Market Highlight 26/11/2025

U.S. September retail sales came in weaker than expected, while consumer confidence fell to a seven-month low. U.S. equities extended gains on Tuesday as a series of economic data reinforced expectations of a Federal Reserve rate cut in December. However, weakness in tech stocks limited Nasdaq’s advance. All three major indices opened lower but closed higher, with the Dow up 1.4%, the S&P 500 up 0.9%, and the Nasdaq gaining 0.67%. The U.S. dollar weakened amid mixed data, strengthening market bets for a Fed rate cut next month.

Gold prices held steady into the close, as the weaker-than-expected retail sales report boosted expectations for a December Fed rate cut. Spot gold settled at $4,129.95 per ounce after briefly touching its highest level since November 14 earlier in the session. Crude oil prices fell to their lowest since October 22, driven by signals that U.S. diplomatic efforts to push Ukraine toward peace talks with Russia may be gaining traction.

Key Outlook 26/11/2025

Markets are watching today’s UK Autumn Budget, which will determine GBP direction as Chancellor Reeves tries to balance voter expectations, public finances, and market confidence. Concerns over economic drag continue to weigh on sterling and rate-cut expectations.

In the U.S., September durable goods orders are expected to slow sharply to 0.9%, while the return of initial jobless claims data may add volatility.

Key Data and Events Today:

- 21:30 US Durable Goods Orders MoM SEP **

- 21:30 US Initial Jobless Claims ***

- 23:30 EIA Crude Oil Stock Change **

Tomorrow:

