Market Highlight 18/12/2025

Major U.S. equity indexes closed lower on Wednesday, with the S&P 500 and the tech-heavy Nasdaq sliding to three-week lows amid renewed concerns about crowded AI trades. The Dow Jones Industrial Average fell 0.47%, the S&P 500 dropped 1.16%, and the Nasdaq declined 1.81%. The U.S. dollar strengthened as traders awaited decisions from other major central banks and assessed recent comments from Federal Reserve officials. The Dollar Index rose 0.16% to 98.37.

Signs of softening in the U.S. labor market reignited hopes for Fed rate cuts, while escalating tensions between the United States and Venezuela boosted safe-haven demand. Silver prices surged past $66 per ounce to a record high. Spot gold rose 0.87% to $4,340.81 per ounce after gaining more than 1% earlier in the session. Oil prices climbed more than 3% after U.S. President Donald Trump ordered a ban on all sanctioned tankers entering Venezuelan ports, intensifying geopolitical tensions and easing concerns over global crude oversupply.

Key Outlook 18/12/2025

Markets await the Bank of England’s policy decision later today, with a 25-bp rate cut to 3.75% widely expected despite likely divided voting, which would mark the first cut since August and the lowest borrowing costs in three years. The ECB is expected to keep rates unchanged. Attention is now on U.S. inflation, with November CPI forecast at 3% y/y; an in-line print would support expectations for a Fed rate cut in January, while any surprise could spark renewed equity volatility, especially in technology stocks.

Key Data and Events Today:

- 20:00 BoE Interest Rate Decision & Meeting Minutes ***

- 21:15 ECB Interest Rate Decision ***

- 21:30 US CPI YoY NOV ***

- 21:30 US Initial Jobless Claims ***

- 21:45 ECB Press Conference ***

Tomorrow:

- 07:30 JP CPI YoY NOV **

- 11:00 BoJ Interest Rate Decision ***

- 14:30 BoJ Press Conference ***

- 15:00 EU GERMANY PPI YoY NOV **

- 15:00 EU GERMANY GfK Consumer Confidence JAN **

- 21:30 CA Retail Sales MoM OCT **

- 23:00 EU Consumer Confidence Flash DEC **

- 23:00 US Michigan Consumer Sentiment Final DEC ***

- 23:00 US Existing Home Sales NOV **

Markets Analysis 18/12/2025

EURUSD

- Resistance: 1.1777/1.1796

- Support: 1.1695/1.1675

EUR/USD held firm near recent highs as safe-haven Dollar bids remained limited, with markets pricing in an ECB hold. Price action shows buyers still absorbing pullbacks, with the pair consolidating above former resistance. A softer US CPI this week could be the catalyst that reopens upside momentum toward the 1.18 area.

GBPUSD

- Resistance: 1.3455/1.3509

- Support: 1.3316/1.3275

GBP/USD eased from a two-month high after UK CPI cooled sharply, locking in expectations of a 25bp BoE rate cut. The pullback has taken price back into a digestion phase rather than a full reversal, suggesting buyers are cautious but not gone. Upside attempts may struggle unless UK inflation or US data delivers a fresh surprise.

USDJPY

- Resistance: 156.25/156.88

- Support: 154.74/154.25

USD/JPY stayed under pressure as markets positioned for a potentially more hawkish BoJ, keeping Yen demand firm. Rising expectations for a rate hike contrast with softer US yield momentum, limiting any sustained rebound. Technically, price is capped below the descending trendline, with rallies likely to fade unless BoJ signals disappoint.

US Crude Oil Futures (JAN)

- Resistance: 57.72/58.38

- Support: 55.77/54.95

Oil jumped nearly 3% after US actions targeting Venezuelan shipments reignited geopolitical risk, temporarily easing oversupply concerns. Fundamentally, the move is driven more by headline risk than demand improvement, keeping sustainability in question. Technically, price rebounded from 55.77 support and is testing broken trend resistance, where upside momentum may slow if follow-through buying fades.

Spot Gold

- Resistance: 4369/4398

- Support: 4274/4245

Spot Silver

- Resistance: 67.59/68.63

- Support: 63.18/61.88

Gold held above $4,330 as Fed rate-cut expectations and geopolitical risks continued to underpin safe-haven demand. Fundamentally, CPI and PCE remain the key catalysts for the next directional move. Technically, price is consolidating above $4,274 support, with upside resistance at $4,369 / $4,398—a break could reopen trend continuation.

Dow Futures

- Resistance: 48431/48744

- Support: 47719/47400

The Dow Futures stayed under pressure as risk appetite softened ahead of CPI and key central bank decisions. Fundamentally, tech weakness and pre-data caution continue to cap upside. Technically, price is holding above 47,719–47,400 support, with a rebound facing resistance at 48,431, where sellers may re-emerge.

