The AUDUSD pair has an interest rate decision from the Reserve Bank of Australia this week as it seeks to mount another rally.

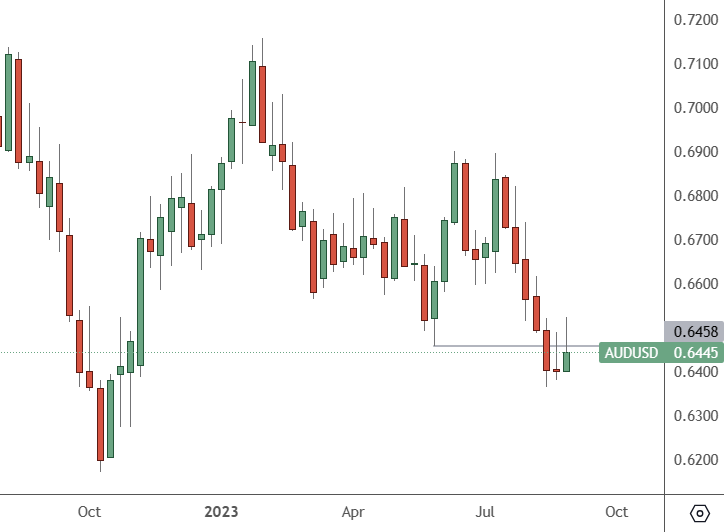

AUDUSD: Weekly Chart

AUDUSD made an attempt at the June lows last week around 0.6460 but was rejected and dropped to 0.6445.

The Reserve Bank of Australia will keep its key interest rate unchanged at 4.10% on Tuesday due to slowing inflation, according to a Reuters poll of economists. The same analysts expect to see another rate hike next quarter.

Unlike recent polls, which were divided, the latest poll showed a nearly unanimous expectation for no move.

With the recent decline in inflation and a slight rise in unemployment, 34 of 36 economists said the RBA would hold its official cash rate at 4.10% on Sept. 5, in line with interest rate pricing in the futures market. Two respondents expected a 25-basis-point hike.

“In August, the RBA saw a credible path to get inflation back to target with rates of 4.10%, and when we look at the data flow since then, we don’t see anything that would have pushed them off that assessment,” said Taylor Nugen from NAB Bank. Among the major local banks, ANZ, CBA, and Westpac expected rates to remain unchanged until the end of 2023, while NAB predicted one more rate hike to 4.35% in November.

Australia will also see the release of the latest GDP figures ahead of Wednesday trading, with a 1.7% year-on-year rate expected for the second quarter.

US gross domestic product grew by 2.1% in the second quarter, according to data from the Bureau of Economic Analysis last week. The GDP figure was below expectations after the bureau previously forecast a 2.4% increase. However, Q1 GDP was upgraded from 1.1% to 2%.

The increase in GDP in Q2 reflected a rise in consumer spending and non-residential fixed investment but was caused by decreases in exports, residential fixed investment, and private inventory investment, the agency said. The slowing in the economy and Friday’s unemployment increase could add a bearish tone to the US dollar.

Ryan Brandham at Validus Risk Management said: “US GDP came in weaker than expected at 2.1% versus expected 2.4%. This is a soft number, and perhaps the surprisingly resilient US economy is finally showing signs of slowing after a long rate hike cycle”.

“This weak figure will support those calling for a Fed pause in September, with more data yet to come before the meeting. We can expect a weaker USD and lower US rates for today’s session,” he added.