-time high in the US market.

US Tech Stocks Forecast

The debt ceiling deal has removed fears for overseas investors, and we have seen the latest batch of earnings. With no other big tech earnings coming for another eight weeks, that could give the market plenty of time to launch a further rally.

US stocks rose on Friday after a report showed that wage growth was slower in May, raising hopes that the Fed would avoid a rate hike next week.

According to CME, ahead of inflation data, traders were pricing in a 76% chance that the Fed would hold interest rates in its June 13-14 policy meeting.

“We are now waiting for that next major data point and to determine whether the Fed is going to be skipping or pausing or hiking,” said Thomas Hayes at Great Hill Capital.