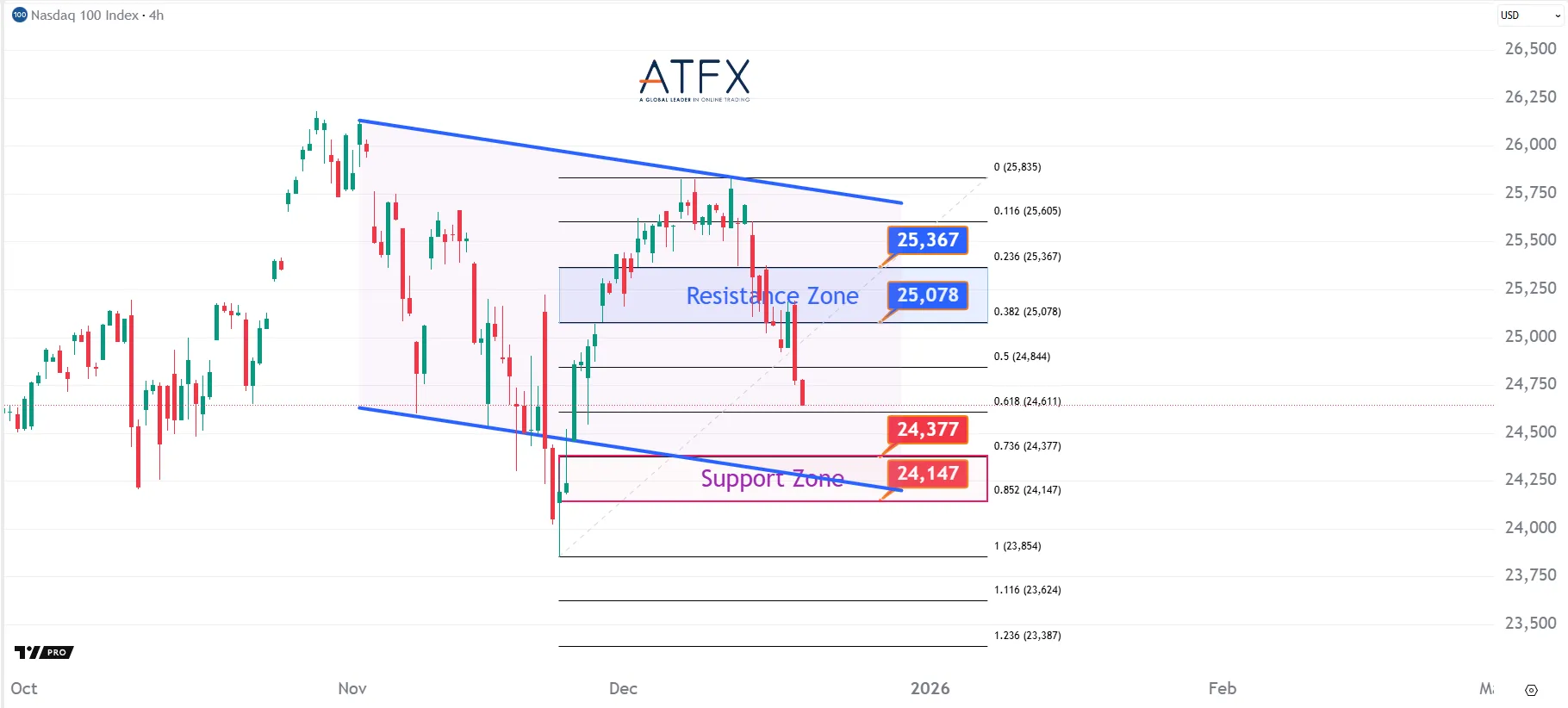

NAS100

- Resistance: 25078/25367

- Support: 24376/24147

The NAS100 slid to a three-week low as AI-related stocks came under heavy pressure amid concerns over capex sustainability. Fundamentally, fading enthusiasm around AI spending has sharply cooled tech sentiment. Technically, price may retest 24,376–24,147 support, with further downside toward 24,200 if it fails, while rebounds may face resistance near 25,078.

BTC

- Resistance: 89249/90531

- Support: 83814/82552

Bitcoin held near $88,500 but stayed capped below the descending trendline as ETF outflows and Fed caution continued to weigh on sentiment. Structurally, price remains heavy with sellers defending rallies, leaving room for a drift toward $83k if risk appetite weakens further. This week’s US CPI will be key in determining whether easing expectations can revive upside momentum.

Enjoy trading! The content is for reference only. Please ensure that you understand the risk.