- 03:00 Fed Beige Book ***

- 15:00 EU GERMANY GfK Consumer Confidence DEC **

- 18:00 EU Economic Sentiment NOV **

- 20:30 ECB Meeting Minutes ***

Markets Analysis 26/11/2025

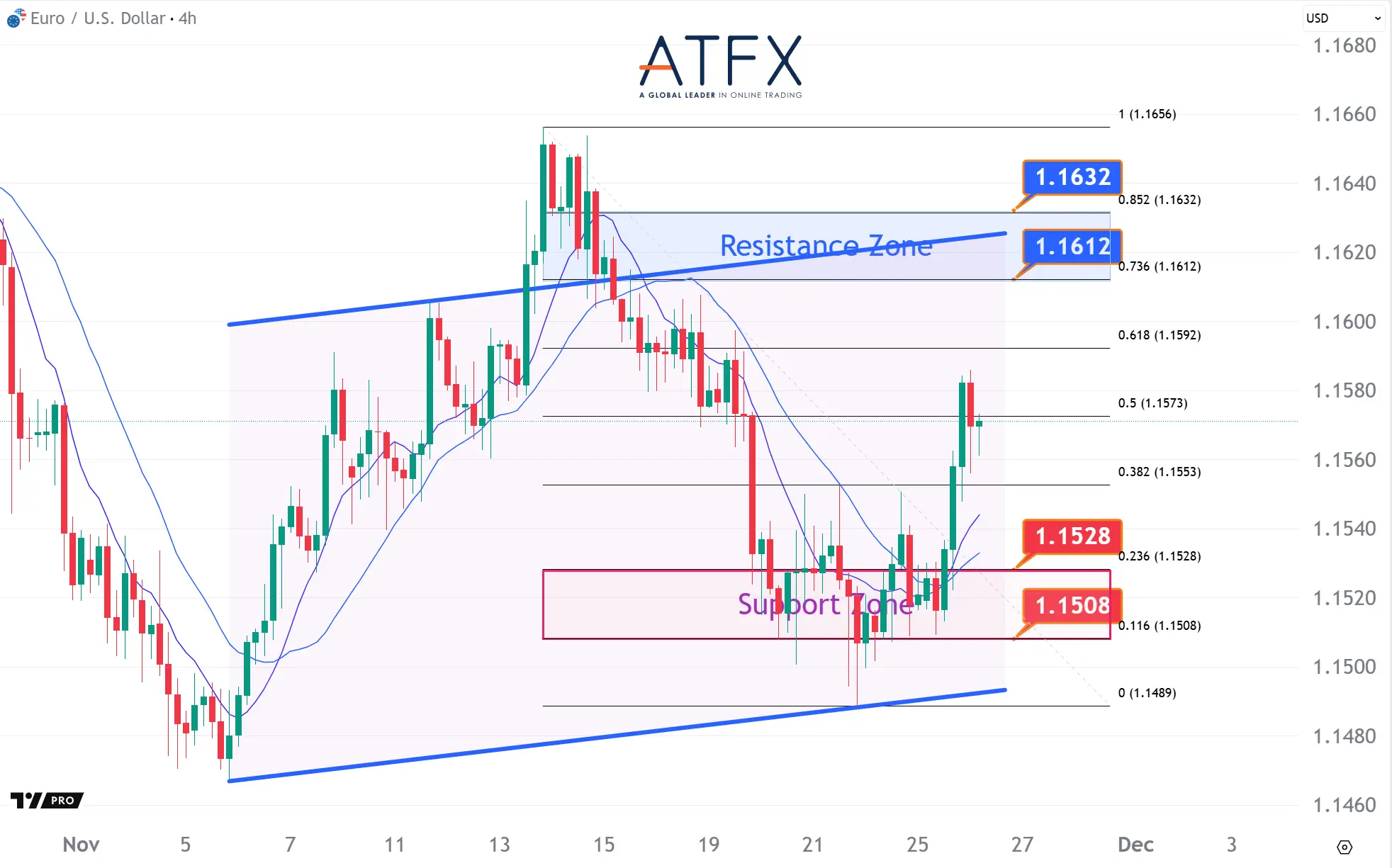

EURUSD

- Resistance: 1.1612/1.1632

- Support: 1.1528/1.1508

EUR/USD climbed toward 1.1576 as weak U.S. retail sales and a sharp drop in consumer confidence boosted expectations of a December Fed rate cut, dragging the dollar lower and easing odds to near 83%. Technically, the pair is supported by the rising trendline near 1.1528 and holding above it opens the door to a move toward 1.1612.

GBPUSD

- Resistance: 1.3216/1.3237

- Support: 1.3127/1.3106

GBP/USD climbed to 1.3203 ahead of the UK budget as broad USD weakness—driven by softer U.S. demand and cooling inflation—supported sterling. Technically, the pair is holding above 1.3127 support, and a corrective pullback could pave the way for a move toward 1.3216 resistance.

