Market Highlight 10/02/2026

Ahead of this week’s key U.S. data releases, U.S. equities climbed steadily on Monday after a choppy start. The S&P 500 and Nasdaq advanced, led by a rebound in tech shares after last week’s pullback. The Dow closed up 0.04%, the S&P 500 gained 0.47%, and the Nasdaq rose 0.9%. U.S. Treasury yields edged lower, while the U.S. Dollar Index fell 0.82% to 96.81.

Gold extended its rebound, rising 2% overnight, supported by a softer dollar. Investors are awaiting a packed slate of U.S. economic data this week to assess the Federal Reserve’s policy outlook. International oil prices also closed higher after the U.S. urged vessels flying the U.S. flag to stay as far as possible from Iranian territorial waters when transiting the Strait of Hormuz and the Gulf of Oman.

Key Outlook 10/02/2026

The spotlight today is on the U.S. Retail Sales report, a key gauge of consumer momentum. The data is expected to show a continued moderate increase, with monthly retail sales forecast at +0.5% (previous: +0.6%). Also in focus is the January NFIB Small Business Optimism Index, which has remained steady since last year and is expected to continue hovering around 100 level.

Key Data and Events Today:

- 19:00 US NFIB Business Optimism Index JAN **

- 21:30 US Retail Sales MoM DEC**

Tomorrow: Japan Holiday

- 01:00 EIA Monthly Oil Market Report **

- 05:30 API Crude Oil Stock Change ***

- 09:30 CN CPI & PPI JAN **

- 20:00 OPEC Monthly Oil Market Report **

- 21:30 US Non Farm Payrolls JAN ***

- 23:30 EIA Crude Oil Stocks Change **

Markets Analysis 10/02/2026

- Resistance: 1.1965/1.2025

- Support: 1.1831/1.1771

EURUSD moved higher amid broad dollar weakness, with markets now focused on upcoming U.S. jobs and inflation data. The rebound has slowed near 1.1890, while the 1.1965–1.2025 area caps upside for now. On the downside, 1.1831–1.1771 remains a key demand zone, cushioning pullbacks.

- Resistance: 1.3809/1.3871

- Support: 1.3544/1.3482

GBPUSD rebounded on a softer dollar, but UK political uncertainty and easing expectations continue to weigh. The recovery stalled near 1.3660, with the 1.3809–1.3871 area acting as a heavy cap. On the downside, demand around 1.3544 offers near-term support, leaving the pair range-bound and USD-driven.

- Resistance: 156.37/157.04

- Support: 154.89/154.23

USDJPY pulled back amid broad dollar weakness, with price action driven more by shifting Fed expectations than by Japan’s domestic outlook. The pair struggled to sustain gains above the 156.37–157.04 area, while dip-buying emerged around 154.23–154.89. Near-term direction remains range-bound and USD-sensitive.

- Resistance: 64.48/65.01

- Support: 63.31/62.79

WTI firmed as Middle East tensions eased, lifting risk premiums, with shipping risks near the Hormuz Strait keeping traders cautious. Prices struggled to extend gains beyond the $64.48–65.01 range, while dip demand emerged around $62.79–63.31. Near-term action looks range-bound and increasingly headline-driven rather than purely fundamental.

- Resistance: 5149/5202

- Support: 4929/4877

- Resistance: 87.32/89.39

- Support: 76.84/74.40

Gold surged on a weaker dollar and revived rate-cut expectations, with steady Asian central-bank buying underpinning the broader trend. Dip demand emerged around $4,877–4,929, while upside traction remains capped near $5,149–5,202. Ahead of key U.S. jobs and inflation data, price action looks firm but consolidation-prone, underpinned by persistent safe-haven demand.

- Resistance: 50374/50516

- Support: 49916/49772

The Dow Futures notched a second consecutive record close as tech shares rebounded and earnings remained supportive. Price is holding above the 49,772–49,916 support area, with upside probing towards the 50,374–50,516 resistance zone. Attention now turns to U.S. jobs and inflation data, which will determine whether momentum can extend at elevated levels.

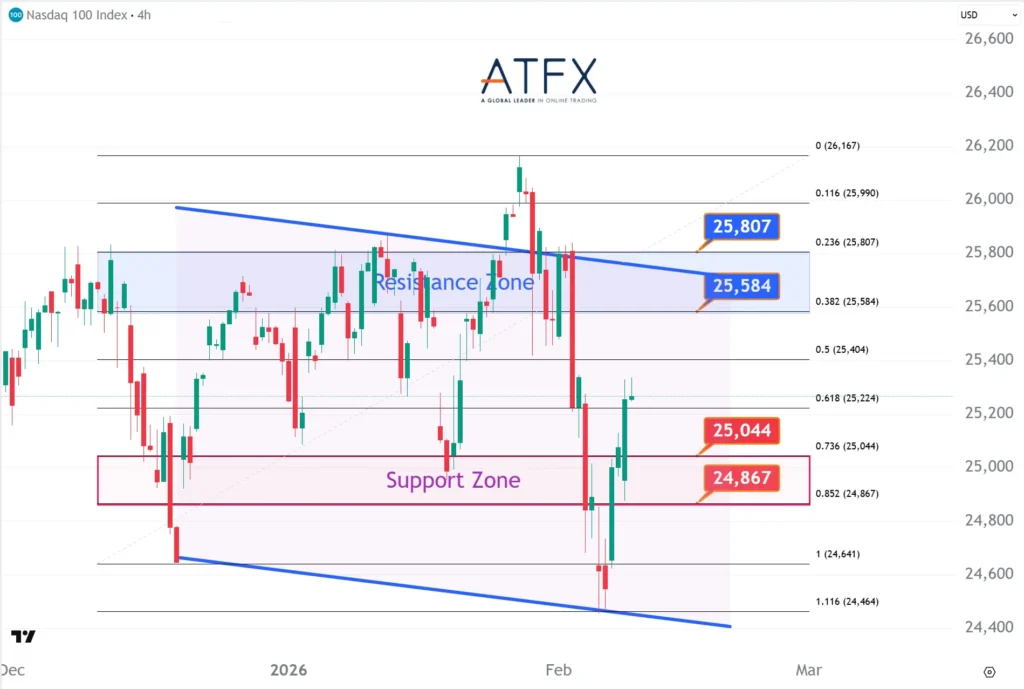

- Resistance: 25584/25807

- Support: 25044/24867

The NAS100 extended its rebound, led by software and mega-cap tech stocks, though heavy AI capex and stretched valuations continue to cap risk appetite. The index bounced from the 24,867–25,044 support zone, with upside now testing the 25,584–25,807 resistance area. Failure to clear this zone may keep the price range-bound.

- Resistance: 74453/78937

- Support: 64344/59935

Bitcoin stabilised above $70,000 after last week’s sharp selloff, supported by improved risk sentiment following Japan’s election and a rebound in tech stocks. However, the $74,453–78,937 zone remains a key resistance level, and price action is likely to remain corrective and volatile ahead of U.S. jobs and CPI data.

Enjoy trading! The content is for reference only. Please ensure that you understand the risk.