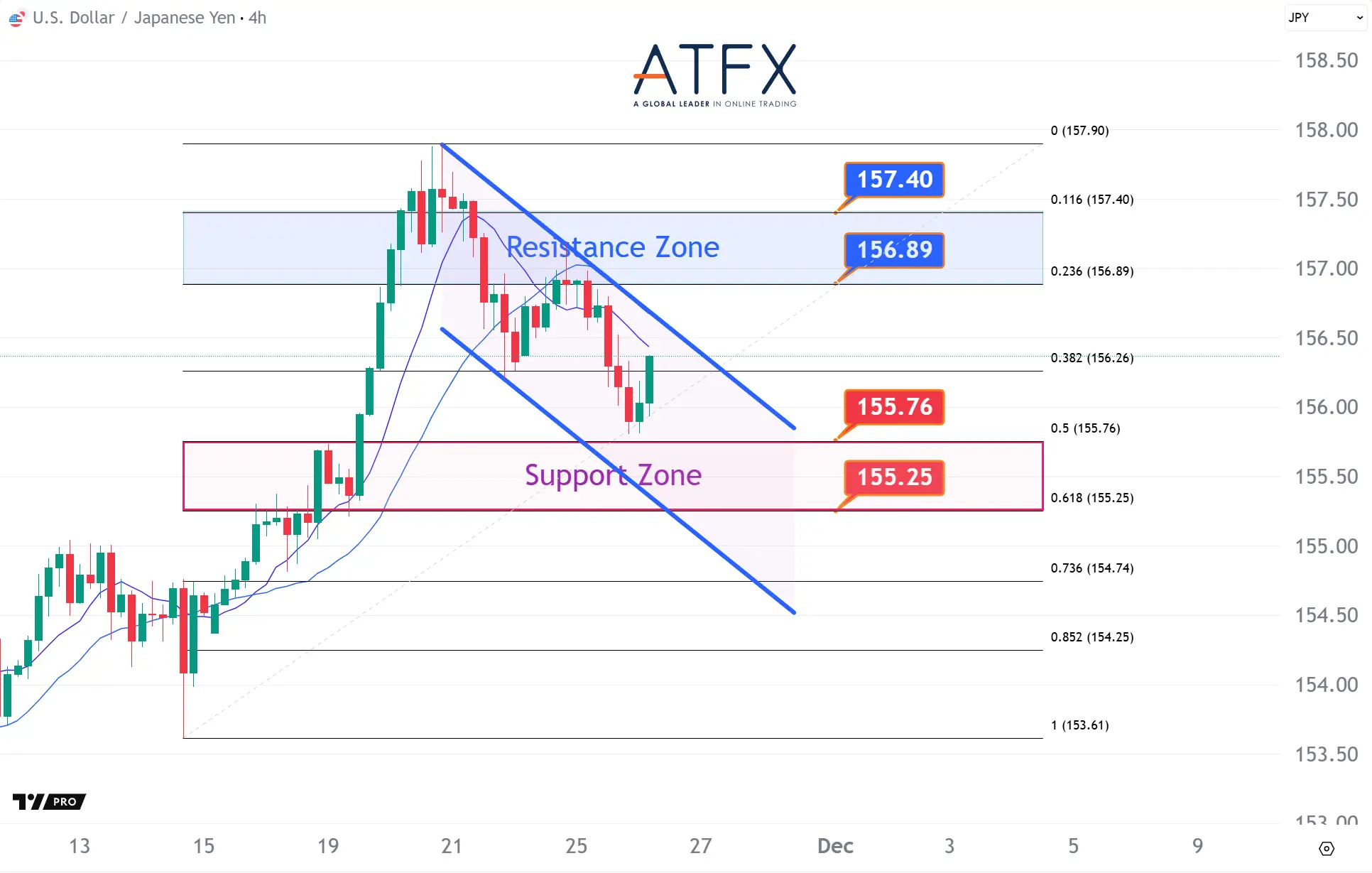

USDJPY

- Resistance: 156.89/157.40

- Support: 155.76/155.25

USD/JPY slid to 155.99 as stronger Fed rate-cut expectations pressured the dollar, while thin holiday liquidity amplified speculation over potential BoJ intervention. Technically, the pair failed to hold above 156.89 and now risks extending lower toward 155.25 if rebound attempts continue to stall.

US Crude Oil Futures (JAN)

- Resistance: 58.52/58.84

- Support: 57.44/57.01

WTI fell toward $58 as Ukraine’s openness to a U.S.-brokered peace framework fueled fears of Russian supply returning, deepening oversupply concerns. Technically, price remains pressured below the descending trendline and $58.52 resistance, keeping risk tilted toward a retest of $57.44 if rallies continue to fail.

Spot Gold

- Resistance: 4180/4209

- Support: 4093/4056

Spot Silver

- Resistance: 52.12/52.49

- Support: 50.91/50.54

Gold steadied near $4,134 after hitting a one-week high, lifted by rising expectations of an 85% December Fed rate cut as U.S. data continued to soften. Technically, XAU/USD is holding above $4,093 support, with a potential pullback likely before attempting a breakout toward the $4,180–$4,209 zone.

Dow Futures

- Resistance: 47721/48093

- Support: 46769/46377

The Dow futures jumped 1.43% (+660 pts) as weak U.S. retail sales and plunging consumer confidence boosted December rate-cut odds, while retail stocks surged sharply. Technically, the index is holding above 46,769 support, and a pullback toward 47,000 may precede a move toward the 47,721 resistance zone.

NAS100

- Resistance: 25294/25569

- Support: 24746/24407

NAS100 rose 0.67%, though upside was capped by Nvidia’s 2.6% decline, with gains supported by strong retail earnings and aggressive Fed rate-cut pricing. Technically, the index is holding above the 24,746 support zone, and a consolidation phase may pave the way for a push toward 25,294 resistance.

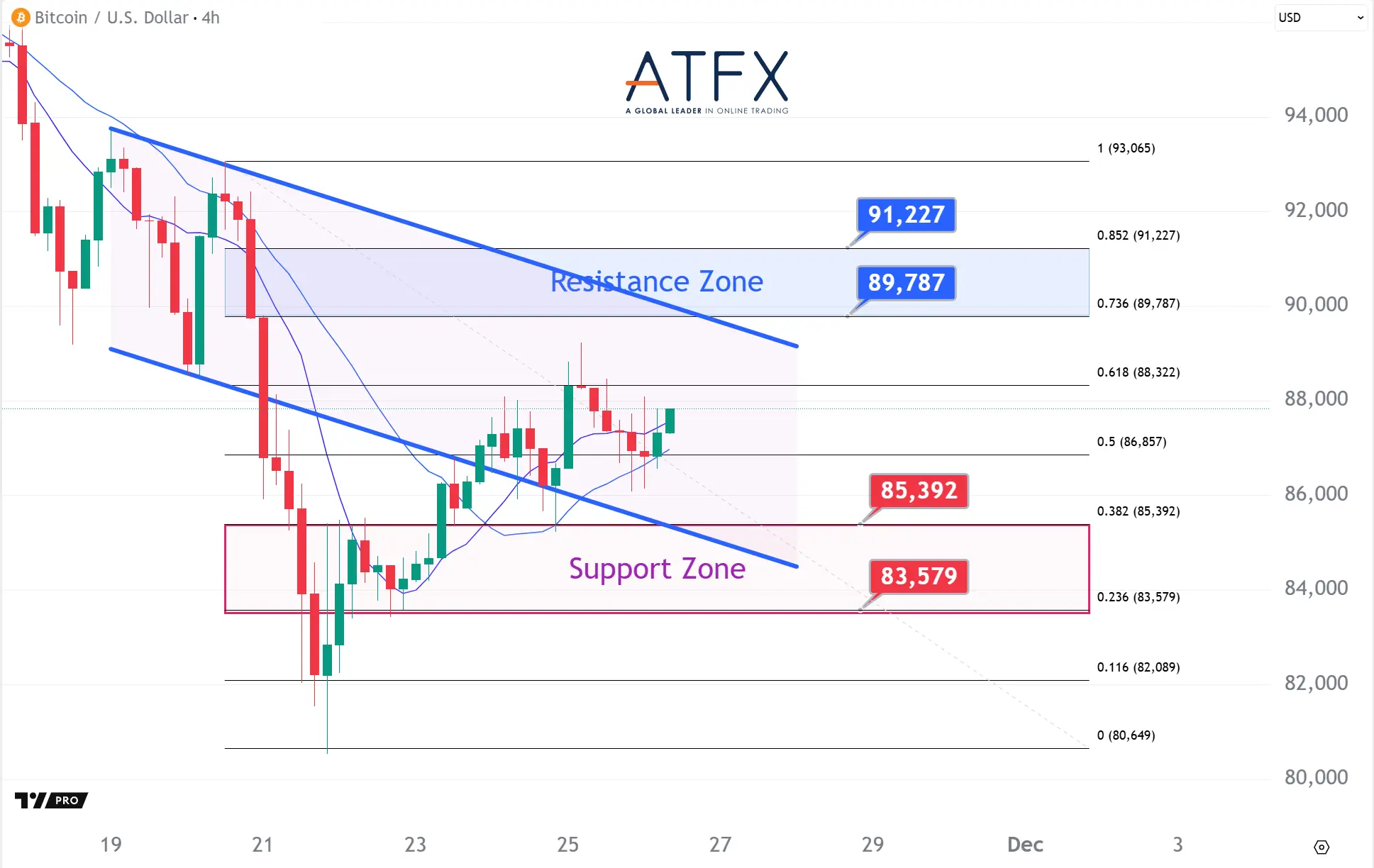

BTC

- Resistance: 89787/91227

- Support: 85392/83579

Bitcoin rebounded toward $87,000 as markets priced a 77% chance of a December Fed rate cut, lifting risk sentiment. Yet upside remains fragile, with ETF outflows persisting for a fifth week. Technically, BTC is struggling below the $89,787 resistance; failure to break higher risks another downturn toward $85,392 and potentially $82,000.

Enjoy trading! The content is for reference only. Please ensure that you understand the risk.